Natural Gas Prices Rise After Shorts Cut Bets

Natural Gas Prices Rise After Shorts Cut Bets

Prices breakout over the 100-day moving average

- Natural gas futures (/NGV3) climbed to start the week.

- Supply disruptions out of Australia underpins volatility.

- Technical picture improving but rangebound trading remains.

Natural gas prices (/NGV3) are trading higher in afternoon Wall Street trading, rising 2.5% or $0.06 per million British thermal units (mmbtu), as longs reenter the trade following a wave of selling late last week. It’s likely that broader strength in oil markets is aiding /NG’s climb. Despite today’s move, the commodity is down over 2% from the start of the month.

The U.S. benchmark hasn’t exceeded $3 mmbtu since early this year when prices fell from loftier levels traded at last winter. While there has been a good amount of volatility in recent months, prices have kept under that mark, except for a brief period in August that was quickly sold off.

Natural gas volatility subject to foreign flows, weather trends

While the U.S. is entering its heating demand season, when stockpiles are typically drawn down amid increased energy demand, the next month offers a transitory period when demand can ease. This can sometimes lead to lower volatility, assuming the U.S. sees seasonal weather.

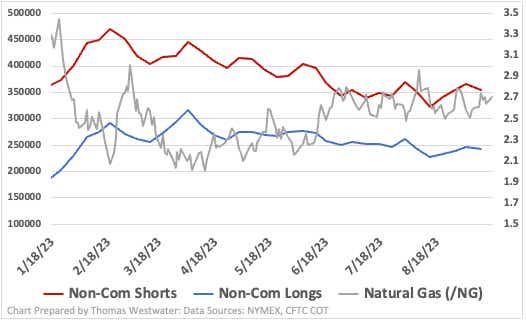

In fact, we are seeing some repositioning among speculators when looking at the Commitments of Traders (COT) report from the CFTC. Data released on Friday for the week ending Sept. 12 showed short contracts fell by 10,057, while long contracts fell by 3,822, a net change of 5,620. This isn’t a monumental shift, but we should expect to see shorts adding back over the coming weeks as winter approaches.

One source of volatility is coming from Australia. Workers at two Chevron (CVX) plants in Western Australia are currently striking. Up until recently, only a limited strike was occurring, but the industrial action is expected to increase, which may impact outflows from Australia that have been unimpacted up to this point.

If so, that could inject a new round of volatility into the U.S. pricing as Europe and Asia would face increased competition over the same liquid natural gas (LNG) cargo. Another issue came out of an LNG facility in Texas. The facility, owned and operated by Freeport, saw a large drop in feed gas deliveries for the week ending September 11, according to a report by S&P Global. That problem was reportedly fixed last week, which may explain some of the late-week weakness.

The week ahead will unveil U.S. inventory figures, which may influence price action. Traders will also continue to closely watch Australia for further news of industrial actions from Chevron workers.

Natural gas technical outlook

Currently, prices are climbing above the 100-day simple moving average. A daily close above the SMA could introduce some bullish confidence. Meanwhile, the moving average convergence/divergence (MACD) made a bullish cross and is heading for its center line, indicating the start of a potential uptrend.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices