Powell Testimony: Fed Chair in the Hot Seat as Inflation Risk Rebuilds

Powell Testimony: Fed Chair in the Hot Seat as Inflation Risk Rebuilds

By:Ilya Spivak

All eyes are on testimony from Fed Chair Jerome Powell as the outlook for ongoing interest rate hikes continues to preoccupy global financial markets.

- Markets anxiously await key testimony from Fed Chair Jerome Powell

- At issue is whether February’s hawkish turn in rate hike bets is sufficient

- Bond markets signal inflation is back on the march, beckoning action

Powell testimony: All eyes on the Fed Chair

The markets wait with bated breath as Federal Reserve Chair Jerome Powell gets set for two days of semi-annual testimony on monetary policy to the US Congress. It is a two-day affair, with the central bank chief appearing in the Senate and following that up with a repeat performance in the House. While the prepared remarks for these outings will be difficult to distinguish, the Q&A following each one can veer into unexpected places.

The markets have been utterly preoccupied with where the Fed is steering since mid-2021, when officials decided they had better do something about runaway inflation that then seemed far less “transitory” than expected. Speculation about the amplitude and length of the rate hike cycle that would ensue in early 2022 has been the narrative du jour for most asset classes since then.

Data Source: Bloomberg

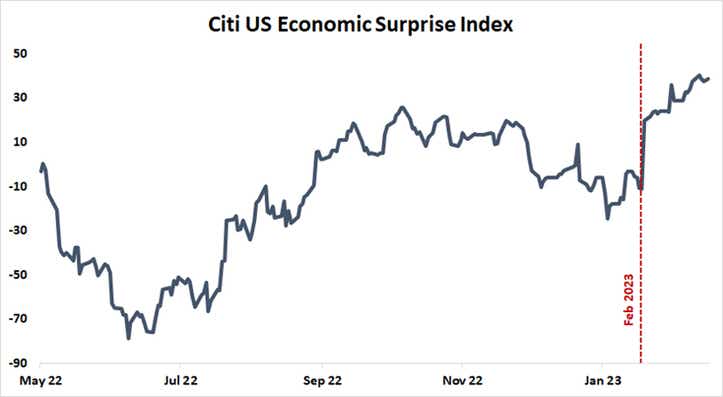

February turned out to be a critical turning point in this story. US economic data began to turn sharply higher relative to baseline expectations, driving rapid re-pricing of the Fed policy outlook to a more hawkish setting. The markets responded as might have been expected: stocks swooned alongside gold prices while the US Dollar rose. The key question now is whether that adjustment is sufficient, or if a larger one must yet be endured.

Inflation is back on the march

The upshift in US economic data has brought with it swelling inflation expectations. The 2-year breakeven rate, a measure of the inflation outlook priced into near-term bond yields, has run up to a 10-month high at 3.4 percent on the eve of the Fed Chair’s testimony. Trends here have tended to lead headline measures of inflation – the common CPI or the Fed’s preferred PCE – by about two months. The latest increase implies the Fed needs to do more to curb price growth.

Data Source: Bloomberg

Data Source: BloombergThat further rate increases are to be signaled seems a given. Indeed, the policy path already implied in Fed Funds interest rate futures already presupposes three 25-basis-point (0.25 percent) rate hikes before the year is out, along with about a 50/50 chance for a fourth. The fireworks may trigger if Mr Powell drives home that policymakers have no attachment to a given peak on rates – including December’s official guess of 5.1 percent – and intend to press on as need be.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices