Oracle (ORCL) Earnings Preview: Spending Spree Puts Profitability in Focus

Oracle (ORCL) Earnings Preview: Spending Spree Puts Profitability in Focus

Oracle Earnings Preview

Oracle (ORCL) reports Q1 fiscal 2026 results after the close on Tuesday, September 9, with analysts expecting EPS of $1.47 on revenue of about $15 billion.

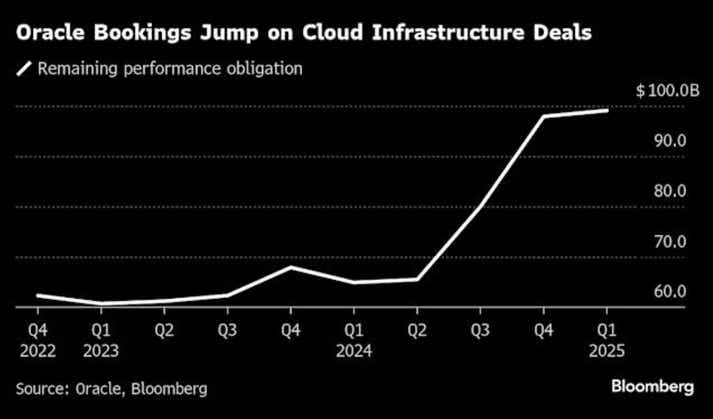

Oracle’s $138 billion backlog and surging cloud infrastructure business signal strong underlying demand.

But with shares up nearly 40% this year and an elevated valuation relative to peers, Oracle must prove it can translate heavy capex spending into durable, high-return earnings power.

Oracle (ORCL) heads into its September 9 earnings report with expectations running high. Shares have surged roughly 40% year-to-date, making it one of the standout performers in the technology sector. Long known for its dominance in databases and enterprise software, Oracle now faces a defining question: can its massive bet on cloud infrastructure and artificial intelligence deliver the kind of growth investors are counting on?

Founded in 1977 around its flagship database, Oracle has steadily expanded into enterprise applications, middleware, and industry-specific software, establishing a global presence in enterprise technology. Today, the company is entering a new era as a full-spectrum cloud provider, with Oracle Cloud Infrastructure (OCI) now its primary growth engine. OCI delivered 52% year-over-year IaaS growth last quarter, reflecting accelerating adoption across both traditional enterprise workloads and new AI-driven demand.

Oracle will report Q1 fiscal 2026 earnings results after the close on Tuesday, September 9. Management has guided revenue to grow 12–14% year-over-year, with consensus estimates at roughly $15 billion. Non-GAAP EPS is expected at $1.47, up about 6% from a year ago. On the surface, those figures point to solid momentum. But for investors, the more pressing test is whether Oracle can prove it is not just expanding cloud revenues, but converting its enormous backlog into sustained profits—and in the process transforming from a legacy software giant into an AI leader.

From Database King to Cloud Contender

Oracle’s upcoming earnings report isn’t just another quarterly check-in—it marks a pivotal stage in the company’s transformation from a software incumbent into a cloud-first provider. Investors will be watching closely for evidence that Oracle can convert its surging backlog and heavy spending into profitable, sustainable growth.

The story so far has been one of solid progress. In the most recent quarter, revenue rose 11% to $15.9 billion, adjusted earnings per share reached $1.70, and operating cash flow climbed 12% to $20.8 billion. Cloud infrastructure led with 52% growth, while application platforms like Fusion and NetSuite delivered double-digit gains. Just as importantly, Oracle’s backlog of contracted business—its remaining performance obligations—expanded 41% to $138 billion, offering visibility but also raising the stakes for execution.

That backlog, and how efficiently it converts into sales, is now central to the Oracle story. Management expects cloud revenue to grow more than 40% in fiscal 2026, fueled by partnerships with Microsoft, Google, and Amazon, and supported by massive investment in capacity—most notably the $30 billion “Stargate” data center project in Texas. If successful, those investments could generate up to $60 billion in annual infrastructure revenue by 2028, putting Oracle in closer competition with hyperscale rivals in AI workloads.

For investors, the trade-off is clear: Oracle is growing fast, but at a steep cost. The company carries more than $100 billion in debt, and capital expenditures are projected to rise sharply—from $21 billion in 2025 to as much as $40 billion by 2027—as it builds out new data centers worldwide. That spending spree raises the risk of margin pressure. The upcoming report will be scrutinized for signs that Oracle can protect profitability while funding this expansion.

All told, investors want to see proof that Oracle can convert its massive backlog into realized revenue, sustain cloud growth above 40%, and defend margins even as capital needs climb. Delivering on those fronts would strengthen confidence in the cloud pivot; falling short could shift attention back to debt, execution risk, and whether rapid growth in capex spending is sustainable.

Stretched Valuation Leaves Little Room for Error

The Oracle narrative is undoubtedly compelling, but the valuation is arguably a sticking point. At roughly $230 per share, the stock trades at 51 times trailing GAAP earnings versus a sector median of 29. Moreover, its price-to-sales multiple of 10.8 and price-to-book ratio of 30 both tower over industry averages of 3.3 and 3.6. Those premiums underscore the market’s conviction in Oracle’s $138 billion backlog and cloud momentum—but they also leave little room for error.

Analysts remain broadly constructive on Oracle, but with tempered expectations. Of the 42 analysts covering the stock, 27 rate it a “buy” or “overweight,” while 14 sit at “hold.” The consensus price target of around $250/share suggests only modest upside from the current $230 level. The more bullish calls reach toward $300, but that outlook assumes Oracle can execute flawlessly—sustaining 40%-plus cloud growth, converting its $138 billion backlog into revenue, and protecting margins while financing an aggressive data center buildout.

The key question is whether Oracle deserves to trade at such a premium. On one side of the ledger, the company offers sticky enterprise relationships, a large and growing backlog, and a cloud infrastructure business that is expanding faster in percentage terms than larger rivals. On the other, Oracle carries more than $100 billion in debt, is entering a period of elevated capital expenditures, and faces pressure to show that revenue and earnings growth can keep pace with expectations. If Oracle demonstrates that its cloud and AI investments are scaling profitably, today’s multiples could be justified. If not, the current valuation risks looking more like a ceiling than a floor.

Oracle Earnings Preview Takeaways

Oracle’s stock has soared nearly 40% this year on the promise of cloud dominance and AI-fueled demand, leaving little margin for disappointment. Double-digit revenue growth, strong cash flow, and a $138 billion backlog should all be cause for celebration—but at $230 a share, investors are already paying for near-flawless execution.

That’s why September 9 matters. Wall Street’s $250 price target leaves little headroom, and the market wants proof that Oracle can scale fast enough to protect margins while turning backlog into revenue. Hitting the 40% cloud growth target and showing progress on megaprojects like Stargate could buy more time for the rally; but anything less could leave the stock struggling to justify its premium.

For investors, this isn’t about growth in the abstract—it’s about proving that growth is both profitable and durable. If Oracle clears that bar, the premium holds. If not, the stock may suddenly look a lot heavier than it did on the way up. Readers looking to explore options strategies designed for trading earnings events can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices