The Top 5 Macro Events This Week: June 11-16, 2023

The Top 5 Macro Events This Week: June 11-16, 2023

Market Key Takeaways

The May US CPI report on Tuesday may help break up the pre-FOMC slog that typically defines the 48-hours ahead of the rate decision.

Volatility across asset classes, particularly from Wednesday onward, will likely be elevated amid the flurry of central bank rate decisions.

Interest rate and foreign currency futures could see more action (relatively speaking) than their equity peers in the coming days.

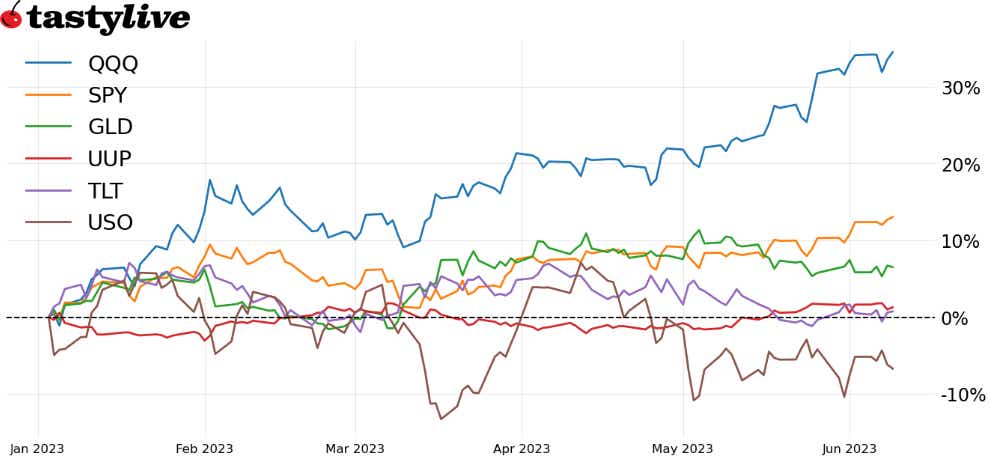

Fig. 1: Month-to-date price percent change chart for SPY, QQQ, TLT, UUP, GLD, and USO

A Busier Week as June Rolls On

After a relatively quiet week on the macroeconomic calendar – the Bank of Canada and the Reserve Bank of Australia rate decisions stood alone – the coming days will see attention shift back to the United States is a significant way.

The May US inflation report on Tuesday will serve as an appetizer for the June FOMC meeting on Wednesday, which is to say that the first half of the week will likely be quieter but for a flash in the pan binary event. Once the event horizon of the Federal Reserve is crossed, all assets – equities, bonds, precious metals, etc. – should wake up meaningfully.

On the other side of the June FOMC meeting, both the Bank of Japan and European Central Bank rate decisions on Thursday have a chance to introduce additional volatility in the interest rates and foreign currency spaces.

Top 5 Macro Events

1) May US Consumer Price Index (CPI): Tuesday, June 13 @ 8:30am EST/7:30am CST

This measures the change in the prices of a basket of goods and services purchased by consumers. A higher than expected CPI may signal rising inflationary pressures and lead to higher interest rates, while a lower than expected CPI may indicate weak demand and lower inflation. Of note: rates markets are now discounting a 67% chance of a 25-bps rate hike in July by the Federal Reserve. The consensus forecast is +0.2% m/m and +4.1% y/y, while the core readings are due in at +0.4% m/m and +5.1% y/y.

What to Watch: SPY, /ES, QQQ, /NQ, TLT, /ZT, /ZN, GLD, /GC, UUP, /6J

2) June Federal Reserve Rate Decision: Wednesday, June 14 @ 2pm EST/1pm CST

The June FOMC meeting will bring about the latest decision on the level of the federal funds rate, the interest rate that banks charge each other for overnight loans. The Fed's policy stance influences the availability and cost of credit in the economy, which has proved surprisingly resilient in recent months. Accordingly, a more optimistic Summary of Economic Projections (SEP) is likely, which could help lay the groundwork for additional rate hikes later this year. There will be a press conference by Fed Chairman Powell 30-minutes after the SEP and policy statement are released.

What to Watch: SPY, /ES, QQQ, /NQ, TLT, /ZT, /ZN, GLD, /GC, UUP, /6J

3) June European Central Bank Rate Decision: Thursday, June 15 @ 8:15am EST/7:15am CST

The ECB is facing an increasingly difficult situation, whereby growth rates and economic activity appear to be slowing as inflationary pressures remain stubbornly higher. Stagflation is a clear and present danger, which is why markets don’t necessarily believe the projected course of action will lead to more prosperity for the Eurozone. Rates markets are discounting 25-bps rate hikes in June and July, with no hikes or cuts for the remainder of 2023 thereafter. Contextually, any hint of dovish hues in the comments by ECB President Lagarde could serve to undercut the Euro.

What to Watch: UUP, /6E

4) May US Retail Sales: Thursday, June 15 @ 8:30am EST/7:30am CST

This report measures the change in the total value of sales at the retail level, making it a major indicator of consumer spending and economic activity, as consumer spending accounts for about 70% of US GDP. A higher than expected retail sales may signal strong consumer confidence and demand and lead to higher GDP growth, while a lower than expected retail sales may indicate weak consumer confidence and demand and lead to lower GDP growth. The consensus forecast is -0.1% m/m and +0.1% m/m for sales excluding autos.

What to Watch: SPY, /ES, TLT, /ZN, IWM, /RTY

5) June Bank of Japan Rate Decision: Thursday, June 15 @ 11:30pm EST/10:30pm CST

Under recently appointed Governor Ueda, the BOJ has both surprised and not surprised markets. On one hand, the decision to review the longstanding Yield Curve Control (YCC) policy has introduced periods of heightened volatility to the Japanese Yen. On the other, facing secular deflation, the continuation of the Kuroda-era BOJ’s policies was largely anticipated. But the BOJ often packs the most punch when few are expecting any sort of shift in policy; given the backdrop of the BOC, RBA, and ECB raising rates ahead of it – and the Fed likely signaling its intent to hike more in the future – it seems like the BOJ will be under the microscope, which caters to the diminished possibility of a surprise shift in policy. The BOJ will likely be the least impactful central bank rate decision of June.

What to Watch: UUP, /6J

It’s Monday somewhere! First Call starts at 5:55 EST/4:55 CST on Sundays. Join us on the homepage of tastylive.com, or directly from the tastytrade platform.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices