Top 10 Stocks to Watch: August 2023

Top 10 Stocks to Watch: August 2023

Our list of hot summer stocks includes ecommerce, auto, gambling, entertainment, retail and AI

- S&P 500 E-Mini Futures reached a year-to-date high of about $4,600, with potential for new all-time highs if it surpasses resistance at $4,630 and $4,700.

- The $4,500 support level could be tested if the current bull run ends, possibly triggering another push toward all-time highs.

- Stock options can be beneficial after earnings reports to dodge binary volatility but exploit short-term fluctuations.

Market update: S&P 500 e-mini futures up 18% year to date

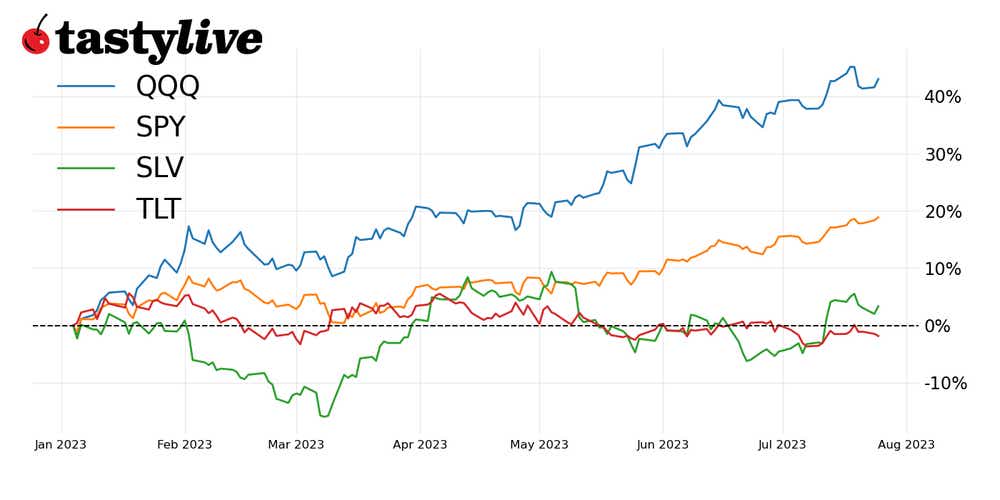

The S&P 500 e-mini futures—electronically-traded futures and options contracts on the Chicago Mercantile Exchange (CME)—pushed to new year-to-date highs this month on July 12. Since then, we have continued higher to $4,600. We are currently retesting this year-to-date (YTD) high. As I type, the S&P is ticking into $4,600. The next key resistance level above current price action is around $4,630, and the next stop after that is around $4,700.

If price action breaks through $4,630 with force, look for bulls to target $4,700. If that happens as we roll into August, and we do tag $4,700, it would not be too surprising if we try to push to new all-time highs in the S&P 500.

It is also possible that this is the last leg up for the current bull run that started at the end of May this year. If that is the case, the next thing the bears are going to want to test is the $4,500 level support. If $4,500 support holds, we could then see a push to all-time highs anyway.

If the market doesn’t want to record an all-time high yet, it is likely that price action bounces around $4,500 looking for either buyers or sellers to take control.

A quick note on the stock picks in this article; you can put on an options position right after an earnings report, so that you can avoid the binary volatility event but still take advantage of short-term volatility.

Top 10 stocks to watch in August 2023

- UBER – 8/1 - Before the Open

- AMD – 8/1 - After the Close

- PYPL - 8/2 - After the Close

- SHOP – 8/2 - After the Close

- AMZN – 8/3 - After the Close

- DKNG – 8/3 - After the Close

- RIVN - 8/8 - After the Close

- DIS – 8/9 - After the Close

- TGT - 8/16 - Before the Open

- NVDA – 8/23 - After the Close

1) Uber Technologies

Uber (UBER), a multinational ride-hailing company, disrupted traditional taxi services. Beyond transportation, Uber has diversified into new verticals like food delivery with Uber Eats and freight logistics with Uber Freight. It operates in numerous cities globally and primarily makes money by taking a commission from each ride or delivery.

Uber stock is trading at $47.28, an 86.34% increase from its 2023 opening price of $25.37. The current implied volatility rank (IVR) on the tastytrade platform is 34.5, with the implied volatility (IV) in the next two monthly contracts above 47. Uber has reported positive net income in one of the last five quarterly reports.

Uber’s options market in August and September contracts is a couple pennies wide and offers a field to craft almost any assumption you might have. The product is small enough for a strangle position in smaller accounts. Iron Condors and spreads will also set up well. August and September contracts can be used for earnings plays. It may be helpful to play earnings in August and roll out to September if you need to.

2) Advanced Micro Devices

Advanced Micro Devices (AMD), a leading global semiconductor company, designs and builds processors and graphic cards for computers and professional systems. AMD is known for its consumer- and professional-grade CPUs (central processing units) under the Ryzen, Threadripper and EPYC brands, as well as Radeon GPUs (graphic processing units). The company competes directly with Intel (INTC) in the CPU market and Nvidia (NVDA) in the GPU market.

AMD is trading at $112.36, up 70.25% from its opening price of $66.00 in 2023. The IVR on the tastytrade platform is 45.4, with IV in the next two monthly contracts above 49. AMD has reported positive net income in four of the last five quarterly reports.

This options market in August and September is pennies wide and offers the opportunity to form almost any options position you’d like to put on. Five- and 10-dollar wide iron condors and spreads set up well. Make your earnings play in August and roll out to September if you need to.

3) PayPal Holdings

PayPal (PYPL), an American company operating a worldwide online payments system, supports online money transfers. PayPal serves as an electronic alternative to traditional paper methods like checks and money orders, enabling users to make payments or hold funds in 25 currencies. The company also offers services like credit product offerings and has business solutions that help merchants collect payments.

PayPal is trading at $73.42, a -0.37% change from its 2023 opening price of $73.69. The IVR on the tastytrade platform is 25.3, and the IV in the next two monthly contracts is above 42. Paypal has reported positive net income in four of the last five quarterly reports.

Paypal’s options market in August and September is pennies wide. An eighteen-delta short Strangle sets up well in August and September with a decent premium to buying power requirement ratio. Short thirty-delta Spreads also set up well if you have a directional assumption.

4) Shopify

Shopify (SHOP), a Canadian e-commerce company, provides a platform for businesses to create their own online stores. Shopify offers tools for managing products, inventory, payments and shipping, which are used by businesses of all sizes. Shopify's platform is subscription-based, and it also generates revenue from its payment processing system, Shopify Payments, as well as other merchant solutions.

Shopify is trading at $65.26, up 82.9% from its opening price of $35.68 in 2023. The IVR on the tastytrade platform is 32.6, with the IV in the next two monthly contracts above 58. Moreover, SHOP has reported positive net income in one of the last five quarterly reports.

Short 17-delta Strangles set up well in August and September, with a good premium collected to buying power required ratio. Iron condors and spreads will also set up well if you’d like to define your risk going into an earnings play.

5) Amazon

Amazon (AMZN), an American multinational technology company that started as an online marketplace for books, but has expanded to a wide variety of products and services. It is known for its disruption of well-established industries through technological innovation and mass scale. It is now the world's largest online marketplace, AI assistant provider, live-streaming platform and cloud computing platform, with various other operations in areas like digital streaming, brick-and-mortar retailing and more.

Amazon is trading at $129.10, reflecting a 51.06% increase from its opening price in 2023. The IVR on the tastytrade platform is 30.3, and the IV in the next two monthly contracts is above 38. Amazon has reported positive net income in three of the last five quarterly reports.

Amazon’s options market is very liquid and pennies wide in August and September. A liquid market like Amazon's offers the opportunity to craft almost any type of options position you’d like create. Calendar spreads are available if you’d like to take advantage of the difference in volatility between monthly contracts. Strangles, iron condors and spreads also set up well.

6) DraftKings

DraftKings (DKNG), a digital sports entertainment and gaming company, provides daily fantasy sports, sports betting and iGaming. DraftKings enables users to enter daily and weekly contests and win money based on individual player and team performances in five major American sports, Premier League and UEFA Champions League soccer, NASCAR auto racing, Canadian Football League, mixed martial arts, and tennis.

