Nike (NKE) Earnings Preview: Has the Stock Finally Bottomed?

Nike (NKE) Earnings Preview: Has the Stock Finally Bottomed?

Nike shares have been stuck in neutral, but a solid quarter could flip the script

Nike (NKE) reports fiscal Q1 2026 results after the market close on September 30, with analysts expecting roughly $11 billion in revenue, down about 5% year-over-year, and $0.27 in EPS—a steep decline from $0.70 in the same quarter last year.

China sales, digital channel performance, inventory progress, and margin recovery will be key focus areas as investors look for early signs that the “Win Now” turnaround plan is beginning to work.

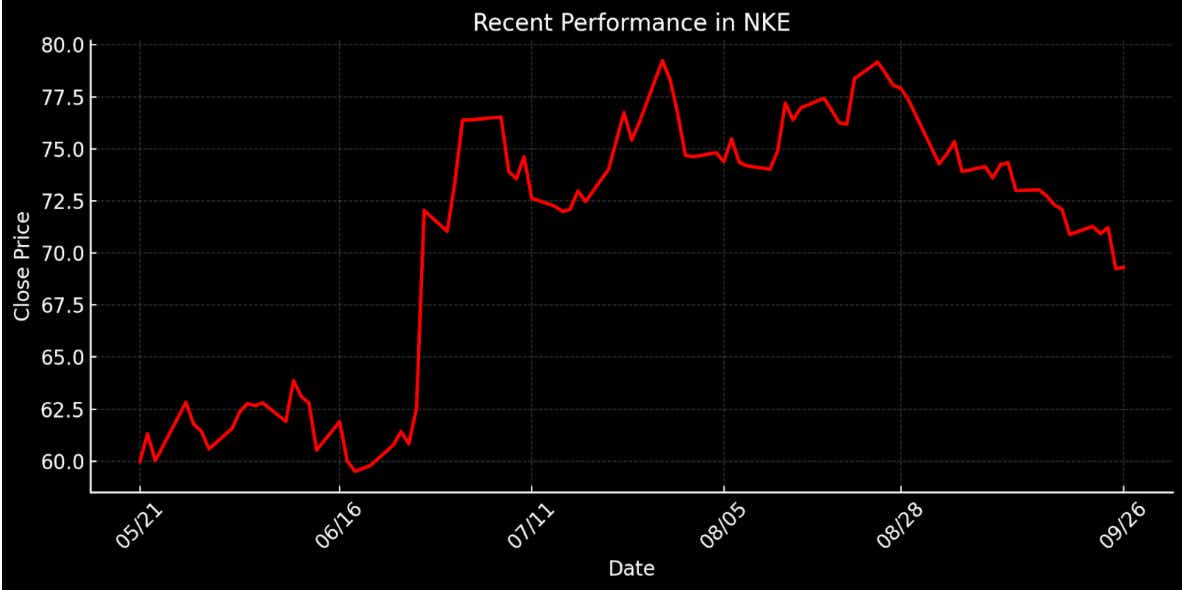

With shares down 20% over the past year and still trading at a premium P/E multiple, this earnings release is shaping up to be a key litmus test — a clear beat could ignite a sharp relief rally, while another soft quarter risks reinforcing bearish sentiment and keeping the stock under pressure.

Nike (NKE) is the world’s largest athletic apparel and footwear company, home to the Nike, Jordan, and Converse brands. With a presence in over 190 countries and a product lineup that spans performance footwear, apparel, and equipment, Nike has built one of the most recognizable consumer brands on the planet. Its direct-to-consumer (DTC) focus, digital investments, and relentless product innovation have long set the standard for the sportswear industry.

Shares of NKE are down about 20% over the past 52 weeks, reflecting investor caution as the company works through a challenging transition. Nike is in the midst of its “Win Now” turnaround strategy, designed to simplify operations, sharpen its focus on sport performance, and realign supply and distribution channels. That strategic reset has come with short-term pain: revenue and profit have both declined in recent quarters, and investors are eager for signs that the worst is over.

Nike is scheduled to report fiscal Q1 2026 earnings results after the market closes on Tuesday, September 30. Analysts expect revenue of about $11 billion, down roughly 5% from a year ago, with earnings per share projected near $0.27—a sharp decline from $0.70 in the same quarter last year. This quarter is viewed by some as the trough of Nike’s restructuring efforts, meaning investors will be watching closely for early evidence that margins are stabilizing and demand is beginning to recover.

