Stock Market Rally Stalls: Will Fed Comments Spoil the Rebound?

Stock Market Rally Stalls: Will Fed Comments Spoil the Rebound?

By:Ilya Spivak

The stock market rebound has stalled. Will worrying comments from Fed officials take them down again?

- Stocks stalled after a rally on hopes for reopening the US government

- The tech sector struggled after SoftBank sold its entire stake in Nvidia

- Fed commentary threatens to revive worries about rate cut prospects

A forceful stock market rebound lost momentum after just one day. Wall Street surged at the start of the trading week amid hopes for an end to the US government shutdown. Reopening has come one step closer as a deal struck in the Senate has made its way to the House of Representatives, but the rally ran aground all the same.

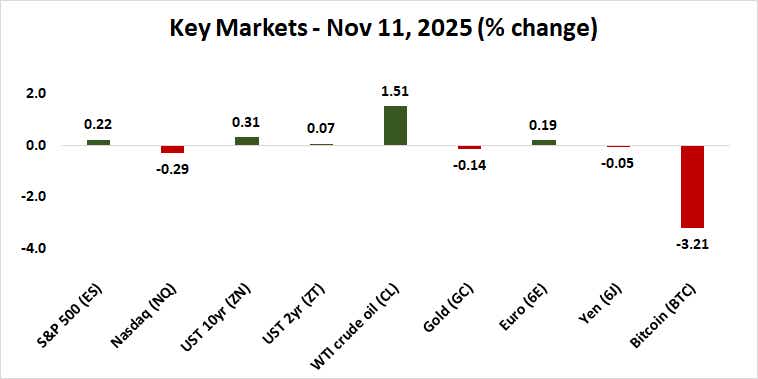

The bellwether S&P 500 put in a paltry gain of 0.22% while the tech-tilted Nasdaq 100 fell 0.29%. That put the outsized influence of the tech sector firmly on display. It was the only sector to lose ground today as shares of market-cap giant Nvidia Corp fell nearly 3% after news that SoftBank sold all of its stake in the chipmaker for $5.83 billion.

Stock market rally: a one-off pause or something more sinister?

This makes it tempting to chalk up the day’s soggy performance to a one-off headline. Indeed, the ProShares S&P 500 excluding Technology ETF (SPXT) rose 0.70%, seemingly highlighting resilience across most of the equity space. However, that rose-colored interpretation probably amounts to wishful thinking.

The small-cap Russell 2000 index – where the tech sector accounts for 13.6% of the index, less than half of the 35% share it captures in the S&P 500 – still managed a rise of just 0.08%. Moreover, price action outside stocks looked unconvincing. Gold and the US dollar stalled while bitcoin fell 3.21% in what could be a hint building “risk off” sentiment.

Perhaps the closure of the US Treasury bond market for the Veterans Day holiday robbed traders of the variables they needed for real directional conviction, even as a modest uptick in 10-year T-note futures pointed to a downward tilt on interest rates. If so, this might imply that Federal Reserve rate cut prospects may be returning to the forefront.

Will Fed officials’ comments sink the markets once again?

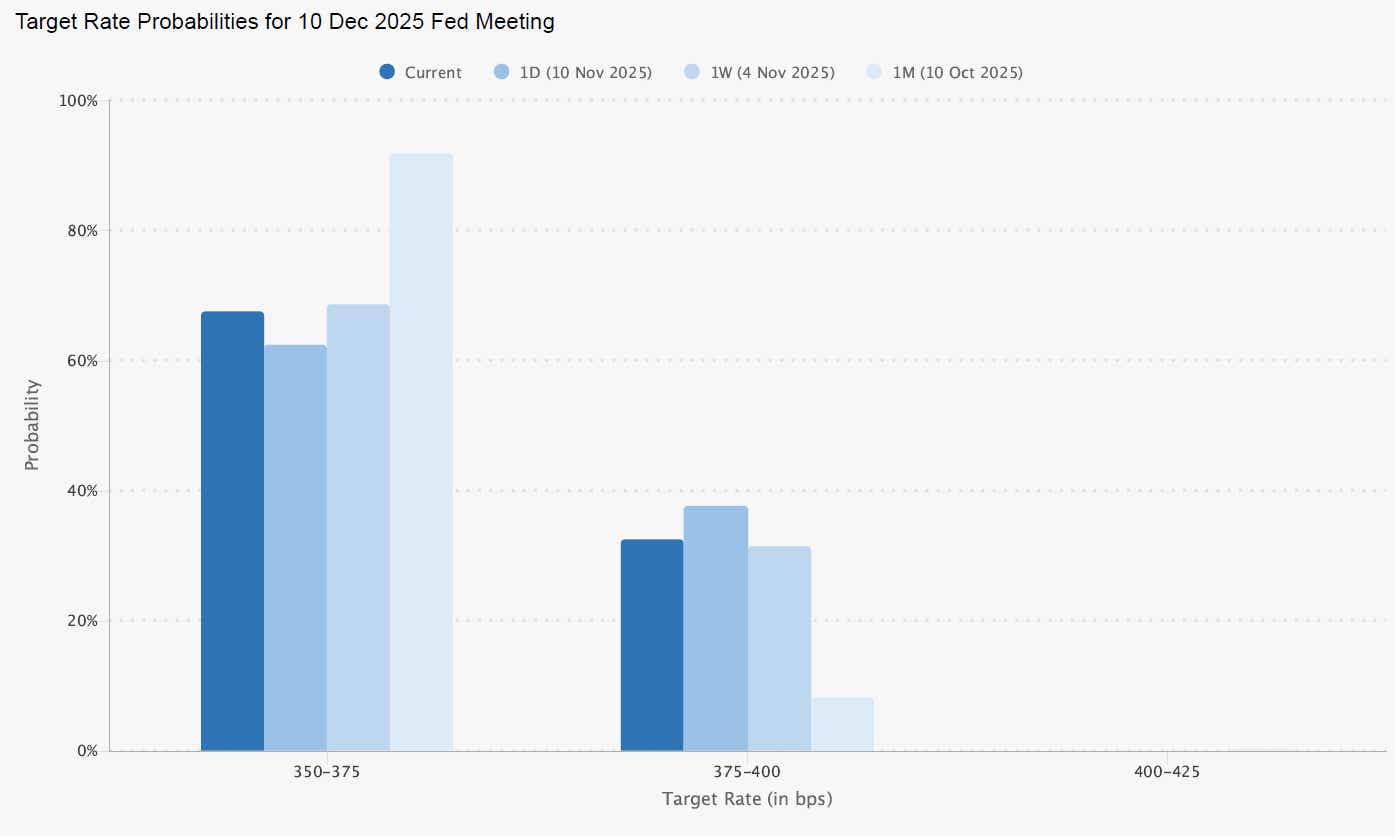

That might be a problem for stock markets, where worries about the diminished probability of another 25-basis-point (bps) reduction in the central bank’s rate target next month fueled sharp selling last week. A slew of speeches from Fed officials will feed speculation on this front in the coming days.

A dovish message from Stephen Miran, inserted onto the Board of Governors by the White House while technically on leave as the Trump administration’s Chair of the Council of Economic Advisors, seems like a given. Remarks from New York Fed President John Williams and Governor Chris Waller may be more instructive.

Both policymakers have endorsed the Fed’s restart of easing in September and the follow-on cut in October. Waller even dissented in favor of easing earlier in the year. Stock may be put on the defensive as the US dollar gains if they appear to be on the fence about whether to act again in December, echoing Chair Powell’s fateful press conference last month.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices