U.S. Consumers Turn Defensive

U.S. Consumers Turn Defensive

By:Ilya Spivak

August’s surprisingly strong U.S. retail sales rise masks underlying weakness, fueling concerns about global recession. The dollar may rise while stocks could fall.

- August U.S. retail sales data tops forecasts but masks weakness under the surface.

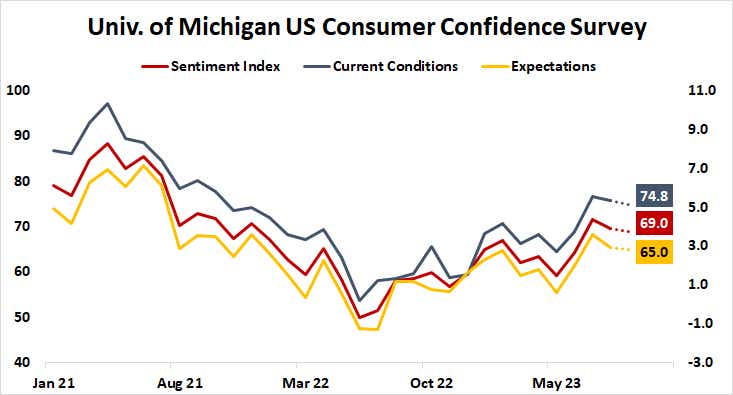

- U of M consumer confidence data may show Fed rate hikes weighing on consumers.

- Slowing U.S. economy bodes ill for global growth, with recession worries building.

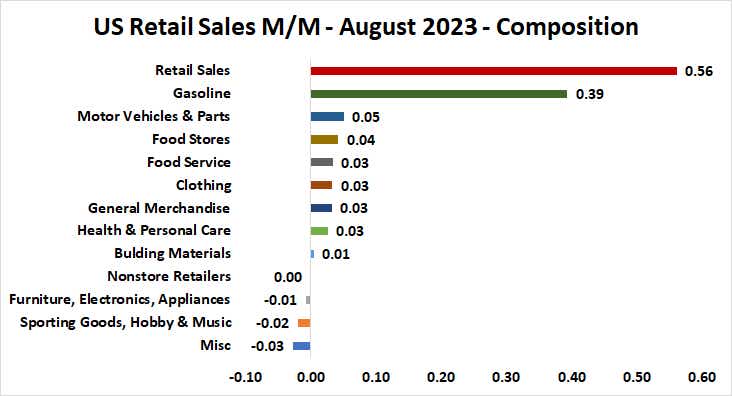

Taken at face value, August’s U.S. retail sales report painted a rosy picture of consumption. Receipts rose 0.6% from the prior month, beating the expected 0.1% increase by a healthy margin.

Looking under the surface reveals something far more sinister.

Gasoline sales accounted for a whopping 70% of the month-over-month advance, contributing 0.39 percentage points. That almost certainly reflects higher crude oil prices. They’ve risen over 23% since the start of June.

Meanwhile, interest-rate-sensitive “furniture, electronics and appliances” sales and those in the discretionary “sporting goods, hobby book and music” category fell. The weakness extended to internet sales, which registered a flat result on the month. Spending at restaurants and bars increased—adding 0.3% from July—but that marked considerable slowdown after the prior month’s 0.8% increase.

Taken together, this reflects consumers that are becoming burdened by Federal Reserve interest rate hikes. The central bank has argued that it takes 12 to 18 months for the impact of a single interest rate hike to be fully absorbed into the economy. This means that the cumulative effect of a blistering tightening cycle beginning in March 2022 should be starting to appear in earnest right about now.

Fed rate hikes are starting to weigh on U.S. consumers

This is probably welcome news for Fed Chair Jerome Powell and company. It suggests that the central bank is in an advantageous position to make good on their plan of banishing inflation locked within the labor market. A lingering supply/demand imbalance there has underpinned wages, keeping employment costs elevated relative to overall inflation benchmarks.

Policymakers’ answer is to trigger a reset of wage agreements—i.e., layoffs–to address the issue. The unemployment rate remains near multi-decade lows despite Augusts’ modest uptick, but job openings have trended decisively lower, implying softening demand.

The retail sales report appears to imply that consumers have caught on and responded by tightening their belts. A bit of confirmation may come courtesy of the latest report on U.S. consumer confidence from the University of Michigan, due Friday. It is expected to show that sentiment soured for a second consecutive month in September.

This probably endorses the markets’ expectation that Fed rate hikes have already ended. The priced-in probability of another hike this year is 43%, with a period of standstill then leading into an easing cycle in the second half of 2024.

Global recession risk is building as U.S. slowdown looms

However, it spells trouble for the global economy. Consumption accounts for close to 70% of U.S. economic growth. With the Eurozone all but certainly in recession and China struggling to find its feet after emerging from COVID lockdowns in December of last year, the unraveling of U.S. retail demand points to a worldwide recession on the horizon.

That augurs poorly for stock markets. Cyclically sensitive commodities like copper and like-minded currencies like the Australian and Canadian dollars are also vulnerable, while the anti-risk U.S. dollar continues to be well-positioned. A flattening yield curve reflecting anticipation of easing and haven demand for longer-dated Treasury bonds may be supportive for the Japanese yen and gold.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices