S&P 500 Failing to Find Footing After Wipeout; Yields Continue to Drop

S&P 500 Failing to Find Footing After Wipeout; Yields Continue to Drop

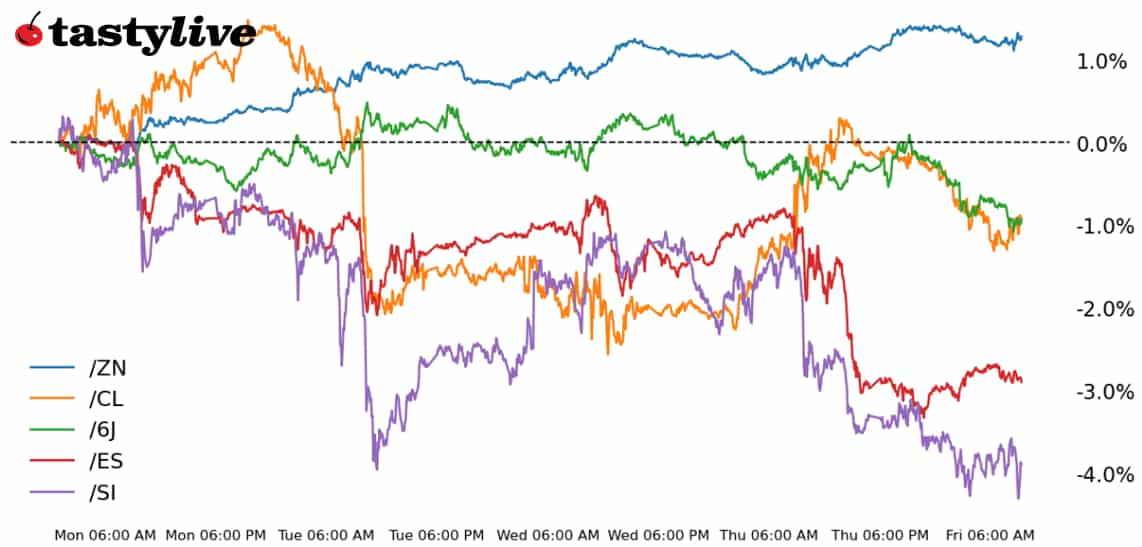

Also, 10-year T-note, silver, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): 0%

- 10-year T-note futures (/ZN): +0.27%

- Silver futures (/SI): -2.1%

- Crude oil futures (/CL): -1.61%

- Japanese yen futures (/6J): -0.55%

The washout in equity markets yesterday has found few dip buyers today. The overhang of tariffs on Canada and Mexico heading into the weekend is likewise doing favors for risk appetite in general, with bitcoin dipping back below 80,000 for the first time since Nov. 10. A lackluster personal consumption expenditures (PCE) report has helped grease the skids for Treasuries, which are up across the curve. Both energy and metals are lower across the board after the U.S.dollar hit its highest level in more than two weeks.

Symbol: Equities | Daily Change |

/ESH5 | 0% |

/NQH5 | -0.08% |

/RTYH5 | +0.21% |

/YMH5 | -0.21% |

U.S. equity futures moved slightly higher this morning after the inflation report was in line with expectations. Asian markets moved mostly lower overnight on the new tariff threat from the U.S. to place an additional 10% tariff on Chinese imports. Despite today’s bounce in equity markets, the S&P 500 (/ESH5) is on track for its worst week of the year. Chinese-linked names, such as Alibaba (BABA), are still feeling the pain of yesterday’s news, with prices down 3% in early trading. Dell (DELL) was down 5.6% this morning after missing estimates on its fourth quarter earnings.

Strategy: (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5425 p Short 5500 p Short 6300 c Long 6375 c | 64% | +700 | -3050 |

Short Strangle | Short 5500 p Short 6300 c | 68% | +2712.50 | x |

Short Put Vertical | Long 5425 p Short 5500 p | 86% | +362.50 | -3387.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.06% |

/ZFH5 | +0.17% |

/ZNH5 | +0.27% |

/ZBH5 | +0.4% |

/UBH5 | +0.46% |

Treasuries resumed their ascent today after the inflation data kept the path open for more rate cuts from the Federal Reserve later this year. 10-year T-note futures (/ZNM5) rose 0.28% in early trading and the underlying yield is dropping into the lowest levels traded since December. Spending cuts and government-wide job cuts have pushed traders into bonds as they anticipate trickle-down effects into the economy amid the broader threat of tariffs. The PCE data lets the Fed focus on potentially cutting rates to support the economy even though it remains above target for now. This could leave the prevailing narrative intact as we look ahead to next week’s jobs report.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109.5 p Short 110 p Short 112 c Long 112.5 c | 37% | +328.13 | -171.88 |

Short Strangle | Short 110 p Short 112 c | 61% | +1421.88 | x |

Short Put Vertical | Long 109.5 p Short 110 p | 76% | +171.88 | -328.13 |

Symbol: Metals | Daily Change |

/GCJ5 | -1.61% |

/SIH5 | -2.1% |

/HGH5 | -2.02% |

A stronger dollar is weighing on precious metals prices, with silver contracts (/SIK5) down 2.15% this morning. Prices pierced below a level of support near the 32 handle in place since late January, reflecting a potentially troublesome surrender by bulls. The next level of support comes from a base established through mid-January around the 30.5 level.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 30.5 p Short 30.75 p Short 32.5 c Long 32.75 c | 22% | +920 | -310 |

Short Strangle | Short 30.75 p Short 32.5 c | 53% | +9350 | x |

Short Put Vertical | Long 30.5 p Short 30.75 p | 58% | +560 | -690 |

Symbol: Energy | Daily Change |

/CLH5 | -1.32% |

/HOH5 | -1.47% |

/NGH5 | -1.02% |

/RBH5 | -1.13% |

Crude oil prices (/CLJ5) shed 1.32% today to reverse some of the gains that came yesterday after President Donald Trump revoked a license for Chevron (CVX) to operate in Venezuela. The move effectively prohibits any oil from Venezuela from entering the U.S. crude complex. Meanwhile, traders remain focused on OPEC and the group's path toward rolling back voluntary production cuts. That seems more unlikely by the day as economic conditions around the world deteriorate. The peace deal between Ukraine and Russia continues to move forward, and Ukrainian President Volodymyr Zelensky is set to visit Washington today to sign an agreement over mineral rights.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 67 p Short 67.5 p Short 71 c Long 71.5 c | 24% | +370 | -130 |

Short Strangle | Short 67.5 p Short 71 c | 58% | +3990 | x |

Short Put Vertical | Long 67 p Short 67.5 p | 60% | +190 | -310 |

Symbol: FX | Daily Change |

/6AH5 | -0.54% |

/6BH5 | -0.07% |

/6CH5 | +0.02% |

/6EH5 | +0.02% |

/6JH5 | -0.55% |

Japanese yen futures (/6JH5) trimmed lower for second day as the dollar gains broader strength. Despite this week’s pullback, February is on track to record a second monthly gain for the currency as expectations for a rate hike from the Bank of Japan (BOJ) continue to increase as domestic economic indicators improved. A resumption of the uptrend would bring the December swing high into focus as the next level for bulls to attack.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.00665 p Short 0.0068 c Long 0.00685 c | 38% | +400 | -225 |

Short Strangle | Short 0.00665 p Short 0.0068 c | 62% | +1450 | x |

Short Put Vertical | Long 0.0066 p Short 0.00665 p | 70% | +237.50 | -387.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.