Stocks, Crude Oil, and the Dollar: Will This Block Fed Rate Cuts?

Stocks, Crude Oil, and the Dollar: Will This Block Fed Rate Cuts?

By:Ilya Spivak

Stocks fell and the US dollar rose as surging crude oil prices spooked the markets. Will this derail Fed rate cuts?

- US CPI inflation data seemed benign, underpinning the Fed’s rate cut logic

- Stocks dipped anyway and the US dollar rose as crude oil prices raced higher

- PPI data is in focus next as input cost risks put traders’ dovish hopes at risk

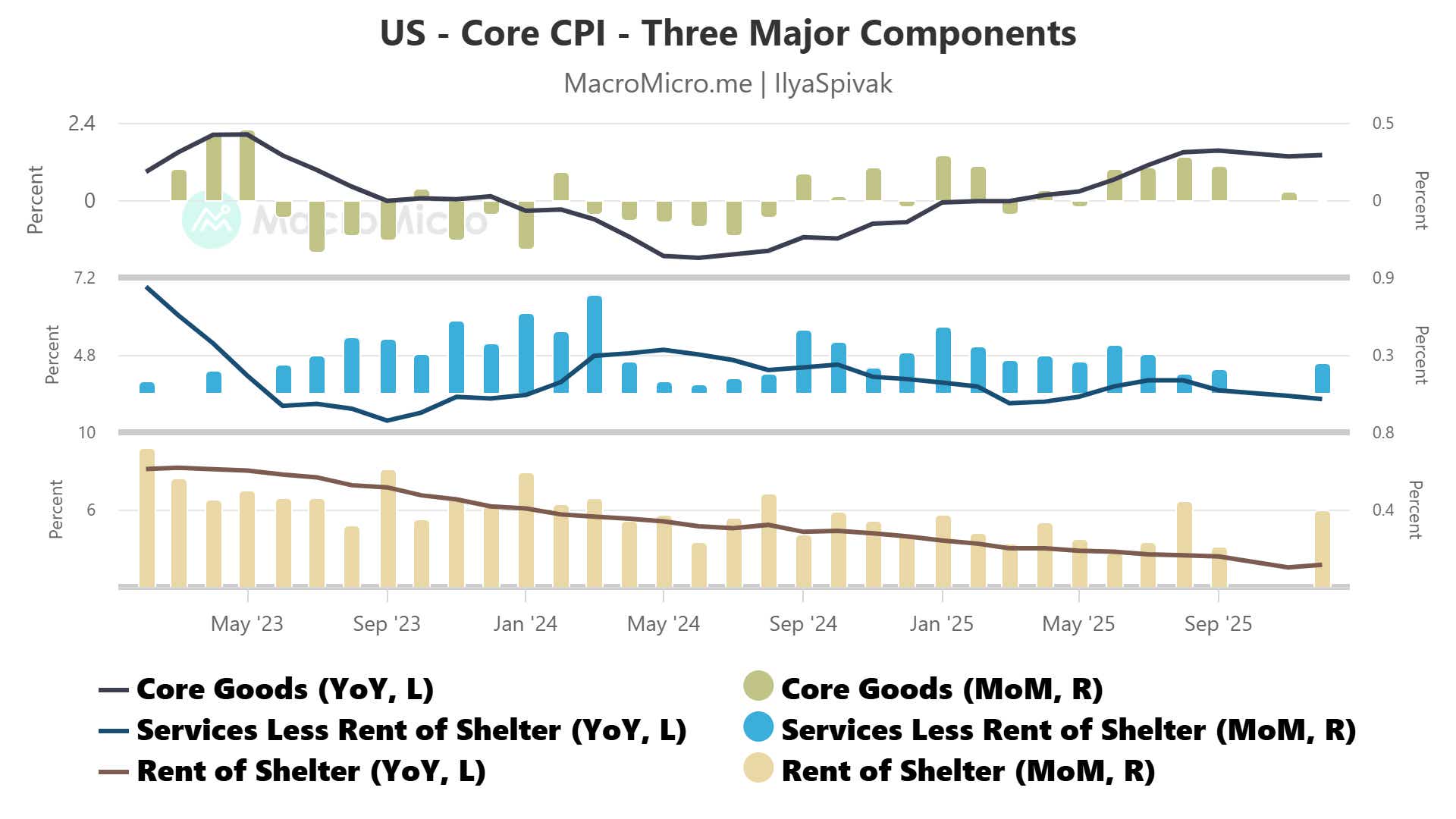

December’s consumer price index (CPI) data showed that headline inflation held steady at 2.7% year-on-year as expected, unchanged from the four-month low recorded in November. The core CPI rate excluding volatile food and energy prices – a focal point for policymakers – held at 2.6% year-on-year, marking a slight undershoot relative to forecasts.

Under the surface, the numbers showed that slight gains in core goods and services prices alongside that of food were offset by cooling energy costs. The trends supporting the policy path set by the Federal Reserve remained broadly in place: a tariff-driven rise on the goods side looks to be plateauing while disinflation continues in services.

Stock markets stumble, dollar gains despite benign CPI data. What gives?

Baseline monetary policy expectations were left broadly unchanged in the wake of the data. Fed Funds futures still show that traders have discounted two 25-basis-point (bps) rate cuts for 2026, double the forecast maintained by central bank officials since June last year. Traders now expect to see the first move in June and the second in September.

The markets offered up a curious reaction. Stocks briefly popped higher while the US dollar took a step lower as the CPI report crossed the wires. Both moves then promptly reversed after mere hour of digestion. The bellwether S&P 500 is now on course to finish the day in the red, while the greenback has erased nearly all of yesterday's losses.

This seems to suggest that markets were paying enough attention to acknowledge the CPI release but ultimately found their cues elsewhere. A sharp rise in crude oil prices may offer an explanation. With Venezuela in limbo, Iran teetering on the brink of revolution, and the US boarding Russian tankers, China’s oil supplies suddenly seem vulnerable.

PPI data now in focus as crude oil rise threatens Fed inflation hopes

Against this backdrop, the benchmark WTI crude oil contract hit a three-month high. Rising prices filter into headline CPI data without a lag of about one month. If they keep marching higher as Beijing leans on alternative supplies, inflation will get an unwelcome boost.

The spotlight now turns to catch-up producer price index (PPI) data. The incoming release is expected to bring the BLS data series up to November after the disruption amid October’s government shutdown. Headline wholesale inflation is expected to hold steady at 2.7%. The core rate is expected to rise to the same level from 2.6% in September.

Though stale, this data may still prove to be insightful for what it says about the Fed’s rosy assumptions about tariff-linked inflation. PPI figures since April 2025 have revealed a hearty squeeze on wholesalers’ margins, implying that they are eating tariff costs rather than pass them on to consumers.

Such sacrifice – ostensibly undertaken to protect demand – is inherently temporary. Add to this mix a rise in crude oil that makes it even harder for firms to shield retail from increasingly expensive inputs, and the path ahead for CPI and thereby for interest rates looks much less benign than currently expected. That might keep stocks under pressure.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices