Russia Risks Food Crisis, Stagflation If It Ends Ukraine Grain Deal

Russia Risks Food Crisis, Stagflation If It Ends Ukraine Grain Deal

By:Ilya Spivak

Markets may shudder amid fears of a global food crisis and stagflation if Russia ends a grain export deal with Ukraine, lifting the price of wheat and other key commodities.

- Moscow hints it may not renew the Black Sea Grain Initiative enabling exports from Ukraine

- Wheat prices may surge if the scheme unravels, risking a massive food crisis and stagflation

- The Kremlin’s overall military strategy seems to suggest that BSGI is likely to endure for now

Food crisis and stagflation menace markets if Russia blocks Ukrainian grain exports

Russia’s invasion of Ukraine may reclaim the spotlight for investors ahead of a looming deadline to renew the Black Sea Grain Initiative (BSGI). The UN- and Turkey-sponsored scheme is meant to allow safe passage for Ukrainian grain exports to global markets in wartime without Russian molestation. It is up for renewal on May 18. Moscow has variously signaled that it may not re-up its commitment.

The global price of wheat is a particular pain point. Ukraine is the world’s fifth-largest exporter, with 9.5 percent of the market as of 2021. Russia comes in first at 14.4 percent. The steady flow of cheap wheat through the Black Sea region despite the conflict has been essential to securing food supplies for highly dependent markets, such as China and the Middle East. It has also helped with central banks’ inflation-fighting efforts, enabling prices to fall alongside a broader decline in commodities as interest rate hikes cool economic activity.

Data Source: Bloomberg

A food crisis might ensue if Russia abandons the arrangement and wheat prices move up sharply. Besides the humanitarian disaster inherent in such a scenario, the negative consequences for worldwide economic activity would be multifaceted and vast. They would also strike at a most inconvenient time, when the global economy is already being squeezed by dramatic monetary tightening and set the stage for still more pain by inflaming price growth anew.

Russian economic and military strategy probably favors BGSI renewal

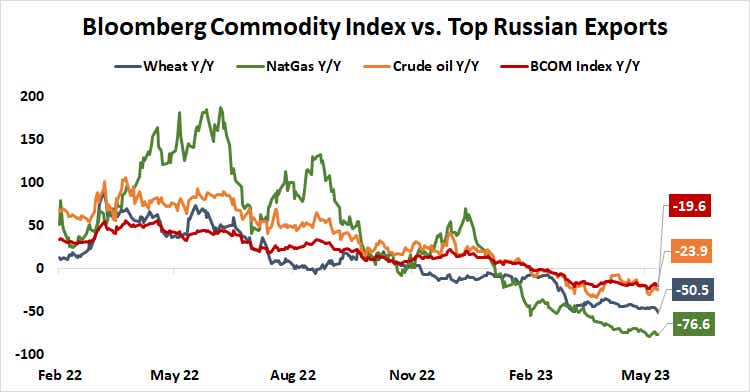

Thankfully, it seems this version of the future is unlikely, at least for now. The Kremlin’s saber-rattling may reflect a desire for a short-term price pop, but it seems likely to renew its BSGI commitment. In fact, keeping commodities where Russia is a dominant exporter trading cheap on global markets seems to be a part of Moscow’s overall strategy. Prices for the top three – wheat, crude oil and natural gas – are down significantly more year-on-year than the Bloomberg average of global raw materials costs.

Data Source: Bloomberg

This may reflect Russia’s desire to protect its market share even as its access to the global commercial order is disrupted by Western sanctions. It has but a few outlets left to raise money, including for its war effort. It would be doubly damaging to give up ground since the leading competition in all three markets comes from countries backing Ukraine in the war, most notably the United States.

Keeping its customers probably speaks to Russia’s broader military strategy as well. Its vast superiority in numbers – a gap of nearly 631,000 of active military personnel and over 47 million in potentially available manpower – appear to give it an edge in a prolonged engagement. In fact, the military triumphs standing tallest in Russia’s collective memory – the victories against Napoleon and Adolf Hitler – were won attrition terms.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices