Markets May Lose Steam If U.S. Jobs Data Disappoints

Markets May Lose Steam If U.S. Jobs Data Disappoints

By:Ilya Spivak

The U.S. economy’s trajectory is discouraging, even after an off-the-charts jump in imports is taken out of the equation

- Imports skewed Q1 U.S. gross domestic product (GDP) data, but slowing consumption is a worry.

- All eyes are turning to the jobs report for a clearer picture of the economy.

- Stock markets may lose steam as bonds rise if labor data disappoints investors.

Stock markets have shrugged off disappointing U.S. economic growth data. The first-quarter gross domestic product (GDP) report showed output unexpectedly shrank for the first time in three years. Shares plunged at first, with the S&P 500 dropping as much as 2.2%, but then bounced to erase the drop and eke out a narrow gain by the closing bell.

Perhaps traders were heartened by the report’s internals. They showed a staggering jump in imports skewed the data downward amid a rush to stockpile inventories before the onset of tariffs championed by the Trump administration. The markets may have reasoned that this distortion will evaporate now that the levies are in place.

What is the real story in U.S. GDP data?

Such optimism seems misplaced, however. That imports amounted to a shocking drag of 5.03 percentage points (ppt) on overall GDP certainly looks like an anomaly. The only other comparable instance for over two decades was the 7.46ppt drawdown in the third quarter of 2020 as growth seesawed amid the COVID-19 pandemic.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

However, the external sector makes a minimal contribution to overall growth, amounting to just 4.2% of the total in the first quarter. By contrast, consumption accounted for 68.5%. Its contribution dropped to just 1.21ppt, the smallest since the second quarter of 2023. That amounted to the slowest expansion for this vital area in nearly two years.

This means the trajectory for the U.S. economy was hardly encouraging in the first three months of the year, even after imports’ off-the-charts expansion is taken out of the equation. With this in mind, the spotlight turns to April’s U.S. employment report as markets search for a clearer picture of the business cycle.

Can stock markets stomach a disappointing U.S. jobs report?

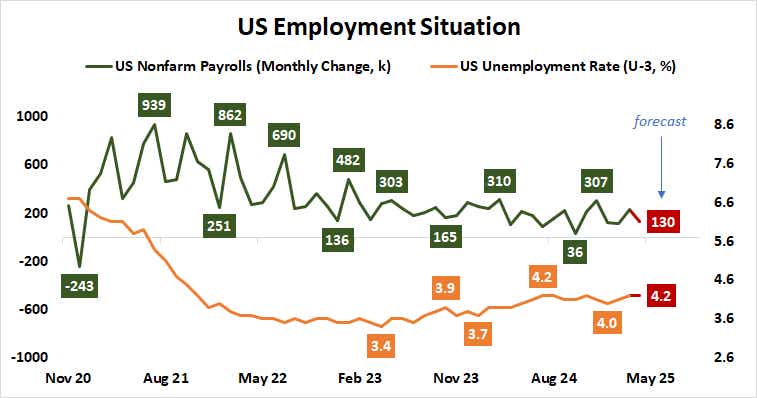

The Bureau of Labor Statistics (BLS) is expected to report that the economy added 130,000 jobs last month, climbing down from the 228,000 increase in March. The unemployment rate is penciled in to remain unchanged at 4.2%. Analytics from Citigroup suggest U.S. data flow has tended to undershoot projections recently, hinting at disappointment risk.

Purchasing managers’ index (PMI) data from the Institute of Supply Management (ISM) and an analog report from S&P Global tracking the U.S. manufacturing sector bolster the case for weakness. The former showed employment fell for a third consecutive month. The latter flagged the worst result for job creation in six months.

Weak labor market figures may shatter traders’ rose-tinted disposition after the GDP report and sharpen worries about the onset of recession. That might weigh heavily on stock markets and stoke speculation about a dovish turn at the Federal Reserve when policymakers meet next week, driving down yields and the U.S. dollar as Treasury bonds rise.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices