The Moment of Truth for Stock Markets

The Moment of Truth for Stock Markets

By:Ilya Spivak

How stocks respond to economic data is in flux just as U.S. jobs data looms

- June’s U.S. employment data is in the spotlight as markets weigh Fed outlook.

- If recent patterns hold, stocks may cheer upbeat data or wilt on weakness.

- However, the data night yet bring back “good=bad” price action patterns.

A sense of occasion accompanies the release of June’s U.S. employment statistics.

The monthly publication already commands considerable attention from financial markets, pivotal as it is for gauging the health of the most singularly impactful consumer market for global economic growth. This time, it will also mark the first bit of truly top-tier economic data after an almost month-long deluge of hawkish posturing from the Federal Reserve.

Fed Chair Jerome Powell took the lead, trying to appear stern even as he announced that the U.S. central bank opted to hold fire at the Federal Open Market Committee (FOMC) meeting held mid-June after consecutive rate hikes at the preceding 10 gatherings. The message remained forceful as Powell sat for semi-annual testimony in Congress the very next week. He was at it again the following week, this time at the annual European Central Bank (ECB) Forum on Central Banking in Sintra, Portugal.

Minutes from June’s conclave released this week summarize policymakers’ disposition nicely. While “almost all” officials saw pausing the tightening cycle as “appropriate or acceptable,” “some” favored a hike but agreed to go along with a wait-and-see approach. A commanding majority of the group remained keenly focused on reducing still-too-high inflation and expected more rate hikes in 2023.

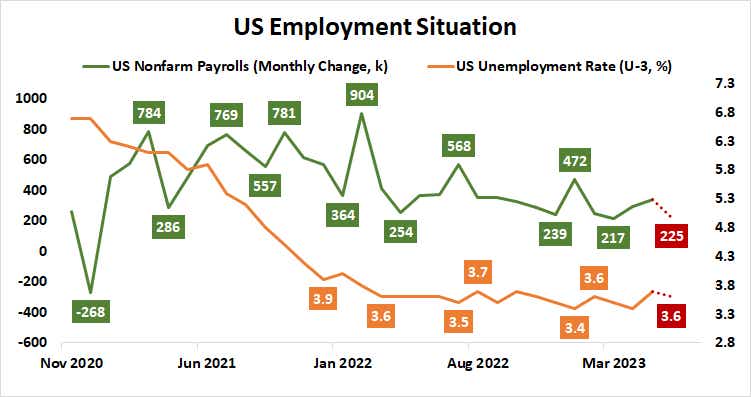

Against this backdrop, June’s labor-market data drop is expected to show a 225,000 rise in non-farm payrolls, the smallest increase in three months. Nevertheless, the jobless rate is seen ticking lower from 3.7% to 3.6%. Average hourly earnings—a measure of wage inflation—is seen easing back from 4.3% to 4.2% year-on-year. Absent a wild surprise on one of these key metrics, the results seem unlikely to meaningfully alter the Fed’s tune.

Stocks have shrugged off four months of hawkish Fed repricing

With this in mind, price action after the numbers cross the wires may prove telling.

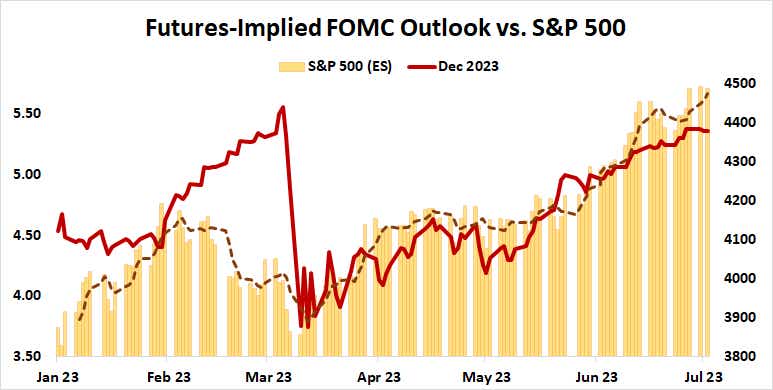

Stocks have managed to rally alongside a steady hawkish shift in the priced-on Fed policy outlook since mid-March. That has amounted to the near-total unwinding of the panicked dovish lurch suffered amid the SVB-led banking crisis. What’s more, measures of credit stress dropped to the lowest yet this year, even as late-2023 rate cut hopes evaporated.

If these dynamics hold, a solid set of jobs figures might be welcomed on Wall Street even as yields rise. Alternatively, a soggy outing might spur worries about flagging economic growth at a time when the Fed has all-but promised more tightening, stoking recession fears.

Resetting market reaction expectations after SVB banking crisis, U.S. debt ceiling mess

An alternate framework for interpreting the numbers might suggest price action over the past four months has amounted to little more than a kind of reset.

With the banking crisis pushed off to the background and the U.S. debt ceiling standoff paused until after the 2024 election cycle, the priced-in policy outlook has recovered the ground it lost when panic peaked. It has not made new ground. The year-end rate implied in Fed Funds futures remains below the March high, even if only slightly so.

Upbeat jobs data that translates to a truly higher high on 2023 Fed Funds expectations may bring back over-tightening fears, much as it did in February. That might see stocks decline on seemingly supportive figures. On the other hand, soft outcomes might be welcomed in that they might limit the Fed to the added action that is already priced in. Markets see the rate hike cycle topping after one more 25-basis-point increase no later than September.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices