S&P 500 Futures Open Flat as Fractured Week Begins

S&P 500 Futures Open Flat as Fractured Week Begins

Also, 10-year T-note, gold, crude oil, and Australian dollar futures

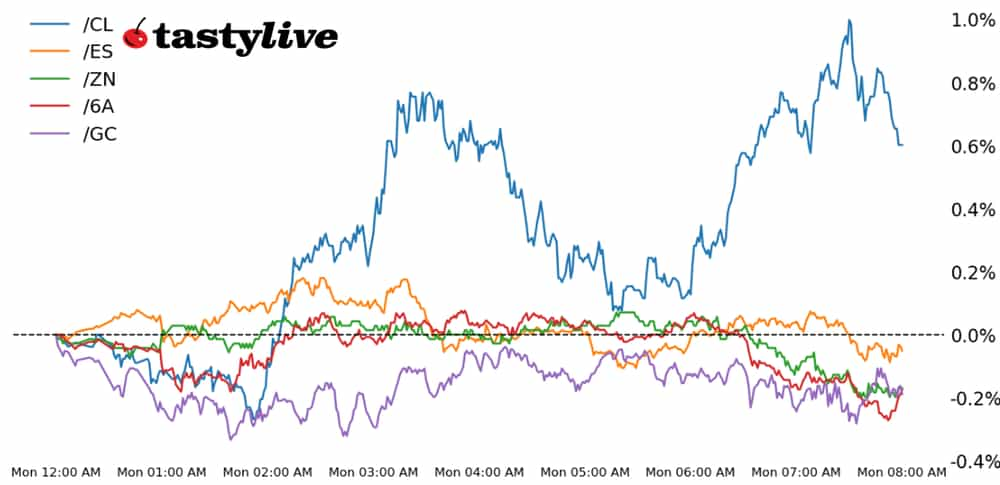

S&P 500 e-mini futures (/ES): -0.12%

10-year T-note futures (/ZN): -0.35%

Gold futures (/GC): -0.44%

Crude oil futures (/CL): +0.64%

Australian dollar futures (/6A): -0.29%

In the wake of a U.S.-centric macro data deluge, the calendar turns quieter over the coming days. A fractured calendar—markets are closed on Wednesday for the Juneteenth federal holiday—likewise offers reason for pause.

Overseas, political risk appears to be subsiding as Marine Le Pen said she would not try to push French President Emmanuel Macron out of power. But perhaps the most interesting headline to emerge over the weekend was that Chinese President Xi Jinping told European Commission President Ursula von der Leyen that the U.S. was trying to “goad Beijing into attacking Taiwan,” an indirect way of saying that China would not strike Taiwan first.

Symbol: Equities | Daily Change |

/ESM4 | -0.12% |

/NQM4 | +0.02% |

/RTYM4 | -0.49% |

/YMM4 | -0.23% |

Stocks move sideways

U.S. equity markets are largely unchanged to start the week in Monday morning trading, with benchmark S&P 500 contracts (/ESM4) down 0.09%.

European markets erased early gains overnight after Marine Le Pen said she wouldn’t force Macron out if she were to win the election later this month. The New York Empire State Manufacturing Index for June wasn’t as bad as investors feared, declining six points versus the expected nine-point decline.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5225 p Short 5250 p Short 5725 c Long 5750 c | 64% | +252.50 | -997.50 |

Short Strangle | Short 5250 p Short 5725 c | 70% | +1775 | x |

Short Put Vertical | Long 5225 p Short 5250 p | 86% | +125 | -1125 |

Symbol: Bonds | Daily Change |

/ZTU4 | -0.10% |

/ZFU4 | -0.22% |

/ZNU4 | -0.35% |

/ZBU4 | -0.78% |

/UBU4 | -1.04% |

Treasuries fall

Treasuries are soft to kick off the trading week as volatility out of European bond markets keeps traders on edge. The 10-year T-note futures (/ZNU4) fell 0.38% ahead of the Wall Street open.

Meanwhile, French bond yields remain at the steepest premium versus German yields since 2012 amid political uncertainty in Paris.

Several Federal Reserve speakers are on tap for today, including Philadelphia Fed President Patrick Harker, and the Treasury will auction 13- and 26-week bills.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 112.5 c Long 113 c | 65% | +125 | -375 |

Short Strangle | Short 108 p Short 112.5 c | 71% | +437.50 | x |

Short Put Vertical | Long 107.5 p Short 108 p | 90% | +46.88 | -453.13 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.44% |

/SIN4 | +0.32% |

/HGN4 | -1.64% |

Gold prices decline

Gold prices (/GCQ4) fell Monday morning as higher yields work against precious metals.

/GC is coming off its best weekly gain since early April, and positioning data from the Commitments of Traders report (COT) showed that gold speculator shorts cut their positions to the smallest since late 2020.

While gold is trading near the bottom of its range carved out from April, traders are likely cutting short bets as the Fed’s path appears less dovish than previously hoped.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2230 p Short 2240 p Short 2440 c Long 2450 c | 64% | +290 | -710 |

Short Strangle | Short 2240 p Short 2440 c | 72% | +2090 | x |

Short Put Vertical | Long 2230 p Short 2240 p | 84% | +140 | -860 |

Symbol: Energy | Daily Change |

/CLQ4 | +0.64% |

/HON4 | +0.11% |

/NGN4 | -2.08% |

/RBN4 | +0.41% |

Oil prices move up

Despite some gloom economic data out of China, crude oil prices (/CLQ4) are higher to start the week.

Strong demand outlooks from the Energy Information Administration (EIA) and OPEC, along with the chance that the cartel will start to reduce production cuts later this year, is helping to lift sentiment for the commodity.

Still, there is a lot of speculation in the market and inventory data will have to support the narrative that demand will strengthen from fuel consumption through the summer. If that demand doesn’t appear, the risk for prices is to the downside.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 73 p Short 73.5 p Short 83.5 c Long 84 c | 63% | +130 | -370 |

Short Strangle | Short 73.5 p Short 83.5 c | 70% | +930 | x |

Short Put Vertical | Long 73 p Short 73.5 p | 83% | +70 | -430 |

Symbol: FX | Daily Change |

/6AU4 | -0.29% |

/6BU4 | -0.09% |

/6CU4 | -0.05% |

/6EU4 | +0.17% |

/6JU4 | -0.39% |

Australian dollar futures fall

Australian dollar futures (/6AU4) fell amid warning signs out of China, Australia’s main trading partner. The Reserve Bank of Australia (RBA) is expected to keep its official cash rate (OCR) at 4.35% at tomorrow’s meeting.

Chances for a rate increase rose after the latest round of inflation data for Australia, which showed that prices increased 3.6% in April from a year ago. That likely isn’t enough to invite a rate hike for the time being. Investors will closely watch Governor Michele Bullock’s comments about the economy and inflation.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.635 p Short 0.64 p Short 0.68 c Long 0.685 c | 63% | +150 | -350 |

Short Strangle | Short 0.64 p Short 0.68 c | 69% | +460 | x |

Short Put Vertical | Long 0.635 p Short 0.64 p | 88% | +70 | -430 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.