Stock Market Meltdown: Is it Already Over or Just Getting Started?

Stock Market Meltdown: Is it Already Over or Just Getting Started?

By:Ilya Spivak

The markets melted down, then came roaring back as the US and China sparred on trade. Now what?

- Global markets swung wildly as the US-China trade war took the spotlight

- A speech from Chair Powell is eyed as traders and the Fed clash on rate cuts

- Financial names are in focus as the Q3 earnings reporting season heats up

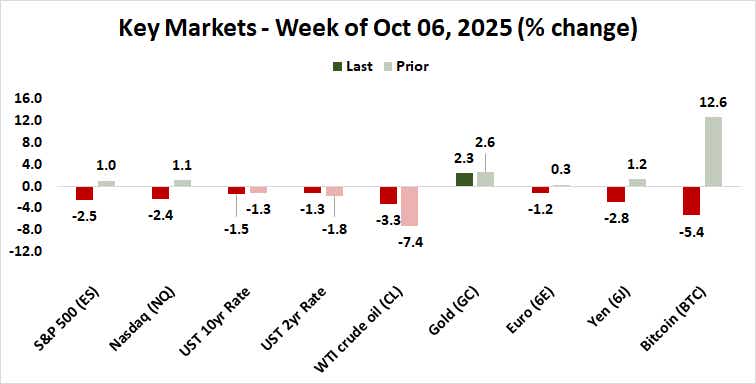

Another head-spinning reversal sent US stock markets lower Friday after a push to record highs a mere 24 hours earlier. The bellwether S&P 500 plunged 2.71% while the tech-tilted Nasdaq 100 lost 3.53%. These moves amounted to the biggest one-day losses for the two leading Wall Street benchmarks in six months.

The bloodletting pulled down Treasury yields as bonds roared higher, seemingly reclaiming their appeal as a haven in troubled times. Crude oil prices also fell, although it is difficult to unpick how much of that move owed to broader risk aversion, and how much reflected easing supply disruption fears after Israel and Hamas agreed to a ceasefire.

Stocks seesaw as the US-China trade war leaps back into the headlines

The selloff followed after US President Donald Trump appeared to signal escalation of the trade war with China. He slammed Beijing’s move to deploy export controls on rare earth minerals, threatening to impose an additional 100% tariff on Chinese imports and seemingly cancelling an upcoming meeting with President Xi Jinping in South Korea.

Sentiment seesawed again as markets reopened this week. Stocks roared higher, erasing more than half of Friday’s losses. That followed a somewhat softer tone from Mr. Trump over the weekend. “Don’t worry about China, it will all be fine,” he urged in a Truth Social post, adding that “highly respected” President Xi just had a “bad moment”.

US Treasury Secretary Scott Bessent tried to help calm the markets’ nerves. He said that new tariffs against China will not go into effect until November 1, leaving room for a direct resolution between Trump and Xi later this month. “I believe [their meeting during the Asia-Pacific Economic Cooperation forum] will still be on,” he said.

Fed Chair Powell speech, Q3 earnings calendar in focus amid government shutdown

This leaves traders without much to go on in the meantime. The ongoing US government shutdown has stripped the calendar of top-tier economic data releases. That puts the spotlight on a speech from Federal Reserve Chair Jerome Powell, as well as the start of the third quarter corporate earnings reporting season.

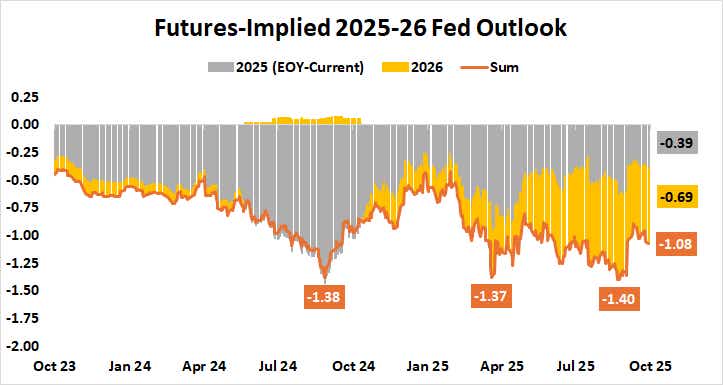

Mr. Powell is due to give an update on outlook for the economy and monetary policy at the National Association for Business Economics (NABE). A familiar cautious tone seems likely, echoing Fed officials’ September call for just one 25-basis-point (bps) rate cut next year, following three cuts in 2025.

For their part, financial markets appear to be broadly aligned with what the central bank has on the menu for this year but see officials delivering 69bps in cuts in 2026. That dovish disconnect means they are unlikely to be happy if Powell is seen pulling in the opposite direction.

On the earnings front, this week’s offering is dominated by major financial names including JPMorgan (JPM), Goldman Sachs (GS), Citigroup (C), BlackRock (BLK), and Wells Fargo (WFC). Healthcare giant Johnson & Johnson (JNJ) and railway operator CSX Corp. (CSX) are also due to report and may act as barometers of economic vigor.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices