Top Dividend Stocks for 2024

Top Dividend Stocks for 2024

We analyze dividend stocks in five sectors, focusing on solid fundamentals and future dividend growth

- Top dividend stocks for 2024: ABBV, OXY, TXN, T and WHR.

- Dividend stocks focused on payment growth and fundamentals.

- Cross-sector dividend investing may help overall portfolio performance.

Who says dividend investing can’t be fun?

With the Federal Reserve expected to cut rates this year, it should help companies generate free cash flow, a key ingredient that allows the payout of dividends at a sustainable pace. In this article, we dive in across five sectors to analyze some top dividend picks, focused on solid fundamentals and future dividend growth.

AbbVie Inc. (health care)

AbbVie Inc. (ABBV) is one of the largest U.S. pharmaceutical companies, with its revenue among the top ten largest in the sector. The company acquired Allergan back in 2020 for $63 billion, which put the popular Botox drug into its portfolio. And while its leading product, Humira, lost patent protection recently, the company looks positioned for more growth, with several leading cancer therapeutics and new immunology drugs among its offerings.

According to Bloomberg, the projected 12-month dividend yield is 3.88%, and the projected three-year growth rate is just shy of 5%. The company goes ex-dividend on Jan. 12 for a projected $1.55 per share.

**All subsequent dividend projection data is sourced from Bloomberg**

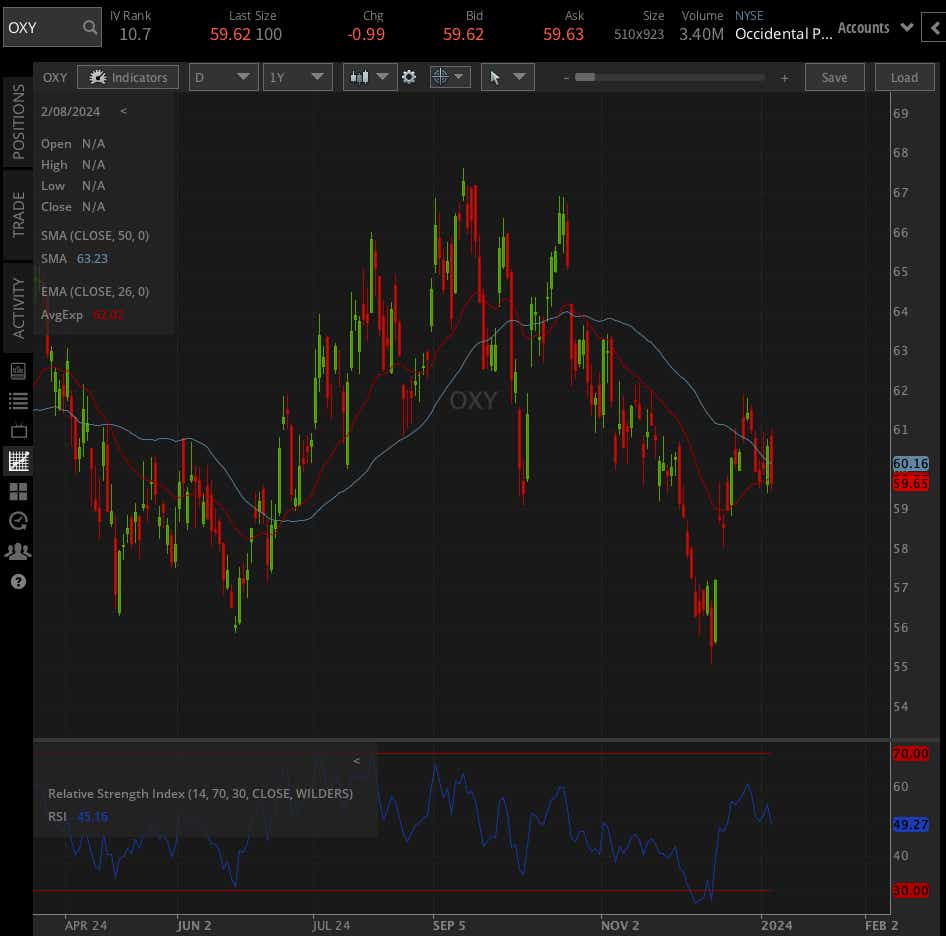

Occidental Petroleum (energy)

Analysts have grown sour on this one lately, but that isn’t unique to the stock itself as much as the energy sector in whole. But how can we not like a stock that has received a nod from Warren Buffett? And he just bought more of it through Berkshire Hathaway just last month to the tune of 10.5 million shares, according to a Securities and Exchange Commission (SEC) filing.

Crude oil prices may not skyrocket this year, but Occidental Petroleum (OXY) is positioned well for continued growth, and it just purchased CrownRock, significantly expanding its Permian Basin portfolio. The deal will generate immediate free cash flow accretion, according to OXY. Who doesn’t like more cash?

OXY’s projected 12-month dividend yield stands at 1.46%, with a projected three-year growth rate of 6.92%. That represents an acceleration in its dividend payout growth from the prior three years of -4.24%. The stock last went ex-dividend on Dec. 7 for $0.18 per share.

Sure, other energy stocks offer much more attractive yields, such as Devon Energy Corp (DVN), which yields a 12-month projection of 7.1% but you likely won’t capture growth in the stock price along with those payments.

Texas Instruments (technology)

Technology stocks usually aren’t known or invested in for their dividends, but they are out there. Texas Instruments (TXN) is one of those options. One of the top semiconductor companies by sales volume globally, TXN is a leading supplier of automotive chips and circuitry components. And with automotive sales expected to grow in 2024—according to Cox Automotive—TXN looks well positioned for a place in a dividend portfolio.

The projected 12-month dividend yield is 3.19%, and the three-year growth rate is a healthy 4.87%. Currently, the dividend is at $1.30 per share, and the stock last went ex-dividend on Oct. 30.

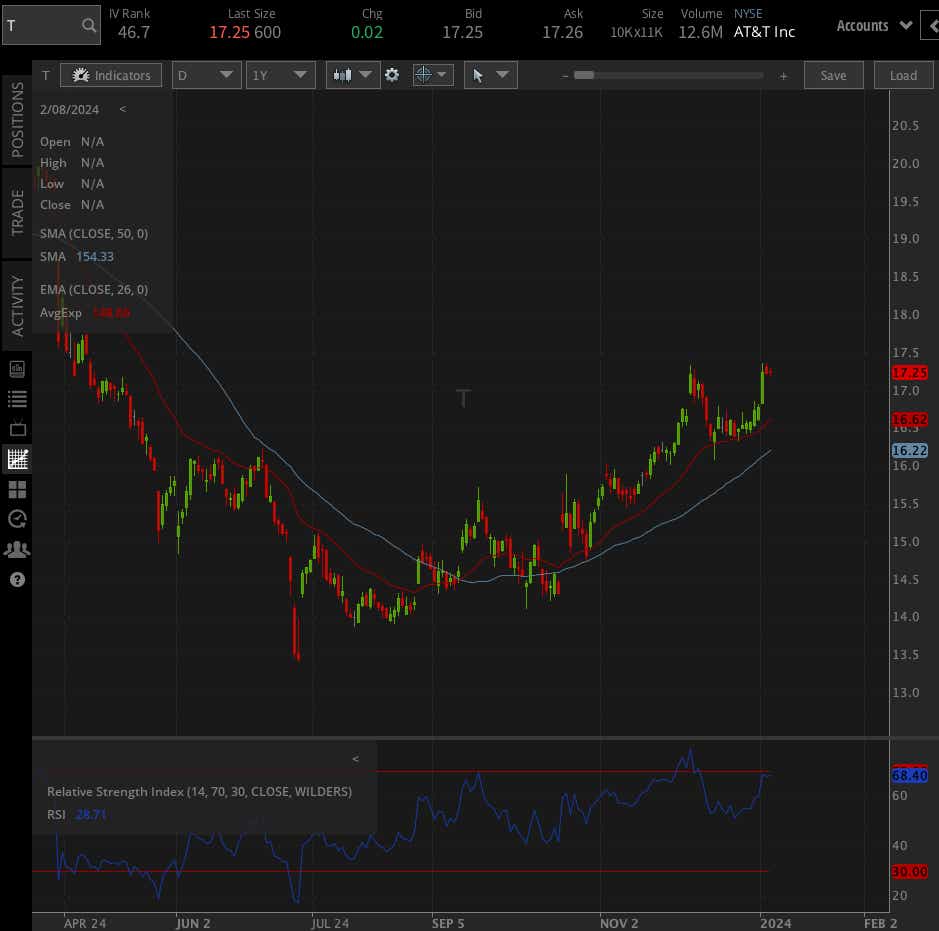

AT&T (telecommunications)

A well-known dividend darling, AT&T (T) is a telecommunications company that offers wireless voice and data services and broadband internet. The stock didn’t perform well in 2023 but it has rallied from its lows in the middle of last year. The company has also lifted its free cash flow outlook recently, which is a good sign for dividend investors who expect those payments to continue.

The dividend yield is currently near a decade-long high, and the projected 12-month yield is 6.44%. That puts it in the top-ten yielders in the S&P 500. The last payment was $0.2775, and the stock goes ex-dividend on Jan. 9.

Whirlpool (consumer discretionary)

The forecasted rate cuts in 2024 should help consumers and ease credit conditions. That should help with big-ticket purchases for things such as home appliances. This is why Whirlpool (WHR) might be a good dividend pick in 2024. The home appliance maker didn’t post the best performance last year, but it has come off its lows over the past few months

The projected 12-month dividend yield is at a more than healthy 6.09%, with a three-year projected growth rate of 2.78%. The stock last went ex-dividend on Nov. 16 at $1.75 per share. The next projected dividend is $1.8 per share.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices