The Latest Entrant in the Quantum Computing Race

The Latest Entrant in the Quantum Computing Race

Breakthroughs in quantum computing could reshape the tech sector—amplifying both the opportunities and risks in pure-play quantum stocks like Infleqtion.

Quantum computing is emerging as one of tech’s most promising frontiers, with each breakthrough and setback amplifying sector volatility.

The upcoming Infleqtion IPO introduces a new pure play to the quantum sector, offering investors direct exposure to neutral-atom technology and quantum sensing.

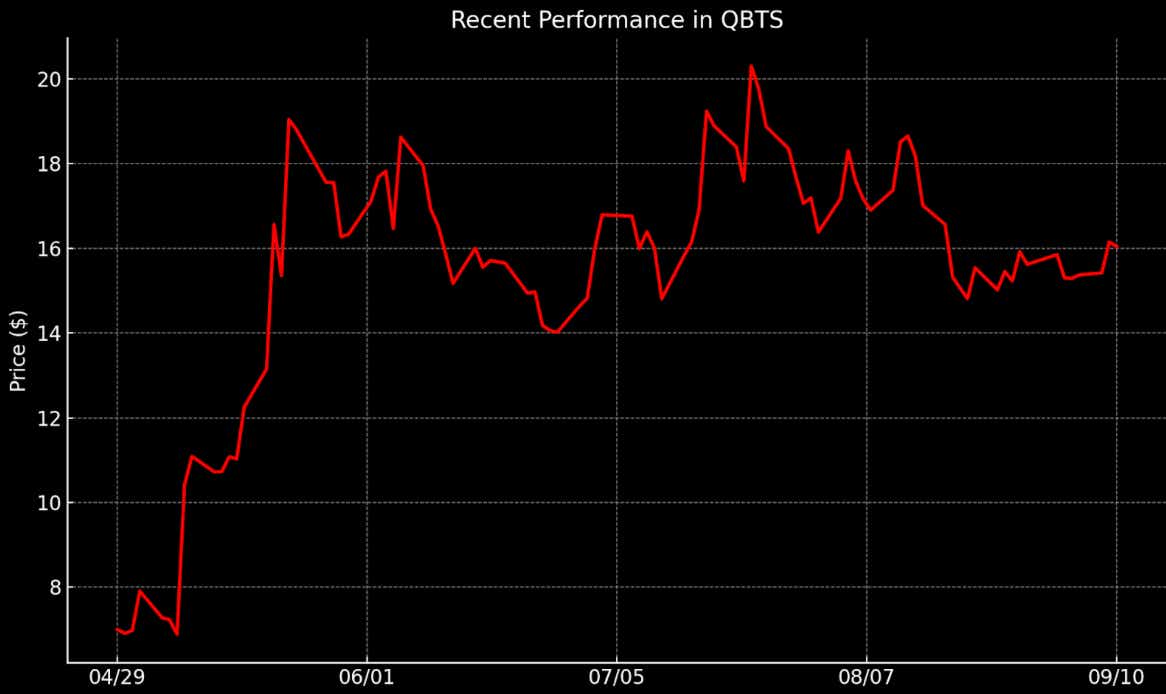

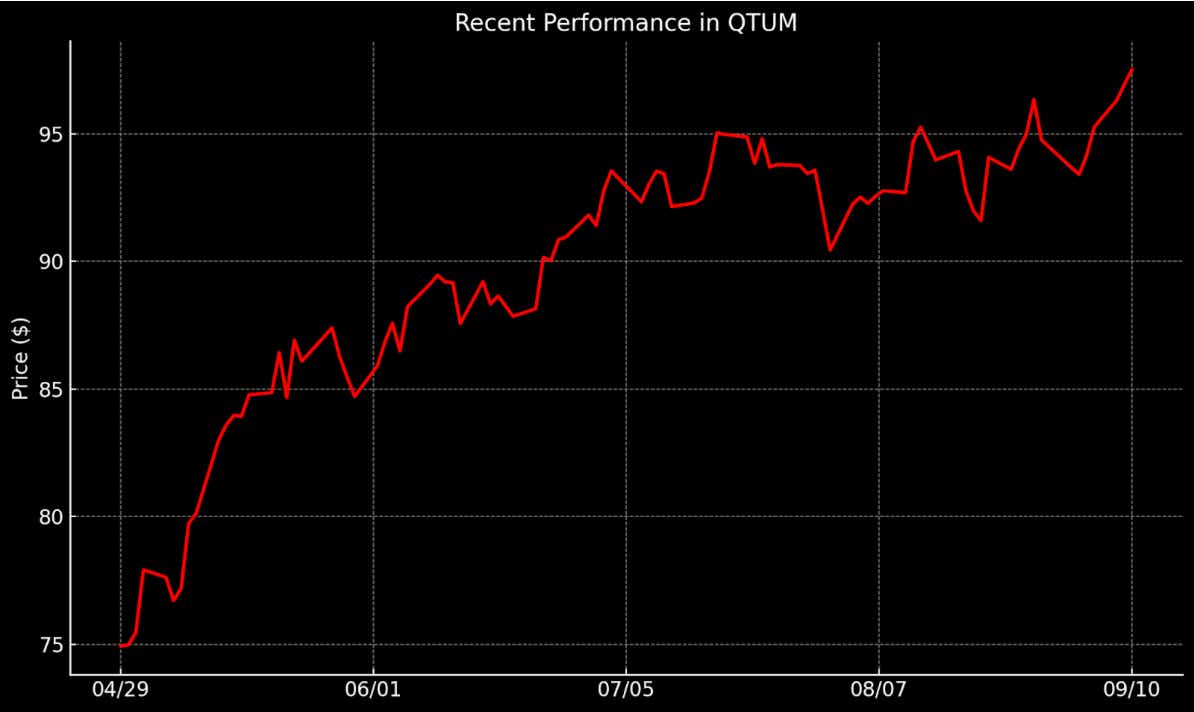

In 2025, D-Wave (QBTS) has been a standout performer, but investors seeking broader exposure to the sector can also consider the Defiance Quantum ETF (QTUM).

Quantum computing is no longer science fiction—it’s quickly becoming one of the most competitive arenas in technology. Major strides in quantum error correction, steady advances from IBM, Google, and Microsoft, and billion-dollar bets on startups like PsiQuantum and Quantinuum have pushed the field out of the lab and into the headlines. Even Nvidia—the powerhouse behind the AI boom—is getting involved, forging partnerships that weave quantum computing into its wider ecosystem.

And with interest in the sector heating up, the pure-play stocks have become the clearest window into its potential—and its risks. Unlike the tech giants, where quantum programs are overshadowed by much larger operations, these companies offer a direct read on how investors are pricing the promise—and the uncertainty—of quantum computing. Not surprisingly, 2025 performance has been mixed, underscoring just how volatile the space remains:

D-Wave Quantum (QBTS): +85%

Defiance Quantum ETF (QTUM): +20%

IonQ (IONQ): +29%

Rigetti Computing (RGTI): −5%

Arqit Quantum (ARQQ): -12%

Quantum Corporation (QMCO): −85%

The sector’s wide range of returns underscores how early-stage and high-beta this theme remains—a single breakthrough can ignite rallies, but missed milestones and heavy cash burn can quickly reverse sentiment.

Against this backdrop, we spotlight Infleqtion—a soon-to-list pure play aiming to carve out its niche in quantum—and examine why D-Wave (QBTS) has emerged as one of 2025’s standout performers. Together, these stories highlight both the upside potential and the risks that come with investing in a still-immature industry.

Infleqtion: A Pure Play IPO Offering Direct Quantum Exposure

The next chapter in quantum investing is set to unfold with Infleqtion, a Boulder, Colorado–based startup preparing to go public through a merger with Churchill Capital Corp X (CCCX), a special purpose acquisition company (SPAC). The deal values Infleqtion at about $1.8 billion and is expected to raise more than $540 million in cash, with backing from institutional investors including Maverick Capital and Counterpoint Global.

Although SPACs have fallen out of favor with some investors, they remain a practical path for capital-intensive, long-horizon technologies where traditional IPO routes can be challenging. A few notable names, such as DraftKings (DKNG), have proven that this approach can succeed when the underlying business resonates with investors. For Infleqtion, the SPAC merger offers both funding certainty and an expedited track to the public markets. If completed on schedule, the company is expected to begin trading under the ticker “INFQ” by late 2025 or early 2026.

What sets Infleqtion apart from peers like IonQ and Rigetti is its focus on neutral atom technology and its commercial emphasis on quantum sensing. Unlike superconducting circuits (IBM, Google) or trapped-ion systems (IonQ), Infleqtion’s approach manipulates atoms cooled near absolute zero with laser arrays. This architecture not only supports future computing applications, but also enables near-term commercial offerings.

For example, the company’s flagship quantum clock—Tiqker—can deliver ultra-precise timing even in environments where GPS signals are jammed or disrupted. Something that’s become increasingly relevant in military and infrastructure settings. This practical application gives Infleqtion near-term revenue potential, setting it apart from peers still years away from meaningful commercialization.

Since taking the helm last year, CEO Matt Kinsella—who joined Infleqtion from Maverick Capital in 2018—has positioned the company as a hybrid quantum innovator. The strategy blends long-term computer development with near-term revenue opportunities in quantum sensing. That approach is already gaining traction: Infleqtion has secured an $11 million U.S. Department of Defense award and continues to work with NASA, where its cold-atom systems operate aboard the International Space Station.

Infleqtion has also partnered with Nvidia, using its CUDA-Q platform for material science demonstrations, a nod to the hybrid future of computing where quantum and classical machines work side by side. With about $29 million in trailing revenue and a pipeline of more than $300 million in potential contracts, Infleqtion is pitching itself as a rare quantum story with both immediate use cases and long-term upside—a combination that could resonate with investors as the company steps onto the public stage.

What’s Driving D-Wave’s (QBTS) 2025 Breakout?

Among the handful of pure-play quantum companies on the market, D-Wave (QBTS) has been a standout performer in 2025. Shares are up sharply this year (+85%), making it worthwhile to look at what’s been working for the company. The surge has less to do with hype, and more with a mix of tangible progress, technical differentiation, and a balance sheet that allows for potential acquisitions.

Unlike peers such as IonQ and Rigetti, which rely on gate-based quantum systems, D-Wave specializes in quantum annealing. This approach is designed for optimization problems—tasks like logistics, materials science, and machine learning that are difficult for classical computers. The company’s Advantage2 system, launched this year, has been a major driver of enthusiasm. It offers improved qubit connectivity, longer coherence times, and reduced noise, and has been highlighted in peer-reviewed research showing computational advantages over traditional systems.

On the commercial front, D-Wave has secured high-profile partnerships with customers ranging from the U.S. National Quantum Computing Center and GE Vernova to Yonsei University in South Korea. It has also pushed deeper into software, releasing open-source AI toolkits that integrate with machine learning frameworks like PyTorch—an effort to make its quantum systems more accessible to developers. These moves have reinforced the perception that D-Wave isn’t just running experiments, but is building an ecosystem around real-world use cases.

Momentum in the stock also stems from financial progress. In Q1, revenue jumped more than fivefold to $15 million, helped by a $12.2 million hardware sale to Germany’s Jülich Supercomputing Centre. That deal underscored a shift toward real product sales, rather than purely service-based revenue. On top of that, D-Wave finished the first half of the year with over $800 million in cash, giving it plenty of runway to fund R&D and pursue acquisitions.

Still, challenges remain. Revenue is modest, losses are significant, and bookings remain lumpy. Yet compared with peers, D-Wave’s combination of unique technology, customer traction, and financial resources has made it a relative bright spot in the sector. That mix helps explain why QBTS has been one of the top-performing pure plays this year.

Quantum Computing Takeaways

Quantum technology is gaining momentum, but the industry is still in its formative years—full of breakthroughs, false starts, and volatility. Infleqtion’s planned IPO highlights how new players are looking to carve out niches in areas like sensing, while D-Wave’s stock surge shows that breakthroughs and customer traction can move the needle in a big way.

The quantum field remains highly fragmented, with each pure play pursuing a different architecture—annealing, trapped ions, neutral atoms—and little agreement on which will ultimately win out. For investors, that makes stock-picking less about near-term fundamentals and more about betting on the sector’s long-term future. For some, that high-stakes risk-reward profile can be hard to stomach.

For investors seeking exposure to the quantum theme without having to pick a single winner, the Defiance Quantum ETF (QTUM) offers a more balanced approach. By bundling many of the sector’s leading names, QTUM lets investors participate in quantum’s long-term potential while reducing the company-specific risks that come with betting on an individual stock.

Alternatively, investors can access exposure to the quantum sector through tech giants like Alphabet (GOOGL), IBM (IBM), and Microsoft (MSFT). For these companies, quantum is just one part of a much larger portfolio, allowing shareholders to benefit from any breakthrough, while avoiding the risks associated with pure-play stocks. This approach may appeal to investors who want quantum exposure, but prefer a lower-risk path.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices