S&P 500 Rebounds as Trump's Steel and Aluminum Tariffs Boost Metal Stocks

S&P 500 Rebounds as Trump's Steel and Aluminum Tariffs Boost Metal Stocks

Also, 10-year T-note, gold, crude oil and Canadian dollar futures

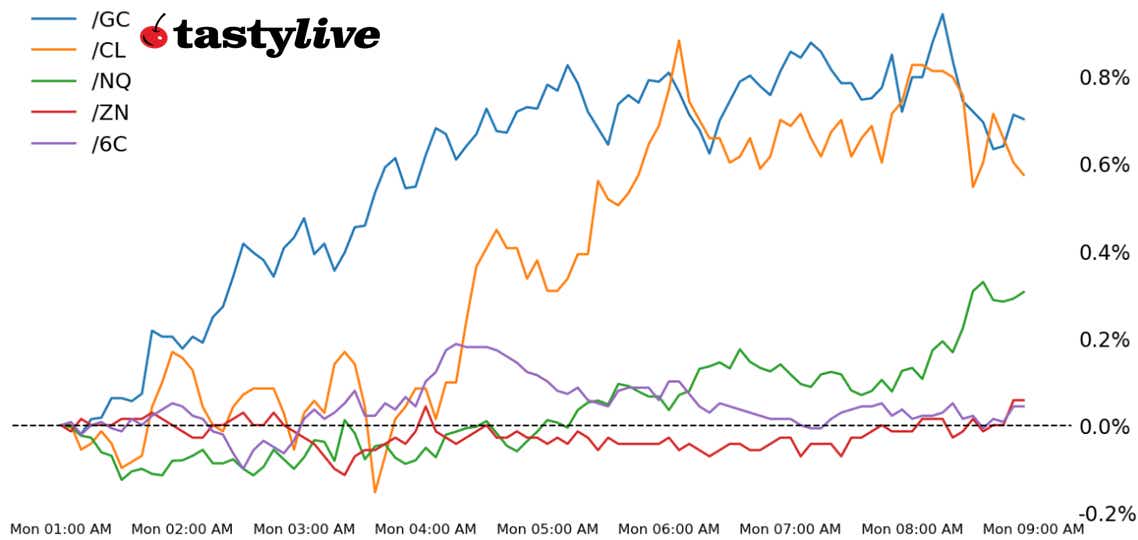

- Nasdaq 100 E-mini futures (/NQ): +0.81%

- 10-year T-note futures (/ZN): +0.03%

- Gold futures (/GC): +1.29%

- Crude oil futures (/CL): +1.15%

- Canadian dollar futures (/6C): -0.39%

It should have been a relatively quiet week, but the Super Bowl managed to produce another weekend gap lower for U.S. equity markets. But the weekend gaps have become shallower and are covered more quickly with each passing week; each of the four U.S. equity indexes are in the green on the session. Bonds are meandering ahead a busy week of Federal Reserve speakers, with Fed Chair Jerome Powell set to hit Capitol Hill over the next few days. Elsewhere, the U.S. dollar is stronger across the board in the wake of the latest tariff talk, while gold prices have scaled 2900.

Symbol: Equities | Daily Change |

/ESH5 | +0.52% |

/NQH5 | +0.81% |

/RTYH5 | +0.57% |

/YMH5 | +0.56% |

The week started on a risk-on footing, with Nasdaq futures (/NQH5) rising 0.9% this morning. Tariffs are back in the fold after President Trump told reporters over the weekend that he is planning a 25% tariff on steel imports. Overnight, tariffs on China went into effect. United States Steel (X) rose 4% in pre-market trading, while Alcoa (AA) gained 3.5% ahead of the bell. McDonald’s (MCD) rose 3% despite posting a sales decline in its latest quarter. U.S. same-store sales were down 1.4% from a year ago but a plan to boost its value offerings seemed to encourage investors this morning.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5700 p Short 5800 p Short 6400 c Long 6500 c | 64% | +825 | -4175 |

Short Strangle | Short 5800 p Short 6400 c | 68% | +2187.50 | x |

Short Put Vertical | Long 5700 p Short 5800 p | 86% | +237.50 | -2262.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.01% |

/ZFH5 | +0.02% |

/ZNH5 | +0.03% |

/ZBH5 | +0.05% |

/UBH5 | -0.03% |

Treasury markets were mostly muted this morning as traders digested the latest round of news around tariffs. The 10-year T-note futures (/ZNH5) rose 0.03% this morning. President Trump said over the weekend that Elon Musk and the Department of Government Efficiency (DOGE) found irregularities in the Treasury system. Federal Reserve Chair Jerome Powell will deliver his semi-annual testimony to Congress this week.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 107.5 p Short 111.5 c Long 113 c | 64% | +312.50 | -1187.50 |

Short Strangle | Short 107.5 p Short 111.5 c | 68% | +453.13 | x |

Short Put Vertical | Long 106 p Short 107.5 p | 85% | +171.88 | -1328.13 |

Symbol: Metals | Daily Change |

/GCJ5 | +1.29% |

/SIH5 | -0.07% |

/HGH5 | +1.48% |

Gold prices (/GCJ5) rose to fresh highs overnight as Asian markets digested tariff threats, which lead to a mixed trading session to start the week. Inflation data due Wednesday may offer clues for the Fed’s path forward on rate cutting, but Friday’s jobs report signaled the Fed could be patient for now. If inflation data comes in soft, it could guide Treasury yields lower and bolster gold’s outlook. Data from China last week showed the country increased its gold holdings for a third month in a row.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2755 p Short 2770 p Short 3095 c Long 3120 c | 66% | +540 | -1960 |

Short Strangle | Short 2770 p Short 3095 c | 72% | +3060 | x |

Short Put Vertical | Long 2755 p Short 2770 p | 84% | +200 | -1300 |

Symbol: Energy | Daily Change |

/CLH5 | +1.15% |

/HOH5 | +0.69% |

/NGH5 | +2.21% |

/RBH5 | +0.09% |

Crude oil futures (/CLH5) rebounded this morning after closing a third weekly loss last week. Prices are trading around the 72 handle despite markets worrying about the global economy following the latest round of announced tariffs. The jump in prices today could be the result of some exhaustion in selling over the past several weeks. We’ve seen a lot of back and forth on tariffs over the last month, so traders might be inclined to temper their reactions to every headline. Meanwhile, increased pressure from the U.S. on Iran is expected to continue following several actions by the U.S. last week to limit its ability to export oil.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 63.5 p Short 65 p Short 81 c Long 83.5 c | 63% | +380 | -1120 |

Short Strangle | Short 65 p Short 81 c | 70% | +1710 | x |

Short Put Vertical | Long 63.5 p Short 65 p | 77% | +260 | -1240 |

Symbol: FX | Daily Change |

/6AH5 | +0.1% |

/6BH5 | -0.29% |

/6CH5 | -0.39% |

/6EH5 | -0.2% |

/6JH5 | -0.25% |

Canadian dollar futures (/6CH5) dipped to start the week despite gains in crude oil prices. The move is likely dollar-driven, with the greenback rising against most of its peers to start the week. China’s retaliatory tariffs on U.S. goods went into effect overnight, which is putting some traders on edge amid an ever-evolving trade situation. Canada exports nearly $20 billion of steel and aluminum to the U.S., which could be dampening sentiment for the Canadian currency.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.69 p Short 0.695 p Short 0.71 c Long 0.715 c | 37% | +280 | -220 |

Short Strangle | Short 0.695 p Short 0.71 c | 55% | +870 | x |

Short Put Vertical | Long 0.69 p Short 0.695 p | 73% | +140 | -360 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices