S&P 500 Rally, Crude Oil Reverse Overnight Moves

S&P 500 Rally, Crude Oil Reverse Overnight Moves

Also 10-year T-bond, gold, crude oil and Japanese yen futures

S&P 500 E-mini futures (/ES): -0.09%

10-year T-Note futures (/ZN): +0.20%

Gold futures (/GC): -0.36%

Crude Oil futures (/CL): -0.88%

Japanese Yen futures (/6J): -0.02%

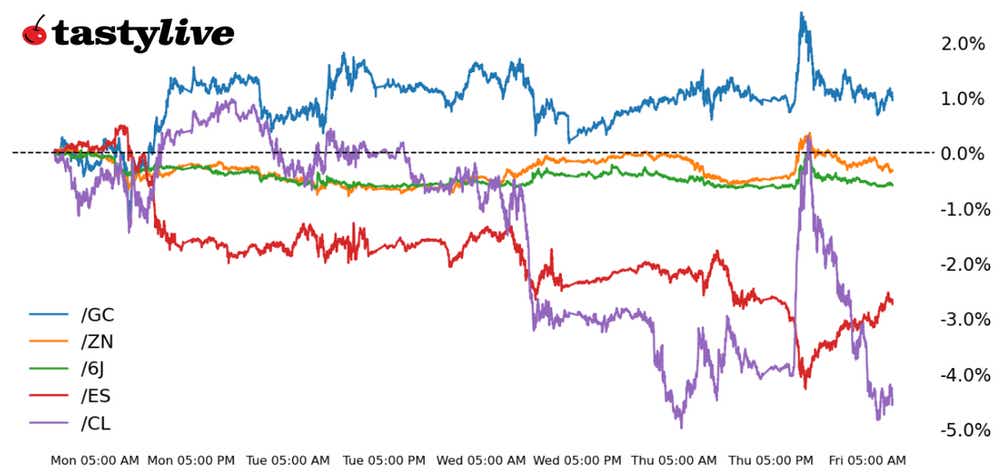

A series of Israeli airstrikes against targets inside Iranian territory last night brought back the “war trade” and sent U.S. equity index futures plummeting. It erased all of their year-to-date gains, in some cases bonds ripping, and both gold and oil surging. But a perplexing Iranian denial, perhaps geared at deescalating the situation, has seen volatility sucked out of the market on this April options expiry day. Everything has reversed: the S&P 500 (/ESM4) hit a low of 4963.50 overnight but was last seen at 5045.75; crude oil (/CLM4) traded as high as 86.28 but is now back at 82.08.

Symbol: Equities | Daily Change |

/ESM4 | -0.09% |

/NQM4 | -0.33% |

/RTYM4 | -0.47% |

/YMM4 | +0.07% |

Volatility futures (/VXK24) surged overnight but the Iranian denial and downplaying of the Israeli attack led traders to believe this is the end of the escalation ladder. The sharp pullback in implied vols is coinciding with a meaningful rebound off the overnight lows, which at a point had eradicated all of the year-to-date gains in the Nasdaq 100 (/NQM4) and the Dow Jones 30 (/YMM4). Aside from the daily candlesticks that appear to be textbook exhaustion efforts, coming into today less than 10% of S&P 500 stocks were trading above their one-month moving average—over the past two years, this has represented a sign that meaningful lows were nearby.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4725 p Short 4750 p Short 5325 c Long 5350 c | 65% | +287.50 | -962.50 |

Short Strangle | Short 4750 p Short 5325 c | 71% | +2225 | x |

Short Put Vertical | Long 4725 p Short 4750 p | 86% | +145 | -1105 |

Symbol: Bonds | Daily Change |

/ZTM4 | +0.02% |

/ZFM4 | +0.08% |

/ZNM4 | +0.20% |

/ZBM4 | +0.63% |

/UBM4 | +0.83% |

Bonds initially caught the benefit of the war trade by rallying alongside gold and oil prices, but the perceived de-escalation of tensions has seen bonds soften across the curve as today’s session has moved from Asian to European to North American hours. The Federal Reserve has laid out a clear shift in thinking in recent days, clarifying that rate cuts this year are not guaranteed and some officials have suggested that a hike may be needed (yet to be priced in by the market). If the war trade continues to come off the board, it will likely come at the detriment of bonds.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106 p Short 110 c Long 111 c | 60% | +265.83 | -734.38 |

Short Strangle | Short 106 p Short 110 c | 66% | +578.13 | x |

Short Put Vertical | Long 105 p Short 106 p | 84% | +140.63 | -859.38 |

Symbol: Metals | Daily Change |

/GCM4 | -0.36% |

/SIK4 | -0.33% |

/HGK4 | +0.64% |

Like bonds, precious metals caught a safe haven bid overnight but gains have turned into losses. Gold prices (/GCM4) were up more than 1.5% during the initial reports of the Israeli attack but have slumped back into negative territory. It was noteworthy last night that gold volatility did not increase meaningful and had started to decline, an early indication markets were quickly discounting a lower probability of continued Israel-Iran hostility.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2250 p Short 2275 p Short 2525 c Long 2550 c | 66% | +640 | -1860 |

Short Strangle | Short 2275 p Short 2525 c | 72% | +2510 | x |

Short Put Vertical | Long 2250 p Short 2275 p | 85% | +310 | -2190 |

Symbol: Energy | Daily Change |

/CLM4 | -0.88% |

/HOK4 | -0.61% |

/NGK4 | +1.59% |

/RBK4 | -0.92% |

Energy markets were ground zero for the overnight chaos in markets, with crude oil prices (/CLM4) rising more than 4.3% at the peak of fear. But the lack of expansion in oil volatility (like in gold vol) was a telling factor, and the reversal in oil vol has come alongside a sharp reversal in prices: /CLM4 is now down on the day. If markets perceive that current geopolitical risks have been “benchmarked,” oil may lose its war premium.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 73 p Short 90 c Long 91 c | 61% | +270 | -730 |

Short Strangle | Short 73 p Short 90 c | 69% | +1980 | x |

Short Put Vertical | Long 72 p Short 73 p | 81% | +140 | -860 |

Symbol: FX | Daily Change |

/6AM4 | -0.08% |

/6BM4 | +0.08% |

/6CM4 | +0.06% |

/6EM4 | +0.14% |

/6JM4 | -0.02% |

Both the U.S. dollar and the Japanese yen (/6JM4) have gone from big winners to modest losers today as traders abandon safe haven positions taken up around the initial reports of the Israeli attack against Iran. Momentum in /6JM4 remains very bearish, and the price action continues to indicate a weak tape. Any signs of bottoming, however, should not be dismissed: /6JM4 has an IVR > 71.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.00635 p Short 0.00675 c Long 0.0068 c | 63% | +162.50 | -462.50 |

Short Strangle | Short 0.00635 p Short 0.00675 c | 71% | +587.50 | x |

Short Put Vertical | Long 0.0063 p Short 0.00635 p | 84% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.