Stocks and Bitcoin Drop, Fed Rate Cut Bets in Focus as Powell Speaks

Stocks and Bitcoin Drop, Fed Rate Cut Bets in Focus as Powell Speaks

By:Ilya Spivak

Testimony from Fed Chair Jerome Powell is under the microscope. A hawkish tilt may push sinking stocks still lower

- Stocks and bitcoin sink despite would-be tailwind from services ISM data.

- Bonds, yen and U.S. dollar find support, flagging broad based risk aversion.

- Hawkish testimony from Fed Chair Powell may stoke more liquidation.

Disappointing U.S. economic data gave stock markets a brief nudge higher—a nod to “bad is good” price dynamics in which the chance at more Fed rate cuts is the greatest aspiration–but ultimately failed to uphold risk appetite.

Shares swooned, with the tech-heavy Nasdaq on pace for a loss of more than 2%. The S&P 500 is trading down 1.1%.

The pain has extended into other sentiment-linked assets: crude oil is down, and bitcoin is on track for its worst day this year. Meanwhile, Treasury bonds and gold prices are on the upswing while the U.S. dollar has erased intraday losses against all its top counterparts except the Japanese yen, which is the strongest major currency on the day.

Stocks and bitcoin sink despite U.S. data tailwind

The Institute of Supply Management (ISM) reported that the service sector grew at a slower pace in February than economists projected. Their non-manufacturing purchasing managers index (PMI) gauge printed at 52.6, down from a four-month high of 53.4 in January and lower than the 53.0 expected.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

This sent up a faint cheer from investors echoing Friday’s rally in the wake of disappointing manufacturing ISM data, but analog follow-through plainly didn’t materialize. That might be because the release left Federal Reserve policy expectations little changed. The priced-in path for 2024 moved by less than 5 basis points (bps) on the day.

It seems sensible that traders were unwilling to commit to major changes in the policy outlook, one way or another. They now face two days of Congressional testimony from Fed Chair Jerome Powell, and so have probably concluded that front-running such event risk is unwise.

Powell will first sit for a session in the House, then go for a repeat performance in the Senate on the following day. Prepared remarks will be mostly unchanged from one outing to the next, with the key differences likely to show up in the Q&A portion of each exercise.

All eyes on Fed Chair Jerome Powell

A relatively hawkish tone is likely. Despite recent misses, U.S. economic data has mostly outperformed relative to forecasts so far in 2024. That has bid up inflation expectations, challenging the Fed. On rate cuts, Powell may repeat that they are probably on the menu this year even as he talks down their urgency and scope.

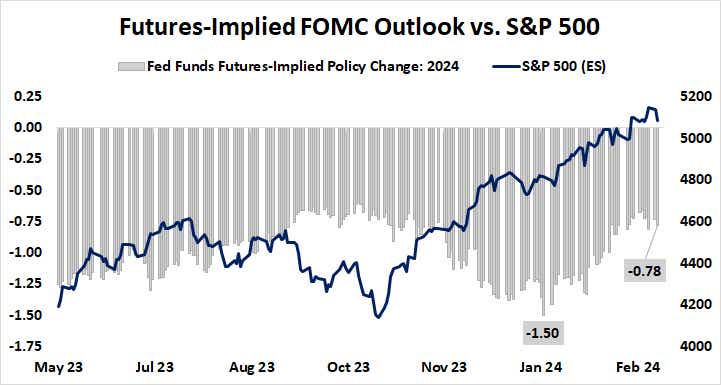

That may not sit well with Wall Street. Markets now price in 78bps in rate cuts this year, down from 150bps in January. The current setting is firmly in line with the 80bps in easing that Fed officials signaled in the last official forecast update published in December.

Stocks understandably performed when markets expected money to be cheaper than the central bank was signaling, amounting to a familiar tail wind for risk-taking. From here, adjusting to anything less dovish would imply markets expect tighter conditions than the Fed baseline, which ought to play the same dynamics in reverse.

It is practically impossible to know if today’s bloodletting amounts to pre-positioning for just such a possibility. If so, the pain may be exhausted relatively quickly. If Powell strikes a still more hawkish tone than markets are already fearing, another wave of risk aversion is probably to come.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices