Soybean Futures Rally on Poor Crop Conditions as U.S. Inflation Eases

Soybean Futures Rally on Poor Crop Conditions as U.S. Inflation Eases

Soybean Prices Rise on Dry Crop Conditions Outlook

Soybean prices (/ZS) surged nearly 2% on Tuesday, or about 26 cents per bushel, to the highest level since mid-May as dry weather conditions across the United States soy planting heartland point to sub-par conditions for the growing season.

The planting season for soybeans has nearly wrapped up across the U.S., with 96% of the crop planted as of June 11, according to the USDA’s crop progress report released on Monday. While that is ahead of the 86% 2018-2022 average, the outlook due to soil moisture is dim.

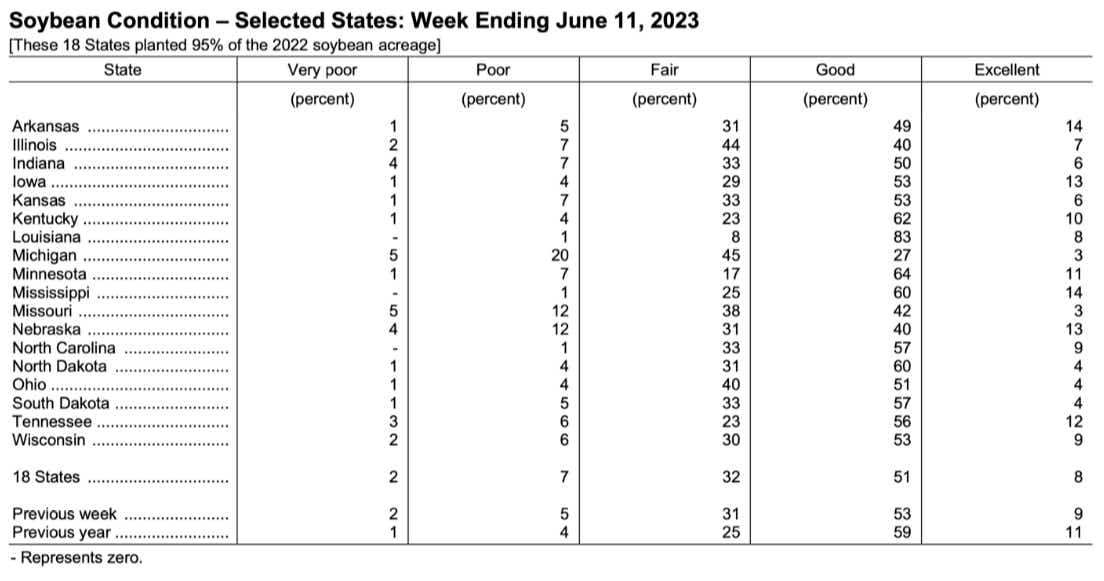

Soybean conditions across 18 states total 51% for “good’ and 8% for “excellent” conditions as of June 11. That compares poorly to the prior year when conditions stood at 59% and 11%, respectively.

Image Source: usda.library.cornell.edu

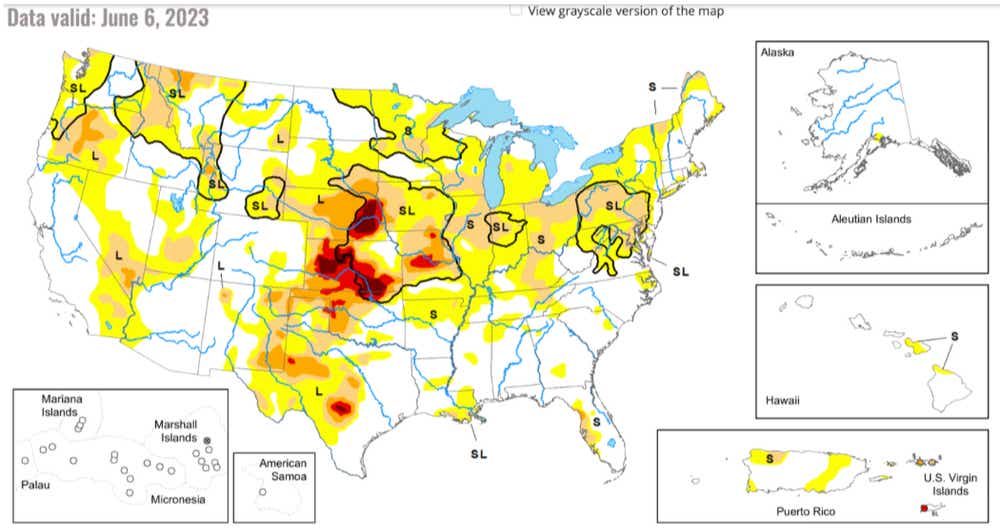

Those numbers will have to improve over the coming weeks or prices will likely continue to face upward pressure. However, drought conditions exist across much of the soy-planting states, especially in the Upper Plains and the Midwest, where a bulk of soy is produced.

For that to happen, soil moisture will need to increase, which requires precipitation and mild conditions. If we look at the NOAA’s 8–14 day temperature and precipitation outlook, we see that there is above-normal probability for above average temperatures and only a slightly above-normal chance for precipitation in a portion of the Upper Plains.

Image Source: droughtmonitor.unl.edu

Russia Threatens to End Black Sea Export Deal…Again

More talk from Russian President Putin on potentially ending the Black Sea export has supported the broader agricultural market in recent weeks. Mr. Putin stated recently that Russia is exploring options to end the deal but so far, no decision has been made.

While soybeans wouldn’t be impacted to a great degree, wheat would. That could indirectly drive up the demand for the legume in countries that would be affected by such a move. For now, however, this is just something to keep an eye on for soybean traders.

Will Soybean Prices Throw a Wrench into Cooling Price Pressures?

U.S. prices cooled to 4% from a year ago in May, according to the Labor Department’s report on Tuesday. Americans breathed a sigh of relief as the numbers crossed the news wires, with the annual rate now less than half of what it was last summer.

Can higher soybean prices ruin the downward pressure? Probably not. Soybean futures and spot prices are still about half the price that they were at this time last year. But if we get back to levels around $18 per bushel, and corn and wheat also doubled, then it would be time to worry.

Soybean Technical Analysis

The technical picture for soybeans compliments the fundamental backdrop for higher prices. Looking at the daily price chart, soybeans have reached its 50-day Simple Moving Average (SMA) after a strong first half of price action in June.

Additionally, the Relative Strength Index (RSI) has crossed above its mid-level 50 mark, indicating healthy upward momentum. If we get a daily close above the 50-day SMA in the short-term, that could facilitate higher prices on a technical basis.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices