Stocks Jolted as Iran Hits Israel. ISM Services Data May Be Another Headwind.

Stocks Jolted as Iran Hits Israel. ISM Services Data May Be Another Headwind.

By:Ilya Spivak

Trimming of Fed rate cut bets for 2025 may sting stocks and boost the dollar.

Financial markets scrambled as Iran fired a barrage of missiles at Israel.

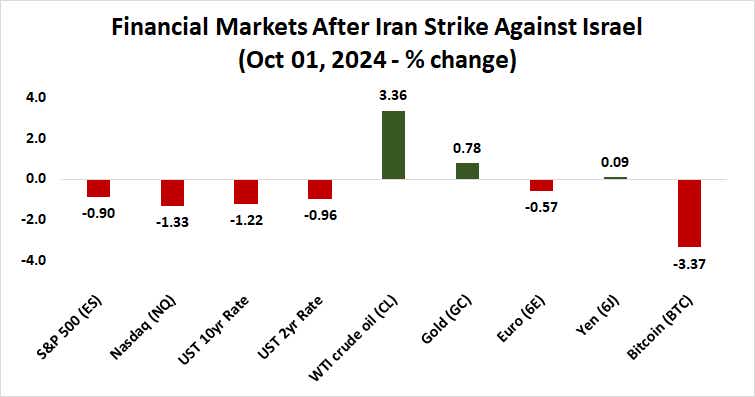

Crude oil spiked and stocks fell as haven flows lifted gold and the U.S. dollar.

Stocks may not like it if ISM services data dilutes the 2025 Fed rate cut outlook.

The markets shuddered as Iran fired hundreds of missiles at Israel. Initial reports point to about 200 ballistic weapons fired toward a broad swathe of Israeli territory, including major population centers. While videos circulating online seemed to show some isolated projectiles making landfall, the Israeli Red Cross reported no casualties after the attack.

The Islamic Republic’s Revolutionary Guard Corps (IRGC) issued a statement threatening to target Israel again if it retaliates. A spokesman for Israel’s military called the attack “serious” and said it will have consequences, adding that the response will come “at the appropriate time and place.”

Financial markets rattled as Iran fires missiles at Israel

Crude oil prices raced higher, erasing an intraday loss of nearly 3% to probe within a hair of $72 per barrel (bbl), the highest in a week. That marked a rise of more than 5.2% from the session open before the panic eased. The West Texas Intermediate (WTI) crude oil benchmark is heading into the close with a gain of 2.7%.

Wall Street was far from immune, with the bellwether S&P 500 stock index and its tech-tilted Nasdaq 100 counterpart falling as much as 1.26% and 2.05%, respectively, before trimming losses to 0.6% and 1% as the dust began to settle. Gold prices added 1%, and the U.S. dollar rose 0.26% against an average of major currencies.

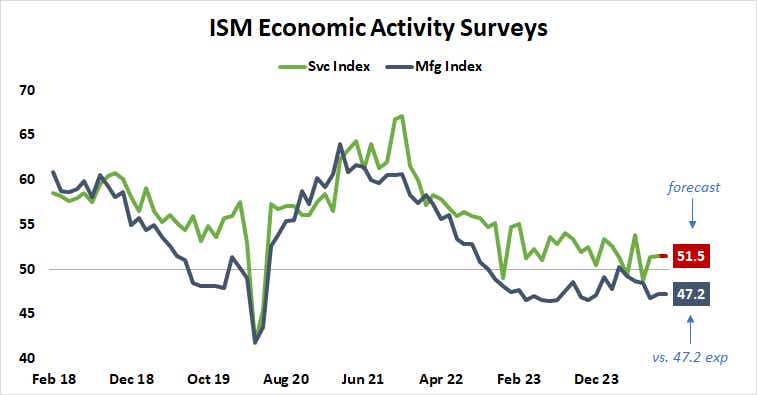

Market-watchers could hardly be blamed for overlooking the day’s macroeconomic offerings amid such tumult. Nevertheless, September’s manufacturing survey from the Institute of Supply Management (ISM) offered some curious insight about the trajectory of U.S. economic growth.

Stocks may not like firm ISM service sector data

Activity in the sector shrank for a sixth consecutive month, as expected. The pace of contraction matched that August, when conditions modestly improved after the year’s worst reading so far was recorded in July. On balance, this speaks to some modest anchoring after four months of accelerating contraction beginning in April.

A look under the surface seems to endorse this cautiously optimistic interpretation. Measures of new orders and production shrank at a slower rate, with the latter nearly back to growth. Inventories fell sharply and prices dropped for the first time since December. Supplier deliveries slowed, which may portend a pickup in demand.

On balance, this speaks to an economy on somewhat sounder footing before ISM releases the companion service sector survey, which captures a far larger share of output and employment. Economists are penciling in steady growth at a rate broadly unchanged since July’s rebound from June’s shock contraction.

The S&P Global version of PMI statistics painted a similarly benign picture last week. However, data from Citigroup suggests U.S. economic news flow has improved relative to median forecasts of recent weeks. If that foreshadows unexpected strength, a trimming of Fed rate cut bets may sting stocks and boost the dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices