S&P 500: Is the Wall Street Rally Self-Defeating? All Eyes on Fed Chair Powell

S&P 500: Is the Wall Street Rally Self-Defeating? All Eyes on Fed Chair Powell

By:Ilya Spivak

Hawkish guidance from Fed Chair Jerome Powell may pour cold water on stock markets cheering amid fading worries about the banking crisis and the US debt limit while the central bank ends its rate-hike streak.

- S&P 500 soars as tail risks cool, FOMC ends back-to-back rate hike streak

- Priced-in 1- to 2-year disinflation path implying slowing economic growth

- Hawkish testimony from Fed Chair Powell might put markets on defense

Wall Street cheers as tail risks fade, Fed ends rate hike streak

The bulls have been out in force on Wall Street. The bellwether S&P 500 stock index is pace to give June 2023 the strongest performance in five months with a rise of nearly 5 percent. More potently still, the rally broke close to a year of stubborn consolidation, pushing prices to the highest since April 2022.

At surface level, the chipper mood seems understandable.

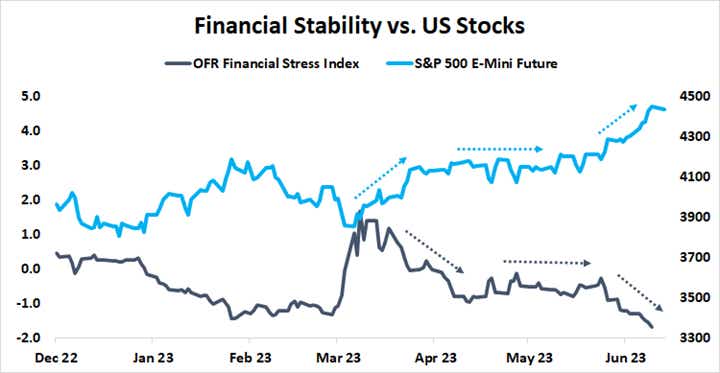

The banking crisis that broke out with the collapse of Silicon Valley Bank (SVB) in early March and rumbled on into the first half of April seems to be in remission – at least for now. Tellingly, Treasury yields have mostly returned to pre-crisis levels, yet measures of credit stress are at their lows for the year.

Data Source: Bloomberg

Next, the markets seemed to conclude at the start of May that – ongoing fire and fury in Washington, DC notwithstanding – the debt ceiling debacle would end without major incident. That this was not confirmed until month-end did not matter: US stocks, rates, and the Dollar rose in tandem for three weeks before the just-in-time deal got done.

The Fed’s decision not to raise interest rates at the June policy meeting – ending a cycle of ten consecutive increases – appears as the cherry atop this bullish sundae. That this stoppage came with hawkish rhetoric which is still seen translating into a hike later this year seems to have left the symbolism entirely untarnished.

The stock market rally may be self-defeating

It is from here that the vulnerabilities in the bullish argument begin to emerge.

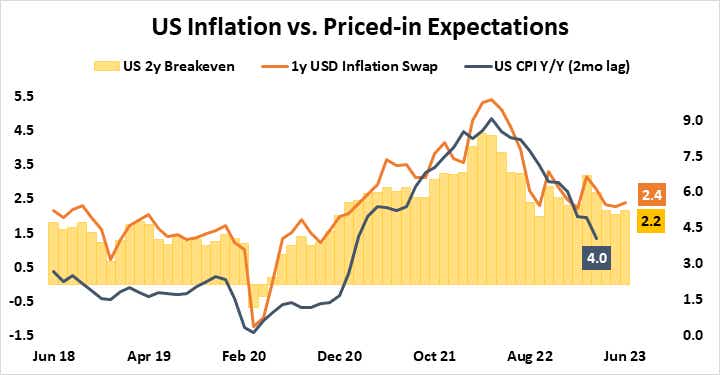

Inflation expectations priced into the market envision rapid disinflation to just above the Fed’s 2 percent target within two years, with the bulk of the drop – a move below 2.5 percent – happening within the next 12 months. Using the latest CPI data as benchmark, that would amount to nearly halving the 4 percent rate recorded in May.

Data Source: Bloomberg

Where does such a drop in price growth come from? Probably not from improving supply chain efficiency much further. Seaborne shipping costs have dropped to pre-pandemic levels. Growth in the cost of moving goods through the production process has slowed to pre-pandemic levels or lower. For intermediate goods, they fell in April and May.

If not from the supply side, this disinflation must come from demand. Put simply, economic growth must slow such that inflation cools with it. If stock market optimism is to be taken at face value, it follows that investors expect this to be relatively benign – the proverbial “soft landing”.

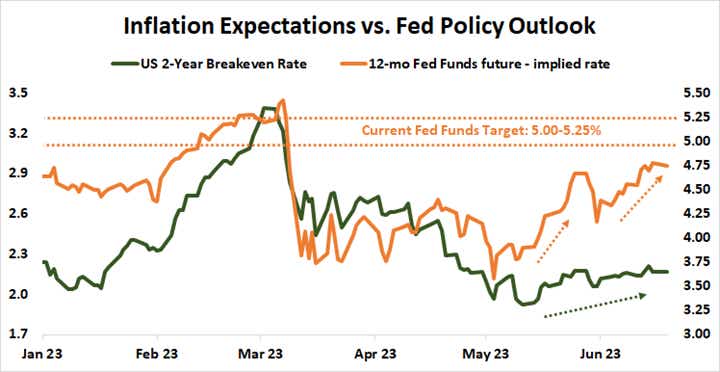

This might prove self-defeating. Rising assets are a form of credit easing because they can be used as collateral for borrowing, which feeds prices and pulls the Fed off course. Market-implied inflation bets have tellingly risen even as rate cut expectations fell away in recent weeks. This may demand more hawkish action than has been penciled in already.

With that in mind, all eyes turn to Fed Chair Jerome Powell as he sits for semi-annual testimony to Congress. A feisty outing where the central bank chief hammers home the point that returning to the inflation target will require a significant degree of economic pain and that policymakers find this acceptable may give equity buyers cause for pause.

Data source: Bloomberg

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices