S&P 500 Set to Open Near Record Highs—Again

S&P 500 Set to Open Near Record Highs—Again

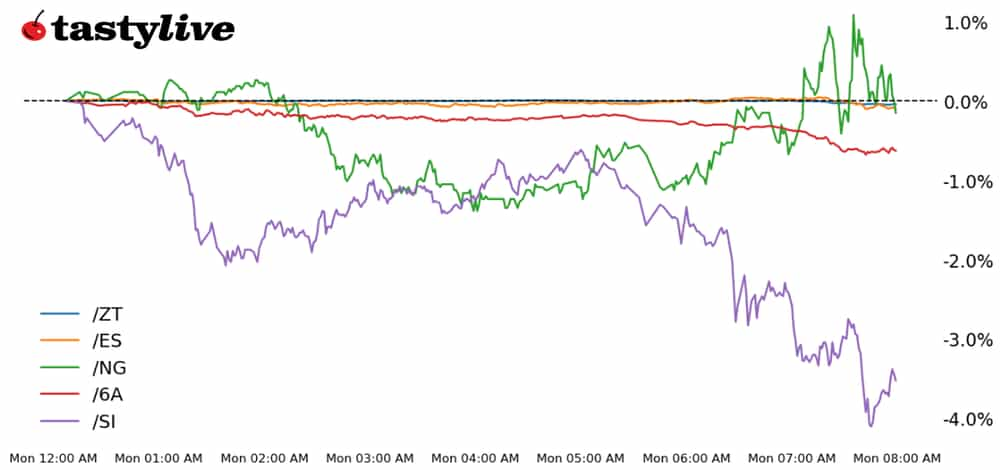

Also, two-year T-note, silver, natural gas and Australian dollar futures

S&P 500 E-mini futures (/ES): +0.06%

Two-year T-note futures (/ZT): -0.03%

Silver futures (/SI): +0.64%

Natural gas futures (/NG): +2.55%

Australian dollar futures (/6A): -0.46%

It’s the final week of the year before summer trading officially begins, and traders are being greeted by U.S. equity markets set to open around all-time highs—again. U.S. Treasury yields are modestly higher across the board ahead of a 20-year bond auction and an auction later this week of 10-year TIPS (Treasury inflation-protected securities). Elsewhere, geopolitical risks may be poised to creep higher amid uncertainty around the fallout of the death of Iranian President Ebrahim Raisi. But because his death was an accident, markets have not been gripped by fear.

Symbol: Equities | Daily Change |

/ESM4 | +0.06% |

/NQM4 | +0.06% |

/RTYM4 | -0.17% |

/YMM4 | +0.02% |

S&P 500 futures (/ESM4) were flat this morning as traders geared up for the week, which includes the minutes from the latest Federal Reserve meeting, more earnings and several Fed speakers. Nvidia (NVDA) will likely be the most influential event for equity markets, with results due Wednesday after the bell. Target (TGT) and Palo Alto Networks (PANW) are also due to report this week. Traders will look to hold /ES contracts above the 5,300 level to maintain technical strength.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5150 p Short 5175 p Short 5600 c Long 5625 c | 62% | +295 | -955 |

Short Strangle | Short 5175 p Short 5600 c | 68% | +1812.50 | x |

Short Put Vertical | Long 5150 p Short 5175 p | 85% | +137.50 | -1112.50 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.03% |

/ZFM4 | -0.10% |

/ZNM4 | -0.16% |

/ZBM4 | -0.35% |

/UBM4 | -0.48% |

Short-term bonds fell to start the week, with the two-year T-note futures (/ZTM4) down 0.03%. This morning, Atlanta Federal Reserve President Raphael Bostic said he expects inflation will ease at a slower pace. Later this week, durable goods orders may influence Fed interest rate hike bets, which are slated for a first cut in September, according to Fed funds futures. The Treasury is scheduled to auction 20-year bonds on Wednesday.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.125 p Short 101.25 p Short 102.75 c Long 103 c | 63% | +31.25 | -218.75 |

Short Strangle | Short 101.25 p Short 102.75 c | 66% | +125 | x |

Short Put Vertical | Long 101.125 p Short 101.25 p | 98% | +15.63 | -234.38 |

Symbol: Metals | Daily Change |

/GCM4 | +0.07% |

/SIN4 | +0.64% |

/HGN4 | -0.5% |

Silver prices (/SIN4) are moving higher as last week’s momentum remains strong following a break above the psychologically important 30 level. The metal has benefited from easing rate cut bets and China’s willingness to correct its property sector woes—benefiting the metal as a precious and industrial asset. Silver has outpaced gold recently, resulting in a gold/silver ratio of nearly 75—the lowest level since late 2022.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.75 p Short 28 p Short 35 c Long 35.25 c | 66% | +325 | -925 |

Short Strangle | Short 28 p Short 35 c | 73% | +3370 | x |

Short Put Vertical | Long 27.75 p Short 28 p | 83% | +140 | -1110 |

Symbol: Energy | Daily Change |

/CLM4 | -0.82% |

/HOM4 | -0.95% |

/NGM4 | +2.55% |

/RBM4 | -1.38% |

Natural gas futures (/NGM4) started the week higher, rising 2.5% this morning following last week’s 16.6% gain—the largest weekly percent gain since October 2023. A pullback in U.S. production has sent the commodity higher, although stocks remain well above one- and five-year averages, according to the Energy Information Administration. The threat of above-average temperatures across the East Coast over the next several weeks is adding a tailwind to prices as the U.S. nears the official start of summer.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.35 p Short 2.4 p Short 3.25 c Long 3.3 c | 63% | +180 | -320 |

Short Strangle | Short 2.4 p Short 3.25 c | 72% | +1040 | x |

Short Put Vertical | Long 2.35 p Short 2.4 p | 82% | +80 | -420 |

Symbol: FX | Daily Change |

/6AM4 | -0.46% |

/6BM4 | -0.07% |

/6CM4 | -0.15% |

/6EM4 | -0.14% |

/6JM4 | -0.29% |

Australian dollar futures (/6AM4) fell 0.46% to start the week. The currency remains near its highest levels since January amid a broader pullback in the dollar and a risk-on mood across global equity markets. Still, a recent drop in Australian bond yields poses a risk to the aussie despite its tailwinds. Reserve Bank of Australia minutes are due later this week, which may influence /6AM4.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.645 p Short 0.65 p Short 0.69 c Long 0.695 c | 68% | +120 | -380 |

Short Strangle | Short 0.65 p Short 0.69 c | 73% | +350 | x |

Short Put Vertical | Long 0.645 p Short 0.65 p | 88% | +70 | -430 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.