A Critical Checkpoint for the “Win Now” Turnaround Plan

In a turnaround, every earnings report doubles as a status update. Investors don’t just want to see the numbers—they want to know if the plan is working. Nike’s upcoming Q1 report therefore carries extra weight: four straight quarters of shrinking sales and compressed margins have put pressure on management to prove that its “Win Now” strategy is more than just talk. This release could mark the first real sign that the company’s reset is starting to take hold.

Expectations are cautiously optimistic. Wall Street sees revenue falling roughly 5% year-over-year—a big step up from the double-digit drops earlier in 2025—and analysts are hoping for a modest EPS beat as cost cuts, inventory clean-ups, and supply-chain fixes begin to flow through to the bottom line. China remains the headline risk after last quarter’s bruising 21% sales drop—but even a faint sign of stabilization in that market could flip the narrative. Investors will also be watching Nike’s digital channels closely. With so much capital tied up in direct-to-consumer and its e-commerce ecosystem, the company needs to show that its app and online business can get back on a growth trajectory.

Margins remain the swing factor. Deep discounting, elevated logistics costs, and a less favorable product mix have dragged profitability lower, and investors will be looking for evidence that Nike is regaining pricing power and dialing back markdowns. Any sign that the company has a credible plan to blunt the $1 billion tariff hit—whether through sourcing diversification, price adjustments, or improved efficiency—would go a long way toward easing near-term anxieties.

Considering all of the above, this report could be a catalyst. With shares already down 20% over the past year, expectations are low—meaning good news on margins, inventories, or China could ignite a relief rally. But the flip side is just as potent: if guidance disappoints or demand shows no signs of life, the market could lose patience, and push Nike shares to fresh lows. Either way, the next move for NKE could be sharp.

Rich Valuation Raises the Stakes

Nike isn’t just trading at a premium—it’s trading at one of the richest valuations in the athletic apparel space. At roughly $69 per share, NKE carries a trailing GAAP P/E of about 33, well above the consumer discretionary sector median near 20x. Its price-to-sales ratio sits around 2.3x—more than double peers—and its price-to-book multiple of 7.9x towers over the sector median near 2.3x. Taken together, the numbers signal that investors still see Nike as the undisputed category leader—one with the brand power and long-term growth runway to warrant a premium “quality” multiple, even in the face of near-term headwinds.

Bulls argue that Nike has earned this premium through decades of brand dominance, global scale, and financial strength. Even in a tough macro environment, Nike generates robust cash flow, invests heavily in innovation, and maintains one of the strongest balance sheets in consumer discretionary. The “Win Now” strategy, if successful, could restore margins, streamline operations, and set the stage for renewed top-line growth—outcomes that would make today’s valuation look justified—perhaps even attractive, in hindsight.

Skeptics warn that Nike’s premium valuation leaves little room for error. After a year of declining sales and margin erosion, investors want proof of a real turnaround—not just promises. Heavy investment in marketing and direct-to-consumer could crimp near-term earnings, and if Q1 fails to show tangible progress, the stock’s lofty multiple could quickly compress, turning a “quality” premium into a liability.

Wall Street remains constructive but cautious. Of the 37 analysts covering NKE, 19 rate it a “buy” or “overweight,” while 16 recommend “hold.” The average 12-month price target sits near $79—about 15% above current levels—suggesting there’s still plenty of room to run—if management can deliver on the turnaround.

Nike Earnings Preview Takeaways

Nike approaches earnings with its global dominance intact, but the clock is ticking on investor patience. The “Win Now” turnaround isn’t just a slogan—it’s a mandate to prove the brand can streamline operations, restore margins, and get growth back on track. In that regard, this quarter feels less like a routine update and more like a critical checkpoint in that race.

Valuation only raises the stakes. At roughly 33x earnings—well above most peers—Nike can’t afford to simply clear a low bar. Investors want to see proof that the bleeding has stopped: margins flattening, China stabilizing, and digital growth showing signs of life.

The wild cards remain consumer demand and competitive pressure. Nike is wrestling with weak China sales, rising input costs, and a $1 billion tariff overhang—all while Adidas, Lululemon, and fast-growing local brands fight for share. Evidence of cleaner inventories, stronger product mix, or upbeat guidance could flip sentiment and spark a relief rally. But if Q1 comes in soft, the stock could stall in a frustrating holding pattern, tying up capital while investors wait for clearer proof of a turnaround.

To learn more about trading earnings events using options, readers can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices