These 10 Stocks Could Have Big Moves in July

These 10 Stocks Could Have Big Moves in July

This seasoned options trader shares the stocks on his short list for July's earnings releases.

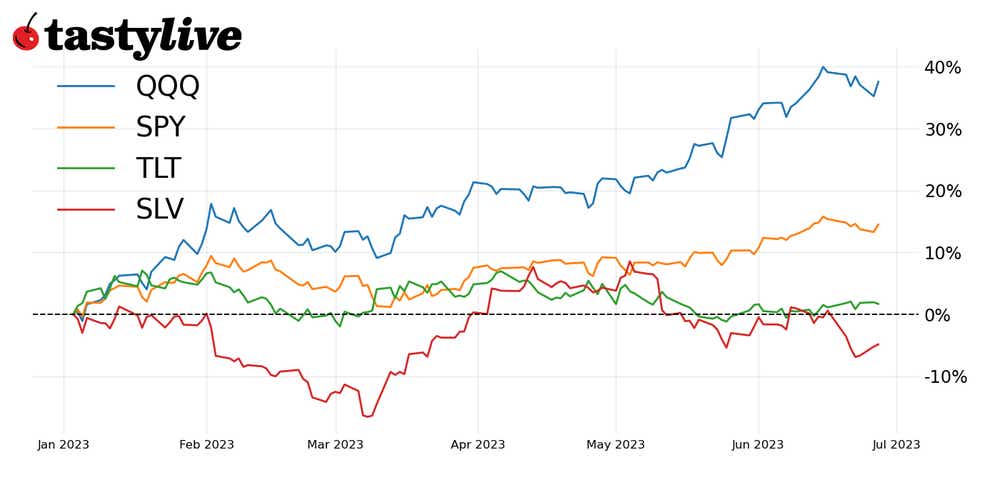

- S&P 500 hit new highs but retreated; constructive price action could lead to new highs again.

- Volatility is slightly above lows; opportunities still exist to sell premium in low IV conditions.

- Selling premium around earnings dates can be profitable but unpredictable; defined risk positions during earnings events is recommended.

The S&P 500 pushed to new highs for the year at the end of last week. Price has since retreated more than 200 points. Constructive price action from here could push us to new year-to-date highs. A major support level below sits around 4,325.

With the VIX around 15.5, volatility sits just above year-to-date lows. While we do prefer to trade in environments where volatility is spiking, it is still possible to find opportunities to sell premium in relatively low IV conditions.

One strategy we can look at is selling premium around earnings dates. As earnings dates draw closer, we can sometimes observe a rise in volatility and IV rank. This creates an opportunity to sell premium. However, earnings events are binary and generally difficult to predict in terms of price direction. For that reason, it is recommended to define your risk through earnings events.

Top 10 stocks to watch in July 2023*

- DAL (7/13)

- SCHW (7/17)

- BAC (7/18 )

- MS (7/18)

- HAL (7/19)

- FCX (7/20)

- SLB (7/21)

- GM (7/25)

- GE (7/25)

- BA (7/26)

* For each security listed above, earnings will be released before the opening on the date indicated.

1) Delta Air Lines (DAL)

Delta Air Lines, one of the major airlines of the United States, offers passenger and cargo transportations to more than 300 destinations in over 50 countries. It also provides aircraft maintenance, repair and overhaul through its subsidiary, Delta TechOps.

DAL is trading at $46.09, up 38.62% from its opening price of 2023. The IV rank on the tasty platform is 6.8, and the implied volatility in the next two monthly contracts is above 30. DAL has reported positive net income in three of the last five quarterly reports.

IV rank is low here but there is juice in the monthly contracts and liquidity is decent. It is probably best to leave this alone until earnings in a couple of weeks, but we could see a spike in IV rank as the date draws closer. DAL could present itself as a good opportunity for small undefined risk positions or wide spreads.

2) The Charles Schwab Corp. (SCHW)

Charles Schwab, a provider of financial services, offers a broad range of investment products, technology, brokerage, banking, asset management, custody and financial advisory services. It serves individual investors, independent investment advisors, retirement plan participants and institutional investors.

SCHW is trading at $55.22, down 33.92% from its opening price of 2023. The IV rank on the tasty platform is 10.3, and the implied volatility in the next two monthly contracts is around 40. SCHW has reported positive net income in all of its last five quarterly reports.

Three bank stocks are on this list, so choose as you will. SCHW has decent liquidity, and markets are fairly tight in the monthly contracts. Earnings plays are an opportunity here. Strangles or wide directional spreads will set up well. Look for a spike in IV rank for an earnings play.

3) Bank of America (BAC)

Bank of America, one of the world's largest financial institutions, offers a wide array of banking, investing, asset management, and other financial and risk management products and services. It serves individual consumers, small- and middle-market businesses, large corporations and governments.

BAC is trading at $28.24, down 14.97% from its opening price of 2023. The IV rank on the tasty platform is 15.4, and the Implied Volatility in the next two monthly contracts is just above 30. BAC has reported positive net income in all of its last five quarterly reports.

Continue to remain cautious trading bank stocks but, if the opportunity presents itself through earnings, a small position may be worth the capital. A small out-of-the money or at-the-money spread can set up well into earnings.

4) Morgan Stanley (MS)

Morgan Stanley, a global financial services firm, offers a wide variety of products and services, including securities, investment management, wealth management and investment banking services. It serves a diverse group of clients, including corporations, governments, financial institutions and individuals.

MS is trading at $84.43, down 1.41% from its opening price of 2023. The IV rank on the tasty platform is 16.1, and the Implied Volatility in the next two monthly contracts is around 27. MS has reported positive net income in all of its last five quarterly reports.

The last bank stock on this list currently has the highest IV rank of the three. As we move farther into July, we may see a rise in IV rank as the earnings date approaches. If the opportunity presents itself, the July and August contracts are liquid enough to facilitate almost any options play on any assumption you have for the underlying.

5) Halliburton (HAL)

Halliburton, an American multinational corporation and one of the world's largest oil field service companies, operates in more than 70 countries. Its core business segment, the Energy Services Group, provides technical products and services for petroleum and natural gas exploration and production.

HAL is currently trading at $32.42, down 16.79% from its opening price of 2023. The current IV rank on the tasty platform is 12.4 and the Implied Volatility in the next two monthly contracts is just over 40. HAL has reported positive net income in all five of its last five quarterly reports.

HAL has decent liquidity and tight markets in the July and August contracts. HAL is an opportunity for a Strangle in smaller accounts. Just remember that lower price stocks have a way of getting away from you. So, manage a short Strangle in HAL early. Directional spreads will also set up well.

6) Freeport-McMoRan (FCX)

Freeport-McMoRan, a leading international mining company, specializes in the exploration, mining and production of mineral resources. Its main products are copper, gold, molybdenum, cobalt, oil and gas.

FCX is trading at $40.41, up 6.48% from its opening price of 2023. The IV rank on the tasty platform is 12.5, and the implied volatility in the next two monthly contracts is above 39. HAL has reported positive net income in all of its last five quarterly reports.

FCX has very good liquidity, and markets are tight in July and August contracts. Look for a pop in IV rank as earnings near in July if you’d like an earnings play. Otherwise, look to put on a position just after earnings. Small short strangles and spreads will set up well.

7) Schlumberger (SLB)

Schlumberger, the world's leading oilfield services provider, supplies technology, information solutions and integrated project management to optimize reservoir performance for the oil and gas industry. Its services include seismic acquisition and processing, drilling, reservoir characterization, cementing, well completion and production optimization.

SLB is trading at $48.14, down 8.93% from its opening price of 2023. The IV rank on the tasty platform is 10.0, and the implied volatility in the next two monthly contracts is above 37. SLB has reported positive net income in all of its last five quarterly reports.

SLB has decent liquidity, and the markets in August are four or five pennies wide out of the money. A twenty-delta short strangle in August is appealing. However, if you’re looking for an earnings play, wait for a rise in IV rank as the earnings data approaches.

8) General Motors (GM)

General Motors, a global automotive company, designs, manufactures and sells cars, trucks, crossovers and automobile parts. The company also provides automotive financing through its General Motors Financial Company subsidiary.

GM is trading at $37.48, up 10.19% from its opening price of 2023. The IV rank on the tasty platform is 11.4, and the implied volatility in the next two monthly contracts is above 30. GM has reported positive net income in all of its last five quarterly reports.

GM had very good liquidity, and markets are tight in August’s contract. Right now, a twenty-delta short strangle in August sets up well. Turn that strangle into a short three-dollar wide iron condor if you’d like to define your risk.

9) General Electric (GE)

General Electric, a multinational conglomerate, operates in sectors like aviation, power, renewable energy, healthcare and capital services. The company designs, manufactures and sells a wide range of products, including jet engines, generators, wind turbines and medical imaging equipment.

GE is trading at $104.92, up 59.97% from its opening price of 2023. The current IV rank on the tasty platform is 17, and the implied volatility in the next two monthly contracts is 24.6 and 29.1. GE has reported positive net income in two of its last five quarterly reports.

The options market in August is 5 cents to 10 cents wide out of the money and liquidity is decent. The 19-delta short strangle in August provides a decent premium to buying power ratio. Turn this short strangle position into a short iron condor position if you’d like to define your risk.

10) Boeing (BA)

Boeing, one of the largest aerospace manufacturers in the world, designs and manufactures airplanes, rotorcraft, rockets, satellites, telecommunications equipment and missiles. The company also provides leasing and product support services to customers worldwide.

BA is currently trading at $209.43, up 8.54% from its opening price of 2023. The current IV rank on the tasty platform is 9.9, and the implied volatility in the next two monthly contracts is above 28. The company has reported positive net income in one of its last five quarterly reports.

Wait for an IV rank pop before taking a position in BA. It may occur as we approach its earnings date at the end of July. If it does, a five- or ten-dollar wide directional spread will set up well. Undefined risk trades in BA are recommended only for larger accounts.

Ryan Sullivan works at tastylive on the master control team as an operator and producer for live shows and pre-produced content. He is an active options and forex trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.