S&P 500 Continues Rebound After Blowout March NFP

S&P 500 Continues Rebound After Blowout March NFP

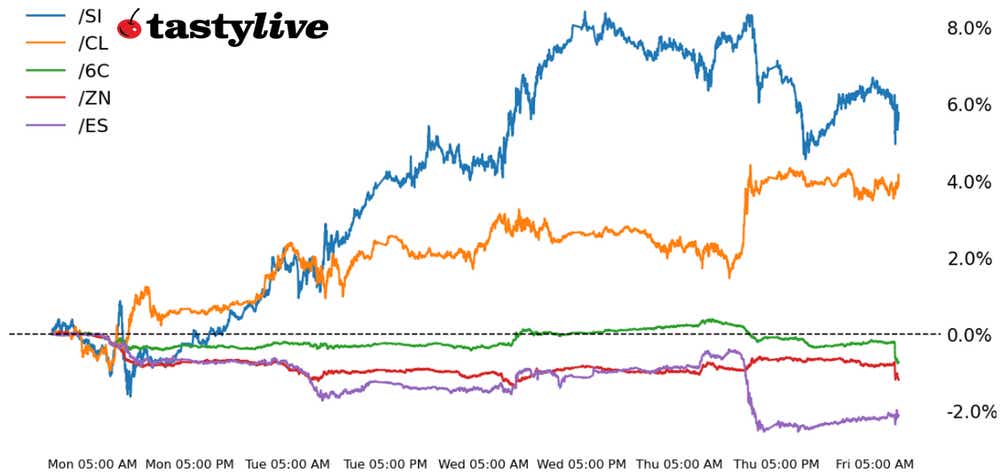

Also 10-year T-note, silver, crude oil and Canadian dollar futures

S&P 500 E-mini futures (/ES): +0.26%

10-year T-Note futures (/ZN): -0.51%

Silver futures (/SI): -1.88%

Crude oil futures (/CL): +0.31%

Canadian dollar futures (/6C): -0.68%

The U.S. economy may be reaccelerating. Another strong jobs report suggests the labor market remains resilient, and traders have further reduced expectations for a Federal Reserve interest rate cut in June.

The nonfarm payrolls report showed a headline gain of 303,000 vs. the consensus forecast of 200,000, and the two-month revision added 22,000 jobs. The household employment survey indicated the unemployment rate (U3) fell to 3.8% against a forecast of holding at 3.9% because workers reported 498,000 more jobs than in February. The labor force participation rate increased to 62.7% from 62.5%.

The wage figures indicated stabilization, perhaps the most important figure in the report given the Fed’s perspective as Phillips Curve economic theorists. Average hourly earnings increased by 0.3% month over month and +4.1% year over year, as expected.

Overall, the March U.S. jobs report produced an initial sell-off in both stocks and bonds (although the former has rebounded modestly, in line with recent reactions to better-than-expected jobs data). The S&P 500 (/ESM4) is leading the way higher following yesterday’s brutal afternoon sell-off. Gold prices (/GCM4) are backing away from all-time highs, while crude oil prices (/CLK4) are lingering near their yearly highs.

Symbol: Equities | Daily Change |

/ESM4 | +0.26% |

/NQM4 | +0.37% |

/RTYM4 | -0.46% |

/YMM4 | +0.13% |

S&P 500 futures (/ESM4) rose about 0.26% following this morning’s U.S. jobs report. The U.S. benchmark is on track to record a loss for the week but trimmed some of that weakness despite the chance the report will cut interest rate bets further. However, the fact that the economy remains resilient amid higher interest rates might be enough of a reason for equity bulls to keep pushing forward.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4950 p Short 4975 p Short 5450 c Long 5475 c | 66% | +332.50 | -917.50 |

Short Strangle | Short 4975 p Short 5450 c | 73% | +2412.50 | x |

Short Put Vertical | Long 4950 p Short 4975 p | 85% | +170 | -1080 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.14% |

/ZFM4 | -0.33% |

/ZNM4 | -0.51% |

/ZBM4 | -1% |

/UBM4 | -1.29% |

Bonds along the middle- and long-end of the curve are reacting to the strength in the labor market, with the 10-year T-Note futures (/ZNM4) down 0.51%. Despite today’s losses, we remain above the lows for the week, and the year for that matter. If yields don’t breach those recent highs in reaction to today’s NFPs, the bottom-is-in thesis remains alive. No Treasury auctions today.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.5 p Short 107 p Short 112 c Long 112.5 c | 64% | +125 | -375 |

Short Strangle | Short 107 p Short 112 c | 70% | +484.38 | x |

Short Put Vertical | Long 106.5 p Short 107 p | 90% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCM4 | -0.02% |

/SIK4 | -1.88% |

/HGK4 | -0.71% |

Silver prices (/SIK4) extended a pullback that started before the jobs report. Now, with yields rising across most of the curve, the metal is having a difficult time holding onto its rapid gains from earlier in the week. Profit taking makes sense given the runup in prices and passage of event risk, with traders likely booking profits ahead of the weekend. The gold-silver ratio is coming off its lowest point since December after a rapid drop this week as silver prices outpaced gold prices. However, if the ratio returns to around the 90 level, traders may want to implement strategies that include being long silver and more neutral or even bearish gold.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 23.5 p Short 24 p Short 30 c Long 30.5 c | 67% | +515 | -1985 |

Short Strangle | Short 24 p Short 30 c | 73% | +2685 | x |

Short Put Vertical | Long 23.5 p Short 24 p | 86% | +220 | -2280 |

Symbol: Energy | Daily Change |

/CLK4 | +0.31% |

/HOK4 | +1.07% |

/NGK4 | -0.45% |

/RBK4 | -0.04% |

Crude prices (/CLK4) are finishing the week higher, rising about 0.31% Friday morning, with a strong U.S. economy aiding the commodity’s upside. This week saw geopolitical tensions rise, and traders are still waiting for Iran to strike back at Israel in response to the airstrike in Damascus that killed several commanders of the Islamic Revolutionary Guard Corps (IRGC). The OPEC meeting came and went without an official policy change, but the cartel is reportedly stepping up enforcement efforts on production cuts for member states. This has all led to a more bullish backdrop but prices around the $90 handle will likely be hard to sustain without more tailwinds.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 78 p Short 79 p Short 94 c Long 95 c | 65% | +320 | -680 |

Short Strangle | Short 79 p Short 94 c | 76% | +2190 | x |

Short Put Vertical | Long 78 p Short 79 p | 82% | +180 | -820 |

Symbol: FX | Daily Change |

/6AM4 | -0.63% |

/6BM4 | -0.53% |

/6CM4 | -0.68% |

/6EM4 | -0.46% |

/6JM4 | -0.34% |

Canada dollar futures (/6CM4) are taking a 1-2 punch this morning after the country reported a miss on its jobs figures for March, losing 2,200 jobs for March vs. an expected gain of 25,000. The country’s unemployment rate rose to 6.1% from 5.8%, underpinning the weakness in its economy. The divergence from the strength seen in its neighbor to the south punished the loonie and complicates the path for the Bank of Canada in accomplishing a soft landing.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.715 p Short 0.72 p Short 0.75 c Long 0.755 c | 66% | +130 | -370 |

Short Strangle | Short 0.72 p Short 0.75 c | 70% | +290 | x |

Short Put Vertical | Long 0.715 p Short 0.72 p | 91% | +70 | -430 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.