Top 10 Stocks to Watch: November 2023

Top 10 Stocks to Watch: November 2023

From PayPal to Nvidia, 10 essential tickers for your November watch list

- The $4,243 and $4,175 levels were targeted and surpassed amid selling pressure, and interest among buyers is being gauged.

- A notable support level is identified at $4,100, which may attract buyers if the selling pressure persists through the end of October.

- The S&P 500 E-Mini Future has seen a 10.29% decrease from its year-to-date highs, reflecting the ongoing market downturn.

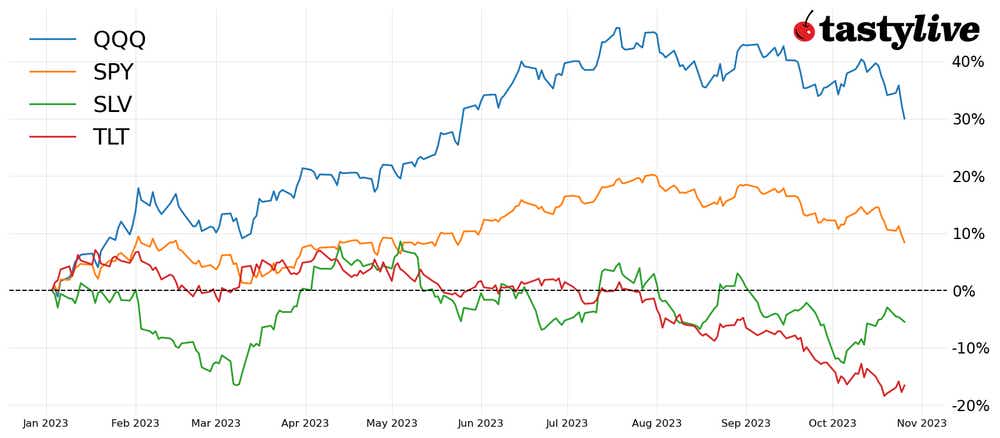

S&P500 e-mini futures up 6.69% for the year to date

Last month we discussed sellers looking to target the $4,243 level if selling pressure continues. We’ve experienced that level twice in October, so far. Once in the first week of the month and again this week. We have since pushed through that level and through $4,175, continuing to look for buyers.

$4100 is a significant support level below current price action. If selling pressure continues through the end of October, we will likely see buyers step in around the $4100 level. It’s possible that we rush through that support band, too. We are currently down 10.29% from year-to-date highs in the S&P500 E-Mini Future.

The implied volatility rank, or IVR, and monthly IV calculation for this article is referenced from the tastytrade trading platform. The equities selected for this list have tight and liquid options markets at the time of writing. Execute trades for opportunities that fit your trading style and account size. Timing is important for successful trading strategies.

Earnings trades can be executed the day before or the day of the earnings event. However, earnings trades can also be placed days or weeks before an earnings report, which could lead to early profit taking before earnings are reported. Evaluate each trade in a way that allows you to execute the strategy you choose.

For many of these trades, you have the option of staring the position in November options contracts. That gives you the opportunity to roll the position out to December options contracts after the earnings event if you need to defend the position by collecting more time and premium.

Top 10 stocks to watch in November 2023

- PayPal (PYPL) – 11/1 – Earnings release after the close

- Roku (ROKU) – 11/1 - After the close

- Qualcomm (QCOM) – 11/1 - After the close

- Apple (AAPL) – 11/2 - After the close

- Uber Technologies (UBER) –11/7 - Before the open

- Walt Disney (DIS) – 11/8 - After the close

- Unity Software (U) – 11/9 - After the close

- The Trade Desk (TTD) – 11/9 - After the close

- Applied Materials (AMAT) 11/16 - After the close

- Nvidia (NVDA) – 11/16 - After the close

1. PayPal Holdings

PayPal (PYPL), a global leader in digital payments, offers solutions for individual consumers and businesses. The company revolutionized online payments by providing a secure and convenient way to transfer money online. It operates a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods.

PYPL is trading at $52.18, down 29.19% from its 2023 opening price of $73.69. The current Implied Volatility Rank (IVR) on the tastytrade platform is 53.12. The Implied Volatility (IV) in November's contract is 63.1, and December's contract is 51.2. PYPL has reported positive net income in four of its last five quarterly reports.

The stock is cheap enough that investors could consider undefined risk positions. A 19-delta short strangle sets up well with a decent credit received to the buying power used. Almost any other options strategy can be set up well in the monthly contracts.

2. Roku

As a pioneer in streaming entertainment, Roku (ROKU) is known for devices and a platform that deliver a range of content. The company provides a user-friendly interface that aggregates content from various streaming services. Roku also offers its own Roku Channel, featuring free and premium content.

ROKU is currently trading at $57.22, up 37.28% from its opening price of 2023 at $41.68. The current Implied Volatility Rank (IVR) on the tastytrade platform is 39.8. The Implied Volatility (IV) in November's contract is 90.5, and December's contract is 74.8. ROKU has reported positive net income in zero of its last five quarterly reports.

ROKU is cheap enough to consider undefined risk positions. A one standard deviation short strangle sets up well with a decent credit received to buying power used. Almost any other options strategy can be set up well in the monthly contracts.

3. Qualcomm

Qualcomm (QCOM), a semiconductor and telecommunications equipment company, designs and markets wireless telecommunications products and services. The company is known for its innovations in 3G, 4G and 5G wireless technology. Qualcomm's chips and patents are essential to smartphones and numerous other connected devices.

QCOM is trading at $106.18, down 4.64% from its opening price of 2023 at $111.35. The current Implied Volatility Rank (IVR) on the tastytrade platform is 56.7. The Implied Volatility (IV) in November's contract is 48.6, and December's contract is 41.8. QCOM has reported positive net income in all of its last five quarterly reports.

