Qualcomm’s Quiet Pivot: Value, Vision and the Future of Edge AI

Qualcomm’s Quiet Pivot: Value, Vision and the Future of Edge AI

Qualcomm’s Quiet Pivot: Value, Vision and the Future of Edge AI

Qualcomm isn’t chasing cloud dominance—it’s quietly embedding its chips in the smart devices reshaping everyday life—from cars and wearables to AI-powered laptops.

Qualcomm is gaining ground in automotive and internet of things (IoT)—newer verticals that are finally starting to move the needle.

With a reasonable earnings multiple, resilient margins and billions flowing back to shareholders, Qualcomm stands out as one of the few AI-adjacent stocks with a valuation that’s grounded in fundamentals.

The market sees the old Qualcomm. It’s quietly becoming something else.

Qualcomm (QCOM) isn’t chasing cloud clout—it’s embedding itself in the smart devices reshaping daily life. While rivals pour billions into centralized AI infrastructure, Qualcomm is taking a different route—powering the edge. That means devices like AR glasses, connected cars, and AI-ready laptops—where processing happens locally, not in distant data centers.

Today, we unpack Qualcomm’s quiet reinvention—and why investors might be overlooking one of the most compelling risk-reward setups in the semiconductor space.

More than modems, Qualcomm’s quiet reinvention

For years, Qualcomm was synonymous with the smartphone boom—its Snapdragon chips and 5G modems powering billions of mobile devices worldwide. But in 2025, it’s no longer just a handset play. Under CEO Cristiano Amon, Qualcomm is actively shedding its mobile-first image and repositioning as a platform company for the next wave of connected computing.

That future is being built at the edge—where AI, XR wearables, automotive systems and smart infrastructure converge. From factory floors to living rooms to city streets, Qualcomm is positioning itself as the essential engine behind the smart, connected experiences of tomorrow.

It’s a bold repositioning in a crowded field. While semiconductor giants like Nvidia (NVDA) and Advanced Micro Devices (AMD) dominate the AI infrastructure narrative, Qualcomm is aiming squarely at the device layer—designing chips that move AI processing closer to the user, not the cloud. This “edge AI” strategy isn’t about winning hyperscale data center contracts. It’s about embedding intelligence into the physical world—such as cars, laptops, wearables and sensors.

But the transformation hasn’t necessarily been easy. Qualcomm remains deeply tethered to the handset market, with mobile chips still making up more than 70% of its QCT revenue. Recent deals with Chinese OEMs like Xiaomi have helped cushion the blow from Apple’s modem exit—but the broader mobile landscape is maturing, increasingly commoditized and clouded by geopolitical tension. For now, Qualcomm sits in a strategic middle ground: no longer just a mobile chipmaker, but not yet fully diversified.

To accelerate its pivot, Qualcomm is doubling down on vertical integration. The planned acquisition of Alphawave IP—specializing in high-speed chip interconnects for AI systems—signals a move deeper into the plumbing of next-gen computing. Paired with Qualcomm’s in-house Oryon CPUs and Hexagon NPUs, the deal positions the company to compete in emerging high-performance niches, from AI PCs to edge servers. Early conversations with hyperscalers and sovereign AI projects are encouraging, but these initiatives are still in their infancy and unlikely to impact the top line before 2028.

In the meantime, Qualcomm is executing where it excels: designing high-efficiency, high-performance chips that meet the evolving needs of modern consumer tech. Whether inside a BMW, a Meta headset or a next-gen laptop, its silicon footprint is expanding—just not fast enough to silence skeptics. Execution risk remains a key overhang, and for investors, vision alone isn’t enough—they’re looking for tangible progress that validates Qualcomm’s long-term narrative.

And yet, something is shifting. Qualcomm is returning capital at scale, gaining traction across high-growth verticals and preserving strong margins even as R&D ramps up. For now, it sits at the intersection of skepticism and potential—still trading at a discount, still flying under the radar and quietly laying the groundwork for a broader breakout.

A strong quarter for Qualcomm, with strategic shifts well underway

Qualcomm’s latest earnings report delivered a familiar mix of outperformance and unresolved questions. The company beat expectations on both the top and bottom line, but concerns around customer concentration and business mix still linger.

Adjusted EPS (earnings per share) came in at $2.77, edging past the $2.71 consensus, while revenue hit $10.4 billion—modestly ahead of forecasts. Net income rose to $2.66 billion ($2.43 per share), up from $2.13 billion a year earlier. And guidance turned heads: for Q4, Qualcomm is targeting $10.7 billion in revenue and $2.85 in EPS at the midpoint—beating Wall Street expectations on both fronts.

Drilling into the numbers, Qualcomm’s legacy handset business still dominates—bringing in $6.33 billion in Q3, or more than 60% of total sales. That total landed just shy of analyst expectations and remains a key concern for investors wary of Apple’s shift toward in-house modems.

The risk isn’t hypothetical. Qualcomm has publicly acknowledged it expects to lose Apple’s modem business in the coming years—a move that threatens one of its most profitable revenue streams. And yet, the company is already reframing the narrative: CEO Cristiano Amon noted that chip revenue from non-Apple customers is up more than 15% year-to-date, fueled by flagship Android launches and rising average selling prices.

That’s not the only area where momentum is building. Qualcomm’s Internet of Things (IoT) segment posted a 24% year-over-year revenue jump to $1.68 billion, driven in part by surging demand for Meta’s smart glasses—now a central piece of Qualcomm’s edge AI strategy. Smart glasses may still feel niche, but the traction is real: Ray-Ban parent EssilorLuxottica reported that sales of the AI-powered glasses have tripled year-over-year, as Meta leans further into its “personal superintelligence” vision—one Qualcomm is eager to power.

Automotive, another cornerstone of the diversification push, generated $984 million in revenue—up 21% from the prior year. While slightly behind IoT in growth rate, auto remains a high-potential, long-cycle opportunity. Expanding design wins—including BMW’s Neue Klasse platform—and rising chip attach rates are fueling steady progress.

Together, IoT and automotive are approaching a critical threshold: the potential to surpass Apple’s contribution to Qualcomm’s business. Hitting that milestone would mark more than a revenue shift—it would be a turning point in reducing dependency and strengthening long-term earnings potential.

On the capital allocation front, Qualcomm is sticking to its playbook. The company returned nearly $3.8 billion to shareholders during the quarter—$2.8 billion through share buybacks (including 19 million shares repurchased) and nearly $1 billion in dividends. That level of return highlights the financial strength Qualcomm maintains, even as it ramps up R&D to support next-gen products across AI PCs, automotive platforms and specialized chips aimed at boosting performance in data centers.

The big picture? Qualcomm is holding its ground. It’s beating estimates, growing in new markets and maintaining healthy margins—even as it absorbs Apple’s modem exit and contends with a slowing mobile business. But in a semiconductor market now defined by breakneck AI growth, resilience isn’t enough. The next phase depends on reacceleration—and showing that Qualcomm isn’t just adapting, but ready to lead the next wave.

Discounted Qualcomm valuation, for now

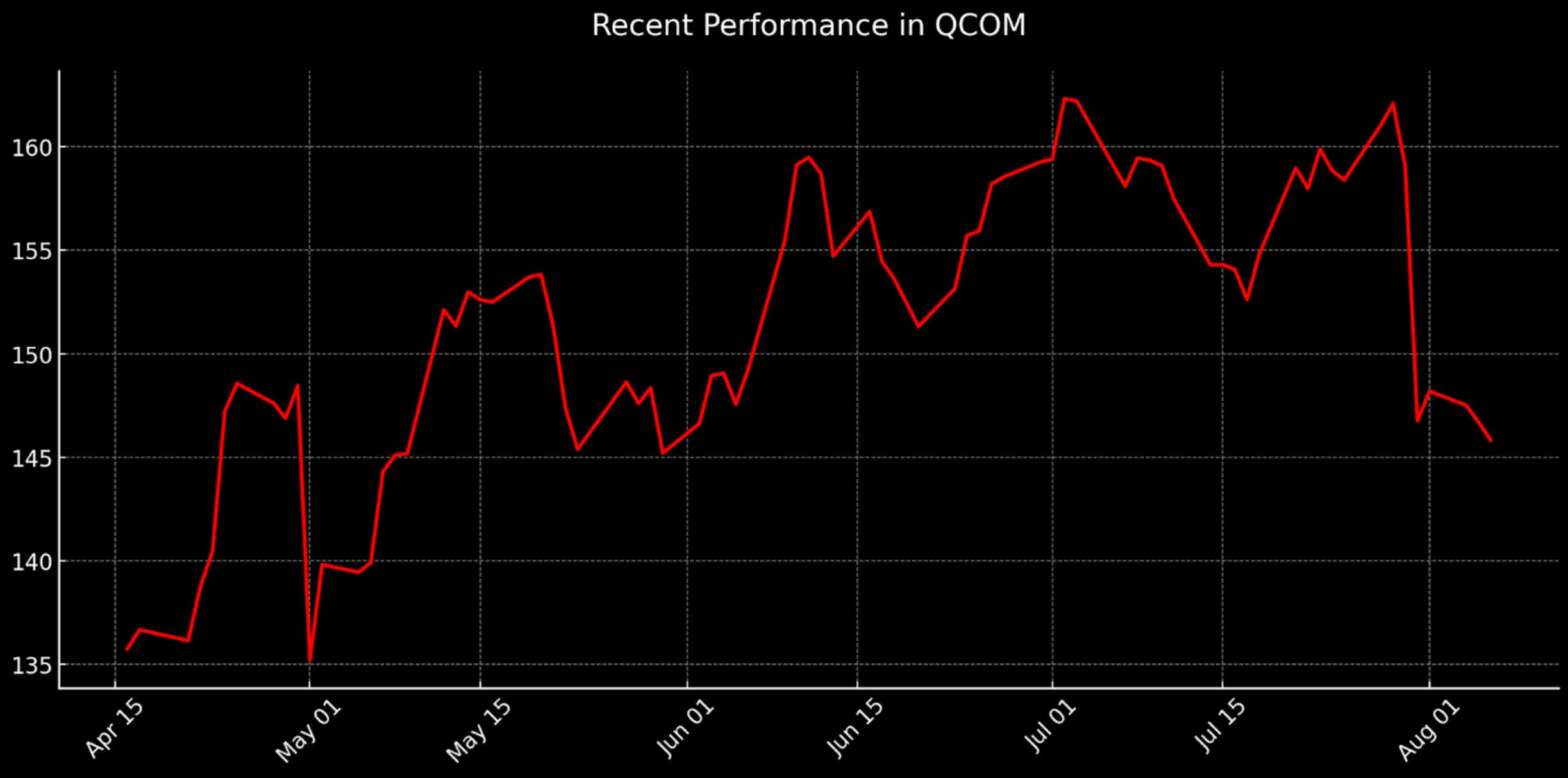

Despite solid execution and growing traction in key verticals, Qualcomm’s stock still trades like a company stuck in transition. Shares hover around $150—well below the average analyst target of $175—and the company’s GAAP trailing P/E sits at just 14, roughly half the sector median of 27. On an earnings basis alone, Qualcomm stands out as a relative bargain in a semiconductor market where AI momentum has inflated multiples across the board.

Still, a closer look reveals a more complex picture. While Qualcomm screens as cheap on earnings, other valuation metrics tell a different story. Its price-to-sales ratio sits at 3.8—above the sector median of 3.1—and its price-to-book is 5.9, compared to a peer average of 3.5. In other words, the stock isn’t a deep value play across the board. The market continues to assign a premium for Qualcomm’s balance sheet strength, its reliable revenue base and its crown-jewel IP portfolio—all reinforced by a steady capital return program.

So how do we reconcile the valuation disconnect? The answer lies in Qualcomm’s evolution. For years, the stock has been viewed through a mobile-first lens—defined by cyclical handset sales, customer concentration and concerns over pricing pressure and slowing unit growth. But that narrative is starting to shift. As the handset business plateaus and new engines like automotive, IoT and edge AI begin to scale, the market may be nearing a re-rating—one that reflects Qualcomm’s broader opportunity set, not just its legacy mobile roots.

There are signs the re-rating has already begun. Despite Apple’s planned modem exit, 21 of the 39 analysts covering Qualcomm still rate it a “buy” or “overweight,” with 17 at “hold.” More notably, the focus is shifting. Analysts are beginning to look past the legacy handset business and zero in on Qualcomm’s execution in high-growth segments—especially AI PCs, smart devices and automotive platforms, where the company is not only securing early design wins but also increasing its attach rates, embedding more of its technology across each device or system.

Still, the case for a valuation reset hinges on follow-through. If Qualcomm can sustain mid-teens growth in non-Apple handset revenue, defend its lead in smartphone silicon, and scale its diversification efforts without sacrificing margins, the current 14x multiple starts to look increasingly disconnected from the company’s trajectory—especially in a market that routinely assigns 25x or more to peers with similar or less impressive growth profiles.

Qualcomm investment takeaways

While investor attention fixates on cloud giants and AI darlings, Qualcomm has been steadily building its footprint across the next wave of connected devices—cars, wearables, laptops, and edge sensors. It’s not chasing headlines. It’s executing: returning capital, protecting margins, and broadening its reach beyond smartphones.

And yet, the stock still trades like it’s stuck in the past. With a 14x earnings multiple and a mobile-heavy reputation, Qualcomm remains discounted despite clear signs of progress. The Apple modem exit looms large, but the bigger story is Qualcomm’s evolution—and the market’s slow recognition of it.

That’s what makes this moment interesting. Qualcomm doesn’t need a breakout to outperform. It just needs to keep proving that its future—anchored in AI PCs, automotive platforms, and edge computing—is already taking shape. If that continues, even modest multiple expansion could unlock meaningful upside.

Qualcomm already looks attractive here—but if broader markets sell off, pulling the stock back toward its prior lows, it may move from “undervalued” to “compelling.” In that context, weakness shouldn’t be feared. It should be viewed as an opportunity to add exposure to a company positioning itself for leadership in the next phase of connected computing.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices