S&P 500 Clawing Back Losses as Crude Oil Plunges

S&P 500 Clawing Back Losses as Crude Oil Plunges

Also, 10-year T-note, gold, crude oil and Japanese yen futures

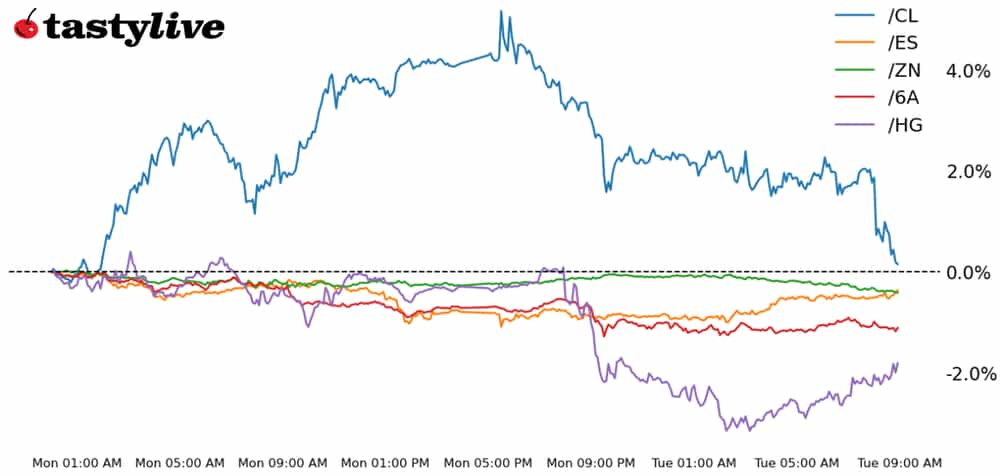

- S&P 500 E-mini futures (/ES): +0.64%

- 10-year T-note futures (/ZN): -0.11%

- Copper futures (/GC): -1.84%

- Crude oil futures (/CL): -4.26%

- Australian dollar futures (/6A): -0.16%

After a sluggish start to the week, traders moved back into risk assets, pushing equities higher on this morning. Geopolitical risk from the Middle East has faded for the time being, while the Federal Reserve’s path to interest rate cuts shifts back into focus. Bond yields moderated and oil prices fell. Chinese equities rallied overnight but copper prices failed to join in on the gains after traders returned from a week-long holiday. The U.S. trade deficit contracted in August, with a sharp increase in exports narrowing the gap.

Symbol: Equities | Daily Change |

/ESZ4 | +0.64% |

/NQZ4 | +1% |

/RTYZ4 | +0.22% |

/YMZ4 | +0.08% |

Equity futures bounced back from yesterday’s decline, with S&P 500 futures (/ESZ4) up about 0.3% ahead of the opening bell. Geopolitical tensions have cooled somewhat, helping to bring some risk back into the market. PepsiCo (PEP) fell 1% in pre-market trading after cutting guidance for the year amid weak sales across North America. Wells Fargo (WFC) rose 1.5% after an analyst upgrade. Meanwhile, technology leaders like Nvidia (NVDA) pointed higher ahead of the open.

Strategy: (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5700 p Short 5725 p Short 5825 c Long 5850 c | 17% | +987.50 | -262.50 |

Short Strangle | Short 5725 p Short 5825 c | 44% | +6875 | x |

Short Put Vertical | Long 5700 p Short 5725 p | 59% | +350 | -900 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.03% |

/ZFZ4 | -0.01% |

/ZNZ4 | -0.11% |

/ZBZ4 | -0.36% |

/UBZ4 | -0.48% |

Bonds were mostly lower this morning. Traders continue d to trim expectations for the next Federal Reserve meeting, with a 25-basis-point (bps)cut as the base case, according to Fed funds futures. There is a small but growing chance the Fed holds rates too. Federal Reserve Gov. Adriana Kugler said overnight that loosening policy more quickly could become appropriate if economic conditions deteriorate. 10-year T-note futures (/ZNZ4) 0.08% ahead of the New York open. There is a three-year note auction today.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 111 p Short 111.5 p Short 113 c Long 113.5 c | 28% | +359.38 | -140.63 |

Short Strangle | Short 111.5 p Short 113 c | 54% | +1562.50 | x |

Short Put Vertical | Long 111 p Short 111.5 p | 72% | +171.88 | -328.13 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.39% |

/SIZ4 | -2.37% |

/HGZ4 | -1.84% |

Chinese traders returned to the market after a week-long holiday, and they apparently decided to start selling copper despite a lot of appetite for onshore equities. Chinese policymakers recently walked back expectations on fiscal stimulus, which signaled less support to help boost the demand side of the economy. Copper futures (/HGZ4) fell more than 2% in early U.S. trading, dropping to the lowest level since Sept. 24.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.39 p Short 4.4 p Short 4.6 c Long 4.61 c | 19% | +212.50 | -37.50 |

Short Strangle | Short 4.4 p Short 4.6 c | 55% | +5910 | x |

Short Put Vertical | Long 4.39 p Short 4.4 p | 58% | +112.50 | -137.50 |

Symbol: Energy | Daily Change |

/CLZ4 | -4.26% |

/HOZ4 | -4.16% |

/NGZ4 | +0.11% |

/RBZ4 | -4.12% |

Geopolitical concerns can only take oil prices so high, and that is what traders are finding out this morning. Despite ongoing uncertainty around Israel’s potential response to Iran for last week’s attacks, the demand and supply sides of the market are having trouble supporting prices near the $79 per barrel level.

Meanwhile, Hurricane Milton barrels across the Gulf of Mexico toward Florida, which is likely disrupting some shipping channels for oil and natural gas exports. Heightened storm activity throughout the Gulf of Mexico over the past several weeks has dented U.S. exports. That has inflated U.S. inventories. The storm’s impact will likely be visible in next week’s inventory data from the American Petroleum Institute (API) as well as government figures. The API will report its weekly inventory data today.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 72.5 p Short 77.5 c Long 78 c | 19% | +390 | -110 |

Short Strangle | Short 72.5 p Short 77.5 c | 54% | +6090 | x |

Short Put Vertical | Long 72 p Short 72.5 p | 55% | +240 | -260 |

Symbol: FX | Daily Change |

/6AZ4 | -0.16% |

/6BZ4 | +0.21% |

/6CZ4 | -0.11% |

/6EZ4 | +0.05% |

/6JZ4 | -0.12% |

Australian dollar futures (/6AZ4) fell for a fifth day on today, dropping to the lowest levels since Sept. 16. The toned-down rhetoric for fiscal stimulus from China weighed on the currency, which has faced headwinds from the country’s monetary policy stance. Traders expected the Reserve Bank of Australia to hike rates recently, but they held on the last meeting, signaling a dovish tone to expectations.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.665 p Short 0.6675 p Short 0.68 c Long 0.6825 c | 27% | +180 | -70 |

Short Strangle | Short 0.6675 p Short 0.68 c | 56% | +1160 | x |

Short Put Vertical | Long 0.665 p Short 0.6675 p | 66% | +90 | -160 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.