Stocks and Bonds Jump then Fade After May FOMC Meeting

Stocks and Bonds Jump then Fade After May FOMC Meeting

The S&P 500 us up 1.12% for the month so far

- In line with expectations, the Federal Reserve did not change its main rate, but the policy statement signaled more concern about recent inflation data.

- Fed Chair Jerome Powell suggested that it’s likely that the FOMC will keep rates on hold for the near future as it needs additional confidence to start the cut cycle.

- Powell also made clear that a rate hike is not under consideration at present time.

The Federal Reserve surprised no one today when it kept its main rate on hold at 5.25-5.50%,

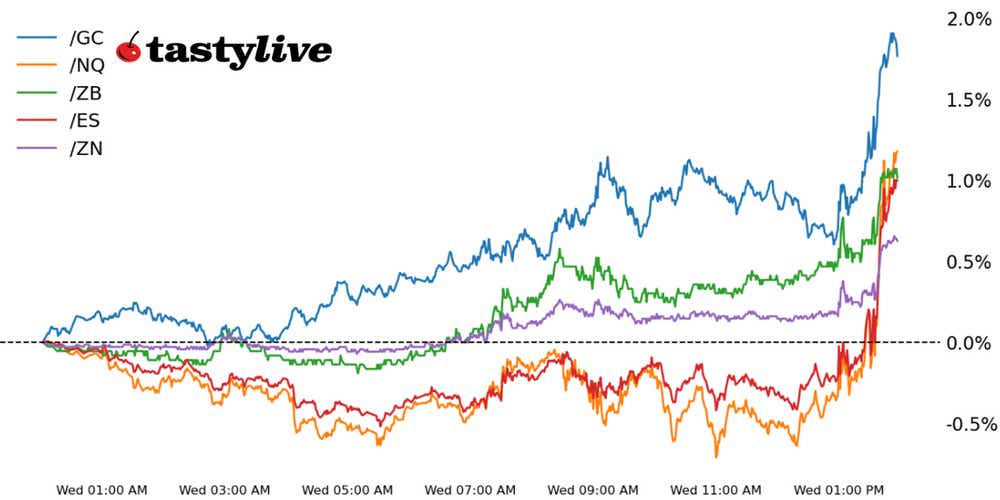

The lack of any hawkish surprise beyond what was anticipated is allowing markets to breathe a sigh of relief, with stocks and bonds rallying sharply during the press conference (although gains were fading rapidly as cash equities headed toward the close).

The May Federal Open Market Committee (FOMC) policy statement showed meaningful changes from March that acknowledged the lack of recent progress on inflation. However, neither the policy statement, nor Fed Chair Jerome Powell at his press conference, offered any signal that a rate hike is likely this year. On several occasions, Fed Chair Powell said that he and the FOMC believed that policy was “sufficiently restrictive,” a dovish silver lining.

In effect, the May FOMC meeting can be summarized as the Fed reconciling its view on rate cuts with that of the market. Powell said that it’s already been priced-in, as rates markets are discounting just 27 basis points worth of cuts through the end of the year.

As of now, it’s too soon to say that a December rate cut is off the table, although the depth of the rate cut cycle may be shallower than previously expected.

Quantitative tightening to be less tight

Furthermore, the FOMC announced a reduction in quantitative tightening from $60 billion per month to $25 billion per month (a reduction of $35 billion per month, slightly more than anticipated $30 billion per month reduction).

While the overall market impact on bonds from the QT change may be limited, the reduction in balance sheet runoff could translate into a reduced need for Treasury issuance over the coming months, which in turn may help take some pressure off the long end of the yield curve, which has seen a string of weaker auctions.

/ZQ Fed funds futures forward curve (May 2024 to November 2026)

Rates markets are starting to calcify around the idea that no rate cuts are coming in June, July, or September this year, which have continued to see cut odds bleed out in recent weeks.

Only one cut is fully discounted when looking at the /ZQ (Fed funds) term structure, which is where the FOMC seems to be anchoring the conversation as it prepares a new round of forecasts for its Summary of Economic Projections in June.

As long as one rate cut for 2024 isn’t eliminated, we may be looking at a floor of sorts forming in bonds.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices