The Stock Market and the US Economy: Good is Bad Again?

The Stock Market and the US Economy: Good is Bad Again?

By:Ilya Spivak

Stock markets may sour if this week’s US economic data casts doubt on Fed rate cut speculation.

- US retail sales may top forecasts after strong consumer confidence figures

- Markets hope January’s US jobs report will support Fed rate cut speculation

- CPI inflation data may spook traders even as the impact from tariffs fades

Blistering seesaw volatility left stock markets without a convincing lead last week. The bellwether S&P 500 stock index closed with a loss of 0.2% having been down 3.1% and up 0.9% at various points along the way. The tech-tilted Nasdaq 100 fared worse but still managed to trim its loss to 2.1% from as much as 5.6% near the weekly lows.

Defensive price action was also on display across other key markets. US Treasury bonds inched up as rates ticked lower across the yield curve. Crude oil pared earlier gains, retracing 3.5% lower after jumping 7.3% in the prior week. Meanwhile gold prices returned on offense, adding 1.7%. Bitcoin plunged 16.5%. The US dollar tiptoed cautiously higher.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

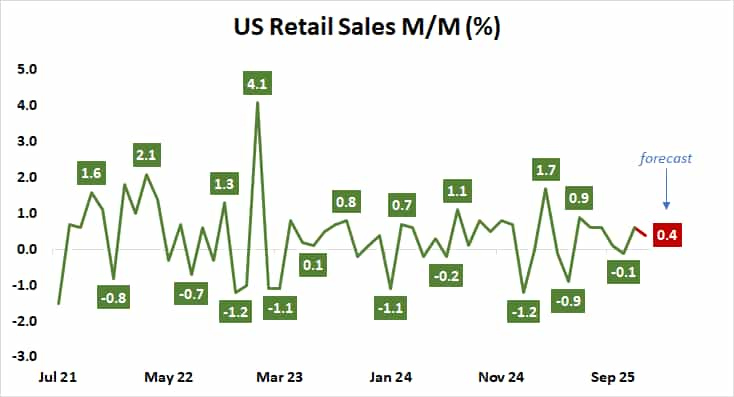

US retail sales data

Consumers dialed back spending a bit in December, according to expectations for that month’s retail sales report. It is projected to show that receipts added 0.4%, marking a modest downshift from the 0.6% rise in November. The numbers follow last week’s University of Michigan (UofM) data pointing to consumer confidence at a six-month high.

Private consumption is the dominant driver of the US economy, accounting for nearly 70% of gross domestic product (GDP) growth. If consumers’ seemingly chipper mood translates into stronger sales than expected, the markets may question once again whether the Federal Reserve can cut interest rates as quickly and as much as they want.

Traders are pricing in 55 basis points (bps) in cuts this year, implying two 25bps cuts are firmly on the menu. They are expected in June and September. Fed officials have only signaled one cut for 2026, and Fed Chair Powell has pushed back on dovish speculation. The S&P 500 has been stuck in a choppy range since he chastised markets in October.

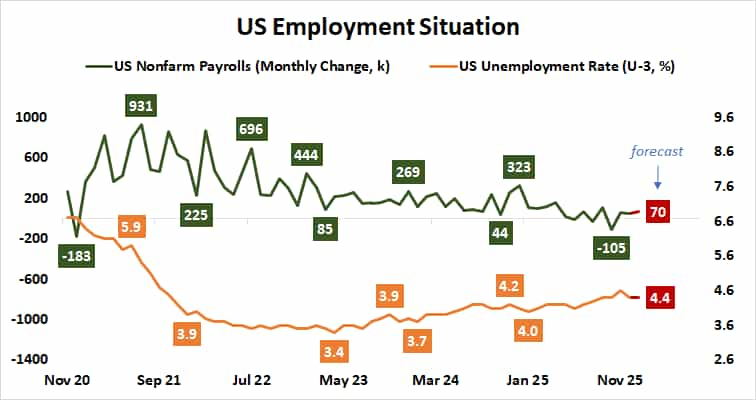

US labor market data

This will set the stage for the belated release of January’s employment report. A rise of 70,000 in nonfarm payrolls is expected, while the unemployment rate is seen holding unchanged at 4.4%. That would amount to a slight pickup in jobs creation from December, which recorded a payrolls rise of 50,000.

A slew of sour labor market indicators spooked investors last week. Separate reports showed that job openings fell more while planned layoffs were larger than anticipated. Meanwhile, the four-week trend in initial jobless claims turned sharply higher, pointing to a steep pickup in applications for benefits.

This seems to have primed the markets for soft results when official jobs data appears. If that proves right and yet consumption still holds up, conflicting forces pitting the Fed’s employment and inflation goals against each other may leave policymakers paralyzed. For the markets, that may look like another disappointing rate cut delay.

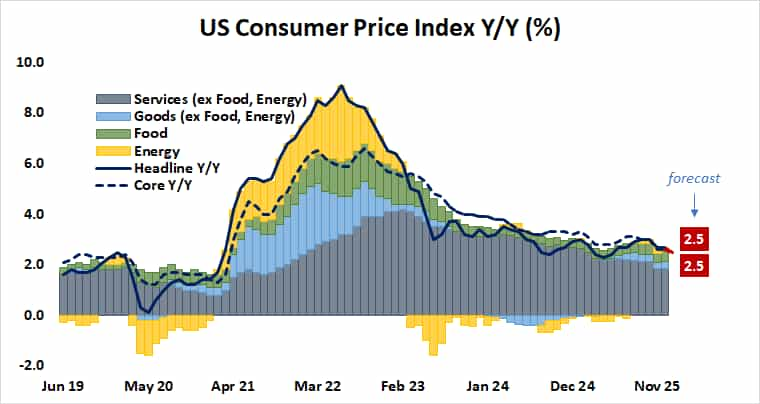

US consumer price index (CPI) data

Moreover, it seems plausible that jobs data might yet surprise on the upside. US economic news-flow has mostly outperformed relative to forecasts since the start of the year, according to analytics from Citigroup. That would make for an ominous lead in for January’s CPI inflation figures, due at the end of the week.

Headline price growth is expected to cool to 2.5% year-on-year, marking an eight-month low. A matching outcome for the core CPI measure excluding volatile food and energy prices – where Fed officials tend to focus – would amount to the slowest increase since March 2021, before the inflationary surge following the COVID-19 pandemic.

The Fed is betting that slower growth in services prices and the fading impact of tariffs on goods inflation calculations will bring their 2% target into view, paving the way for rate cuts. If consumers keep spending despite a limping labor market, the first part may prove wrong even if the second one does not. The markets probably won’t like that.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices