S&P 500, Nasdaq 100 Surge as Powell Tees-Up a September Rate Cut

S&P 500, Nasdaq 100 Surge as Powell Tees-Up a September Rate Cut

Also 30-year T-Bond, Gold, Crude Oil, and Japanese Yen Futures

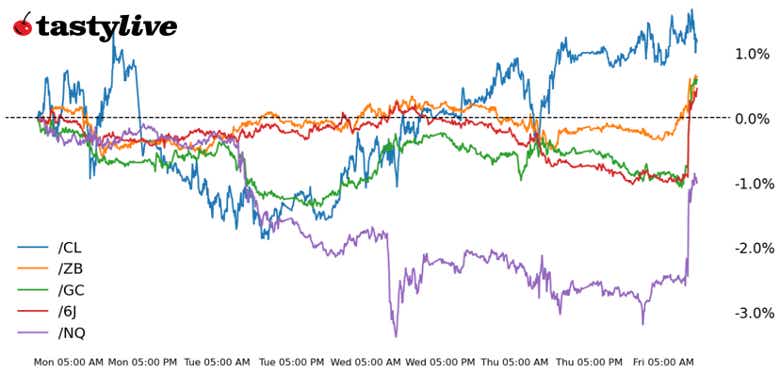

- Nasdaq 100 E-mini futures(/NQ): +1.41%

- 30-year T-Bond futures (/ZB): +0.68%

- Gold futures (/GC): +1.01%

- Crude Oil futures (/CL): -0.11%

- Japanese Yen futures (/6J): +1.08%

Fed Chair Powell’s Jackson Hole remarks put the focus squarely on the downside risks to the labor market, while acknowledging visible inflation pressures from tariffs. Markets took this as confirmation that the Fed is preparing to ease, pulling Treasury yields lower across the curve, with the 2-year leading the move on reduced expectations for policy restraint. The front-end compressed by several basis points, consistent with traders pricing in higher odds of a September rate cut. Spilling into FX, the U.S. Dollar softened against the majors, as the balance of risks tilted away from prolonged policy tightness. Overall, Powell’s careful but dovish lean created a risk-on tone, with lower yields propping up stocks.

| Symbol: Equities | Daily Change |

| /ESU5 | +1.58% |

| /NQU5 | +1.41% |

| /RTYU5 | +4.02% |

| /YMU5 | +2.1% |

Nasdaq futures (NQU5) jumped about 1.3% in early Friday trading after the dovish commentary on the rate outlook for the Fed injected a fresh dose of optimism into equity markets. Despite the upside move, prices are on track for a weekly loss. Nvidia (NVDA) turned positive after trading in the negative ahead of the open after the company reported that it requested some of its suppliers to halt production of H20 chips. Intuit (INTU) fell 6% after the company offered weak guidance in its latest earnings report. Ross Stores (ROST) rose 0.86% after beating earnings per share (EPS) estimates Thursday after the bell.

| Strategy: (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 23400 p Short 23500 p Short 24200 c Long 24250 c | 62% | +1015 | -980 |

| Short Strangle | Short 23500 p Short 24200 c | 50% | +13130 | x |

| Short Put Vertical | Long 23400 p Short 23500 p | 61% | +595 | -1405 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | +0.19% |

| /ZFU5 | +0.43% |

| /ZNU5 | +0.59% |

| /ZBU5 | +0.68% |

| /UBU5 | +0.76% |

30-year T-Bond futures (/ZBU5) shifted higher after Mr. Powell suggested that the Fed is open to a September rate cut. Today’s move put prices on track for a weekly gain, pushing above the 9- and 21-day exponential moving averages (EMAs) as well. Shorter-dated Treasuries also rose, pushing yields lower across the curve. The focus for markets will shift to economic data, as today’s comments don’t guarantee a rate cut as Powell expressed that the Fed will still have optionality to implement its policy decisions. Inflation data due next Friday will be closely monitored by markets.

| Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 112 p Short 113 p Long 117 c | 30% | +640.63 | -359.38 |

| Short Strangle | Short 113 p Short 116 c | 54% | +2609.38 | x |

| Short Put Vertical | Long 112 p Short 113 p | 68% | +328.13 | -671.88 |

| Symbol: Metals | Daily Change |

| /GCZ5 | +1.01% |

| /SIU5 | +2.58% |

| /HGU5 | +0.7% |

A drop in yields and a softer dollar followed Mr. Powell’s comments this morning, which opened a path higher for gold prices. Gold futures (/GCZ5) rose over 1% following the speech, with prices clearing the 9- and 21-day EMAs. Gold is now trading a little over 3% from its record high reached back in early August. If yields and the dollar continue to moderate, the metal may have a chance to challenge that high in the coming weeks, especially if upcoming economic data bodes well for the dovish outlook on rate cuts.

| Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3365 p Short 3370 p Short 3475 c Long 3480 c | 19% | +390 | -110 |

| Short Strangle | Short 3370 p Short 3475 c | 55% | +12200 | x |

| Short Put Vertical | Long 3365 p Short 3370 p | 61% | +220 | -280 |

| Symbol: Energy | Daily Change |

| /CLV5 | -0.11% |

| /HOU5 | -0.12% |

| /NGU5 | -3.64% |

| /RBU5 | -0.1% |

Crude oil prices (/CLV5) traded nearly unchanged Friday morning, leaving prices on track for its first weekly gain since July. A larger-than-expected draw in U.S. crude oil inventories by the Energy Information Administration (EIA) helped to support prices this week. Meanwhile, trader remain uncertain about a potential peace deal between Ukraine and Russia. Moscow is insisting that Ukraine surrender land in a deal, but Ukraine has resisted those demands.

| Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 61 p Short 61.5 p Short 65.5 c Long 66 c | 21% | +380 | -120 |

| Short Strangle | Short 61.5 p Short 65.5 c | 52% | +4150 | x |

| Short Put Vertical | Long 61 p Short 61.5 p | 58% | +200 | -300 |

| Symbol: FX | Daily Change |

| /6AU5 | +1.06% |

| /6BU5 | +0.89% |

| /6CU5 | +0.47% |

| /6EU5 | +0.97% |

| /6JU5 | +1.08% |

Japanese Yen futures (/6JU5) rose after comments from Jackson Hole weakened the dollar. Recent inflation data out of Japan also surprised to the upside, adding some support for the currency even if the data won’t immediately push the Bank of Japan (BoJ) to hike rates. However, positive movement on trade and stronger economic activity have pushed rate hike bets higher for Japan, offering a lane for the currency to strengthen.

| Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.0068 p Short 0.00685 p Short 0.00695 c Long 0.007 c | 28% | +450 | -175 |

| Short Strangle | Short 0.00685 p Short 0.00695 c | 54% | +1600 | x |

| Short Put Vertical | Long 0.0068 p Short 0.00685 p | 66% | +250 | -375 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices