S&P 500 Aims for Fourth Straight Week of Gains

S&P 500 Aims for Fourth Straight Week of Gains

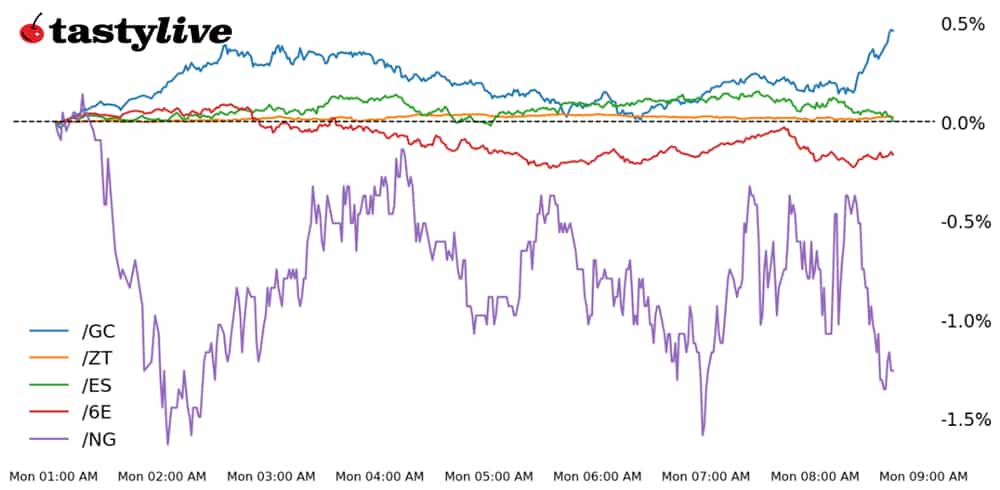

Also, 2-year T-note, gold, natural gas, and euro futures

- S&P 500 e-mini futures (/ES): -0.01%

- 2-year T-note futures (/ZT): +0.06%

- Gold futures (/GC): +0.96%

- Natural gas futures (/NG): -3.08%

- Euro futures (/6E): -0.34%

A jam-packed week, including earnings releases and macroeconomic data, starts on Monday on a quiet note.

The excitement picks up tomorrow and accelerates into the end of the week. The lack of catalysts today is catering to a typical pre-Federal Open Market Committee (FOMC) trading environment, whereby U.S. equity indexes don’t move all that much prior to 2 p.m. Eastern Time/1 p.m. Central Time on Wednesday.

The U.S. Treasury’s Quarterly Refunding Announcement (QRA) on Wednesday may prove to be a significant catalyst for the bond market in a week devoid of meaningful auctions. Commodities continue to be sensitive to geopolitical event risk emanating from the Middle East, where a direct confrontation between the U.S. and Iran appears to be increasing.

Symbol: Equities | Daily Change |

/ESH4 | -0.01% |

/NQH4 | +0.10% |

/RTYH4 | +0.08% |

/YMH4 | -0.05% |

A slew of earnings announcements

Ahead of a brisk week of macroeconomic event risk and a packed earnings calendar, U.S. equity markets are in a holding pattern on Monday morning.

No major index is up or down by more than +/-0.1%, highlighting the relatively staid situation. Based on the earnings released thus far, companies are reporting a positive earnings growth rate for the second consecutive quarter (although the blended earnings rate is negative for the fourth time in five quarters). The S&P 500 (/ESH4) rallied for three consecutive weeks, and 12 of the last 13 weeks overall.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4830 p Short 4850 p Short 4980 c Long 5000 c | 24% | +650 | -350 |

Short Strangle | Short 4850 p Short 4980 c | 49% | +5112.50 | X |

Short Put Vertical | Long 4830 p Short 4850 p | 65% | +275 | -725 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.06% |

/ZFH4 | +0.22% |

/ZNH4 | +0.38% |

/ZBH4 | +0.73% |

/UBH4 | +0.87% |

Bonds move up

Bonds are trading higher across the curve in front of what has become meaningful event risk in recent months: the Treasury’s QRA, which is set for later this week.

The short end of the curve is relatively tame, with Two-year Treasuries (/ZTH4) down by two basis points. The Treasury auction schedule this week is light, with only bills due. The January FOMC meeting on Wednesday and the January U.S. jobs report on Friday may help stir volatility in Treasuries, which have seen implied vols plummet across the curve to near some of the lowest levels seen over the past year.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 102.5 p Short 102.75 p Short 103.75 c Long 104 c | 36% | +250 | -250 |

Short Strangle | Short 102.75 p Short 103.75 c | 48% | +703.13 | X |

Short Put Vertical | Long 102.5 p Short 102.75 p | 91% | +140.63 | -359.38 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.96% |

/SIH4 | +1.28% |

/HGH4 | +0.31% |

Gold rises

Gold futures (/GCJ4) are up nearly 1% Monday ahead of the New York opening bell as lower Treasury yields help open a path for the precious metal.

Increasing geopolitical tensions in the Middle East following an attack on a U.S. base that resulted in several casualties is also helping to boost the metal as traders wait for an expected retaliation by American forces.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2010 p Short 2020 p Short 2100 c Long 2110 c | 36% | +600 | -400 |

Short Strangle | Short 2020 p Short 2100 c | 58% | +4080 | X |

Short Put Vertical | Long 2010 p Short 2020 p | 71% | +350 | -650 |

Symbol: Energy | Daily Change |

/CLH4 | -0.53% |

/HOH4 | -0.03% |

/NGH4 | -3.08% |

/RBH4 | -0.82% |

Energy prices rise

A weekend of escalating tensions between the United States and Iran-backed proxies in the Middle East, culminating in the death of three U.S. servicemen, provoking a gap higher in crude oil prices (/CLJ4).

But with widespread weakness in energy markets otherwise, the gap open higher was closed and now all four energy products are trading lower on Monday. Natural gas prices (/NGH4) are moving the most as updated month-ahead forecasts show warmer weather on tap for much of the lower 48 states.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.9 p Short 1.95 p Short 2.35 c Long 2.4 c | 31% | +310 | -190 |

Short Strangle | Short 1.95 p Short 2.35 c | 53% | +2170 | x |

Short Put Vertical | Long 1.9 p Short 1.95 p | 60% | +170 | -330 |

Symbol: FX | Daily Change |

/6AH4 | +0.26% |

/6BH4 | -0.09% |

/6CH4 | +0.09% |

/6EH4 | -0.34% |

/6JH4 | +0.07% |

The Euro (/6EH4) is leading the way lower on Monday following comments over the weekend by Bank of France Governor Francois Villeroy de Galhau, who said that “everything will be open,” including cuts, at forthcoming European Central Bank policy meetings.

Eurozone overnight index swaps (OIS) are now pricing in a 25% chance of a 25-bps rate cut in March, up from 10% last week. While the macroeconomic calendar is quiet on Monday, Tuesday brings about the 4Q’23 Eurozone and German GDP releases.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.065 p Short 1.07 p Short 1.1 c Long 1.105 c | 51% | +275 | -350 |

Short Strangle | Short 1.07 p Short 1.1 c | 63% | +950 | x |

Short Put Vertical | Long 1.065 p Short 1.07 p | 81% | +137.50 | -487.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.