Natural Gas Prices Rise Amidst Sweltering Heat Dome

Natural Gas Prices Rise Amidst Sweltering Heat Dome

Heat and storage figures support the bull case for energy prices

- U.S. natural gas prices rise amid extreme heat, inventory draw.

- European gas prices collapse after Australian workers strike deal.

- The technical outlook is unconvincing, but you should expect volatility to continue.

U.S. natural gas prices (/NG) surged higher on Thursday afternoon following the release of the Energy Information Administration's (EIA) weekly inventory figures for the week ending August 18. The report revealed an 18 billion cubic feet (bcf) build, significantly missing the 33 bcf consensus estimate and falling short of the previous week’s 35 bcf increase.

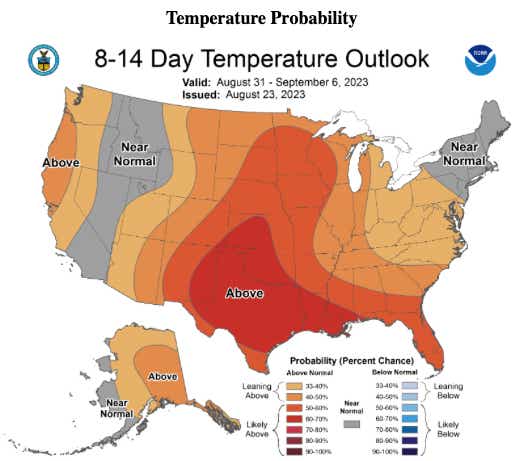

The market's reaction to the smaller-than-expected build is not surprising, even amidst falling equity and crude oil prices on Wall Street. A brutal heat dome is currently causing record and near-record temperatures across much of the Midwest and the South. Although some short-term relief is expected for the Midwest, the eight- to 14-day temperature outlook indicates high temperatures should return soon. This is likely to stave off bearish price action for the time being.

European prices collapse as Australian supply woes clear

European prices, as per Dutch Title Transfer Facility (TTF) futures, dipped nearly 14% overnight following the news that workers at Australia's largest liquified natural gas (LNG) facility have reached a preliminary agreement with Woodside Energy (WPL.AX) after a prolonged stretch of anxiety over a deal. This development is likely to prevent a significant supply shock. The union members have already cast their votes to finalize the deal, although the results have not been publicly disclosed yet.

Australia exports its LNG primarily to Japan and other Asian countries, with only a minimal number of cargoes destined for the U.S. A slowdown in Australian LNG exports due to a strike could have caused Japan to compete for U.S. cargoes, on which Europe has been heavily dependent. With the threat now eliminated, much of the risk premium has evaporated from the market. U.S. exports are expected to continue operating near capacity, while intense heat maintains domestic demand.

Natural gas technical outlook

/NG’s position has weakened over the past couple of weeks after falling below its 50- and 100-day Simple Moving Averages (SMAs). However, when looking at the chart, those SMAs haven’t stopped volatile price action from whipsawing around them.

Given that prices are near the lower end of the trading range seen over the past few months, traders may feel slightly inclined to take a long position at the current levels. Despite a low IV Rank (IVR) at 18.8%, there is still plenty of premium for those who would like to take the long side with a short put or short put vertical.

![[NG chart]](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/bltd5829b992784cde1/64e7ae1daa596eedcb81a4cc/natgas_chart.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.