This stock is slightly more expensive than the previous two symbols on this list. Iron condors will set up well with as much risk as you’d like to take by widening the strikes for each leg. Consider short credit spreads if you’d like to be directional.

4. Apple

A multinational technology company, Apple (AAPL) is known for innovative consumer electronics, software and online services. The company’s products, like the iPhone, iPad and Mac computers, have had a significant influence in the tech industry. It also offers services like the App Store, Apple Music and iCloud.

AAPL is trading at $167.34, up 28.45% from its opening price of 2023 at $130.28. The current Implied Volatility Rank (IVR) on the tastytrade platform is 48.3. The Implied Volatility (IV) in November's contract is 34.6, and December's contract is 30.4. AAPL has reported positive net income in all of its last five quarterly reports.

AAPL is in a similar situation to ROKU. Consider defined risk positions for earnings trades in AAPL. The volatility in November and December contracts is very close, so calendarized spreads may or may not work out, depending on the strategy you want to execute.

5. Uber Technologies

Uber (UBER) is a technology company offering platforms for ride-hailing, food delivery and freight shipping. The company transformed urban mobility by making it easy to book a ride or a meal with a few taps on a smartphone. Uber continues to expand its services and geographic reach in the transportation and delivery industries.

UBER is trading at $40.74, up 60.65% from its opening price of 2023 at $25.36. The current Implied Volatility Rank (IVR) on the tastytrade platform is 54.6. The Implied Volatility (IV) in November's contract is 61.3, and December's contract is 52.4. UBER has reported positive net income in two of its last five quarterly reports.

UBER is cheap enough to consider undefined risk positions. A 19-delta short strangle sets up well with a decent credit received to buying power used. Almost any other options strategy can be set up well in the monthly contracts.

6. Disney

The Walt Disney Company (DIS), a diversified multinational entertainment and media conglomerate, operates film studios, theme parks and media networks, Disney is a household name in family entertainment. The company also made significant strides in digital media with the launch of its streaming service, Disney+.

DIS is trading at $88.97, down 10.06% from its opening price of 2023 at $80.02. The current Implied Volatility Rank (IVR) on the tastytrade platform is 48.5. The Implied Volatility (IV) in November's contract is 41.9, and December's contract is 36.4. DIS has reported positive net income in four of its last five quarterly reports.

DIS is cheap enough to consider undefined risk positions for medium-sized accounts. A 19-delta short strangle sets up well with a decent credit received to buying power used. Directional spreads may play well considering DIS has been beaten up this year and the market is down too right now.

7. Unity Software

A leading platform for creating and operating interactive, real-time 3D content, Unity Software (U) is widely used in video game development, as well as in industries like film, automotive and architecture. Unity's technology empowers creators to bring their visions to life.

U is currently trading at $25.91, down 12.76% from its opening price of 2023 at $29.70. The current Implied Volatility Rank (IVR) on the tastytrade platform is 46.7. The Implied Volatility (IV) in November's contract is 84.9, and December's contract is 67.1. U has reported positive net income in none of its last five quarterly reports.

U is cheap enough to consider undefined risk positions. A 19-delta short strangle sets up well with a decent credit received to buying power used. There is a decent difference in volatility between November and December contracts, so calendarized spreads may play well.

8. The Trade Desk

The Trade Desk (TTD), a technology company that provides a self-service platform for digital ad buyers, uses data-driven insight to optimize advertising campaigns for various formats and devices. The Trade Desk is known for its role in transforming the landscape of online advertising.

TTD is trading at $66.06, up 43.64% from its opening price of 2023 at $45.99. The current Implied Volatility Rank (IVR) on the tastytrade platform is 52.6. The Implied Volatility (IV) in November's contract is 84.3, and December's contract is 65.7. TTD has reported positive net income in four of its last five quarterly reports.

TTD is a similar situation to U. A 19-delta short strangle sets up well but with higher buying power used to credit received. There is a decent difference in volatility between November and December contracts, so calendarized spreads could play well.

9. Applied Materials

Applied Materials (AMAT) provides equipment, services and software for the manufacture of semiconductor chips. The company plays a crucial role in enabling the production of virtually every new chip and advanced display in the world. Applied Materials' technology is at the heart of the electronics revolution.

AMAT is trading at $131.29, up 31.6% from its opening price of 2023 at $99.77. The current Implied Volatility Rank (IVR) on the tastytrade platform is 58.7. The Implied Volatility (IV) in November's contract is 44.5, and December's contract is 41.6. AMAT has reported positive net income in all of its last five quarterly reports.

AMAT has a higher price compared to the other symbols on this list and requires a significant amount of buying power for undefined risk positions. For that reason, I would consider undefined risk positions only in large accounts. Iron condors and directional spreads will setup well.

10. Nvidia

Nvidia (NVDIA), a technology company offering graphics processing units (GPUs) for gaming and professional markets, has also become a major player in AI and deep learning. Nvidia's innovations extend to the automotive, healthcare and robotics sectors.

NVDA is trading at $404.41, up 172.31% from its opening price of 2023 at $148.51. The current Implied Volatility Rank (IVR) on the tastytrade platform is 75.8. The Implied Volatility (IV) in November's contract is 48.5, and December's contract is 56.3. NVDA has reported positive net income in all of its last five quarterly reports.

Earnings trades will need to be placed in December’s monthly contract because the earnings report will occur after November contracts expire. NVDA is an expensive stock, and I recommend only defined risk positions for most accounts. Almost any strategy can be set up in monthly contracts to express the type of strategy you’d like to use.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.