DraftKings is trading at $31.50, marking a significant increase of 170.15% from its 2023 opening price of $11.66. The IVR on the tastytrade platform is 28.2, while the IV in the next two monthly contracts stands above 60. However, DKNG has not reported positive net income in any of its last five quarterly reports.

DKNG is a small enough product and has liquid enough markets for smaller accounts to consider an undefined risk position. However, be cautious because smaller underlyings tend to make bigger moves when they get going. At-the-money spreads also set up well for directional assumptions.

7) Rivian Automotive

Rivian Automotive (RIVN), an American electric vehicle automaker and automotive technology company, has gained significant attention for its clean, futuristic designs. It creates electric trucks and SUVs, with models like the R1T pickup and R1S SUV. Rivian also has a contract with Amazon to produce 100,000 electric delivery vans.

Rivian is trading at $26.20, up 38.62% from its opening price of $18.90 in 2023. The IVR on the tastytrade platform is 41.9, with IV in the next two monthly contracts above 84. Rivian has not reported positive net income in any of the last five quarterly reports.

Rivian is a small enough product and has liquid enough markets for smaller accounts to consider an undefined risk position, but defining your risk in this production is probably a smart move. Again, smaller underlyings tend to make bigger moves when they get going, and Rivian is primed for big directional moves in the current market environment. At-the-money spreads also set up well for directional assumptions.

8) Walt Disney

Disney (DIS), a global entertainment conglomerate, is known for its film studio division, the Walt Disney Studios, which includes Walt Disney Pictures, Pixar, Marvel Studios, Lucasfilm, 20th Century Studios and Searchlight Pictures. Disney's other main divisions are media networks, such as ABC and ESPN, theme parks and resorts, streaming services like Disney+, Hulu, and ESPN+, and consumer products and interactive media.

Disney is priced at $86.19, a -3.14% change from its 2023 opening price of $88.98. The IVR on the tastytrade platform is 38.9, with IV in the next two monthly contracts above 33. Moreover, DIS has reported positive net income in its last five quarterly reports.

Disney has a tight and liquid options market in August and September. A short 25 delta iron condor sets up well in September’s contract. The short Strangle in premium collected to buying power used ratio in August and September is a little low for me. At-the-money directional spreads set up well, too.

9) Target

Target (TGT), the eighth-largest retailer in the United States, provides a wide array of products, including clothing, furniture, food and more. Target operates large department store-like establishments as well as an online platform, offering both general merchandise and food.

Target is priced at $134.17, a decline of 10.54% from its 2023 opening price of $149.98. The stock has an IVR of 48.3, with the IV in the next two monthly contracts above 35. TGT has an impressive track record, with all five of its latest earnings reports showing positive net income.

TGT’s options market in August and September contracts is very liquid and about five pennies wide. A short 18-delta strangle and five-dollar wide iron condor sets up well in August and September contracts. However, by the time Aug.16 rolls around for TGT earnings, the August contract will likely be too short term for an options play, unless you’re interested in a purely binary trade. If that is the case, I would define your risk.

10) Nvidia

Nvidia (NVDA) is an American multinational technology company known for its graphics processing units (GPUs) for gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive markets. Nvidia's GPUs are used in a wide range of applications, including video games, film production and artificial intelligence. The company is also considered a major player in the race to develop AI platforms for the automotive industry.

Nvidia stock is trading at $459.05, up 220.68% from its opening price of $143.15 in 2023. The IVR on the tastytrade platform is 57.5, with the IV in the next two monthly contracts above 45. Nvidia has reported positive net income in the last five quarterly reports.

Nvidia's options market in August and September are very liquid and tight. Nvidia is a relatively expensive product to trade, and that is true for its options as well. Defined risk strategies are likely the best option for most account sizes. By the time Aug. 23 arrives, Nvidia's August contracts will have already expired. That means you’ll need to do your earnings plays in September’s contracts. Short 17-delta iron condors set up well in September. Short twenty-two-delta spreads also set up well.

Ryan Sullivan works on the master tastylive control team as an operator and producer for live shows and pre-produced content. He is an active options and forex trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.