Cars, Corrections and Coffee

Cars, Corrections and Coffee

By:James Melton

A weekly look inside Luckbox magazine

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Your next Luckbox is coming soon

The upcoming Spring 2024 Luckbox is all about cars and the trends shaping the industry that makes them. We look from several angles at the business of making vehicles that run on batteries, hybrid systems and old-fashioned dinosaur juice. And we include a lot of cool car photos.

Companies mentioned include venerable names like General Motors (GM), Ford (F), Tesla (TSLA) and Toyota (TM), but also up-and-comers like Lucid (LCID) and privately held Olympian Motors and China's BYD (BYDDY)—aka, the carmaker keeping Elon Musk awake at night.

Could a stock correction come soon?

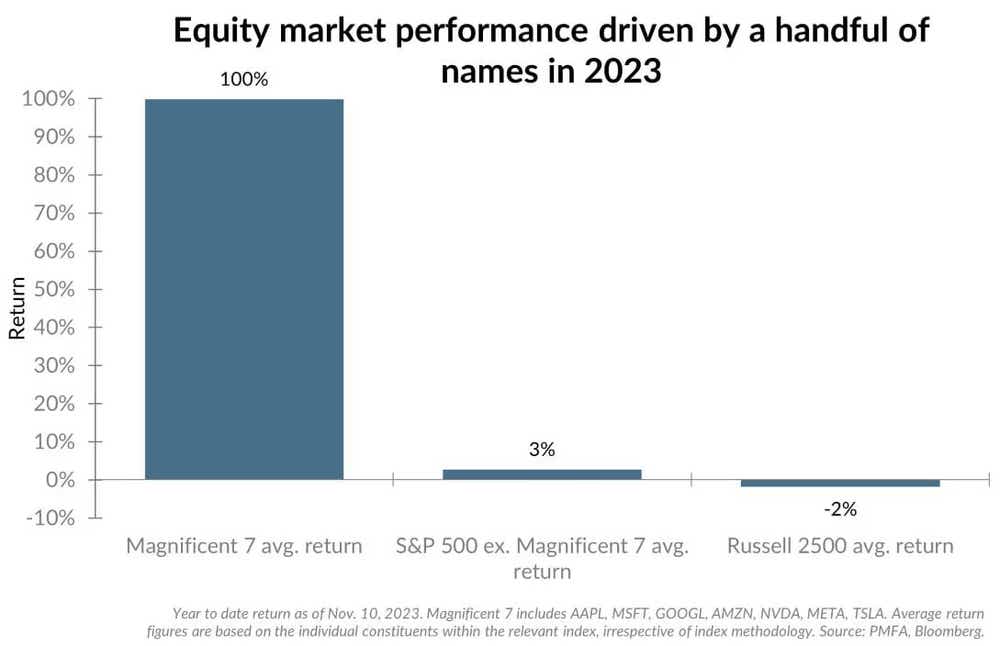

It may not seem like it right now, but the stock market historically moves up and down. Due to that historical reality, it's likely the stock will enter a 10% correction at some point in 2024. This is especially true given that 2024 is a presidential election year, which can be more volatile than an "average" trading year.

So far in 2024, the S&P 500 is up 8%, but since bottoming last October, it's up nearly 25% in just four months. Last October, the S&P 500 bottomed out around 4,100, and today trades closer to 5,100. But according to one Wall Street analyst, the current dynamic in the stock market is more characteristic of the latter stages of a rally, as opposed to the early part, or middle.

Robust performance for Robusta coffee beans

Coffee continues to be one of the hottest commodities in the world. With prices remaining stubbornly high, coffee will undoubtedly play a continuing role in the ongoing inflation narrative, alongside the rising prices of other consumer goods.

In 2022, the price of Arabica coffee—considered the premium bean in the coffee world—surged to a five-year high of roughly $6.20/kilogram. That rise in prices was primarily attributable to a poor coffee harvest. In response, many coffee makers started buying a larger percentage of Robusta coffee beans, which are traditionally a lot cheaper than Arabica.

This market dynamic caused Arabica beans to fall in price, while Robusta beans have been rose. Since peaking above $6/kilogram in 2022, Arabica beans have retraced back to about $4.50/kilogram in early March.

Be careful with zero DTE options

Zero days to expiration (0DTE) options have exploded in popularity among retail investors because they can offer volatility during otherwise calm markets and may offer cheaper alternatives to longer-term trades. But they can be risky.

0DTE trades highly speculative, and investors should not consider them a reliable source of income. Traditional options risk metrics tend to break down for such short-dated contracts, and the expiration mechanics of options become much more relevant with 0DTEs, compared to longer-term options.

We offer the correct strategy.

Read the latest edition of Luckbox magazine here.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Not receiving Luckbox? Subscribe for free at getluckbox.com.

James Melton is managing editor of Luckbox magazine. @JDMeltonWriter

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.