U.S. Stocks Tick Higher Ahead of Nvidia Earnings as Treasury Bonds Slip

U.S. Stocks Tick Higher Ahead of Nvidia Earnings as Treasury Bonds Slip

Also 30-year T-Bond, Silver, Natural Gas, and Euro Futures

- Nasdaq 100 E-mini futures

- 30-year T-Bond futures (/ZB): -0.47%

- Silver futures (/SI): -0.27%

- Natural Gas futures (/NG): +3.00%

- Euro futures (/6E): -0.24%

U.S. markets displayed a risk-on tilt Wednesday morning, with modest advances in equity prices coming alongside a pullback in precious metals prices. Yields moved higher as investors sold Treasuries and the dollar advanced. All eyes are on Nvidia (NVDA) earnings, which are scheduled for release after the closing bell today. The chip maker’s huge weight in the S&P 500 and its relevance to the enthusiasm around artificial intelligence makes it a potentially make-or-break report for markets. After Nvidia’s results cross the wires, markets will shift their attention to the second reading for U.S. GDP due out tomorrow morning.

| Symbol: Equities | Daily Change |

| /ESU5 | +0.15% |

| /NQU5 | +0.06% |

| /RTYU5 | +0.41% |

| /YMU5 | +0.20% |

MongoDB (MDB) surged over 30% after the data platform exceeded analysts’ estimates and guided above consensus. Kohl’s (KSS) jumped 20% following upbeat results that beat estimates. Canada Goose Holdings (GOOS) rose 14.6% after news circulated that a majority shareholder received offers to take the company private. Cracker Barrel Old Country Store (CBRL) rose 8% after the food chain said it would abandon its rebranding plans that have sparked backlash. Okta (OKTA) gained 3% after guiding higher than expected during its earnings report.

| Strategy: (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 23000 p Short 23250 p Short 24250 c Long 24500 c | 25% | +3465 | -1535 |

| Short Strangle | Short 23250 p Short 24250 c | 50% | +18590 | x |

| Short Put Vertical | Long 23000 p Short 23250 p | 64% | +1275 | -3720 |

| Symbol: Bonds | Daily Change |

| /ZTZ5 | -0.01% |

| /ZFZ5 | -0.01% |

| /ZNZ5 | -0.04% |

| /ZBZ5 | -0.47% |

| /UBZ5 | -0.59% |

Long-term bond yields rose on Wednesday to extend gains from the prior two sessions. 30-year T-Bond futures (/ZBZ5) fell 0.47% in early U.S. trading. Investors remain concerned about President Trump’s attempt to fire Federal Reserve Governor Lisa Cook, which is highlighting concerns about Fed independence. The move, if successful, could give Trump more influence over monetary policy and potentially bolster long-term inflation expectations. The Treasury will auction 2-year floating rate notes (FRNs) and 5-year notes today.

| Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 112 p Short 113 p Short 115 c Long 116 c | 26% | +703.13 | -296.88 |

| Short Strangle | Short 113 p Short 115 c | 53% | +2765.63 | x |

| Short Put Vertical | Long 112 p Short 113 p | 65% | +359.38 | -640.63 |

| Symbol: Metals | Daily Change |

| /GCZ5 | +0.17% |

| /SIZ5 | -0.27% |

| /HGU5 | -1.16% |

Silver prices (/SIZ5) continued lower Wednesday morning, dropping by about 0.27% in early trading. The metal trimmed deeper losses from overnight trading, with some buying pressure appearing as U.S. trading kicked off. So far, the metal is holding above its 9-day exponential moving average, leaving it in a somewhat resilient position for now. Dollar strength is working against precious metals, but the market’s reaction to Nvidia’s earnings after the bell will likely control broader risk sentiment in the market, which could influence silver prices.

| Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 38 p Short 38.25 p Short 40.25 c Long 40.5 c | 22% | +955 | -295 |

| Short Strangle | Short 38.25 p Short 40.25 c | 56% | +11300 | x |

| Short Put Vertical | Long 38 p Short 38.25 p | 59% | +570 | -680 |

| Symbol: Energy | Daily Change |

| /CLV5 | +1.14% |

| /HOV5 | +0.59% |

| /NGV5 | +3.00% |

| /RBV5 | +0.59% |

Natural gas futures (/NGV5) rose over 3% Wednesday morning as the front-month September contract set to expire. The contract expiration usually brings the chance for heightened volatility, which is exactly what we’re seeing today. Prices have advanced nearly 5% from Monday’s low, which marked the lowest level traded since November. A cool August dragged prices lower over the past month and the weather forecast for September remains unsupported. That means this move is likely being driven by some profit taking from shorts. Prices are at the 9-day EMA this morning and will need to clear the moving average to sustain the recent gains.

| Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3.05 p Short 3.1 p Short 3.5 c Long 3.55 c | 23% | +370 | -140 |

| Short Strangle | Short 3.1 p Short 3.5 c | 56% | +4030 | x |

| Short Put Vertical | Long 3.05 p Short 3.1 p | 54% | +230 | -270 |

| Symbol: FX | Daily Change |

| /6AU5 | +0.06% |

| /6BU5 | -0.01% |

| /6CU5 | +0.12% |

| /6EU5 | -0.24% |

| /6JU5 | -0.23% |

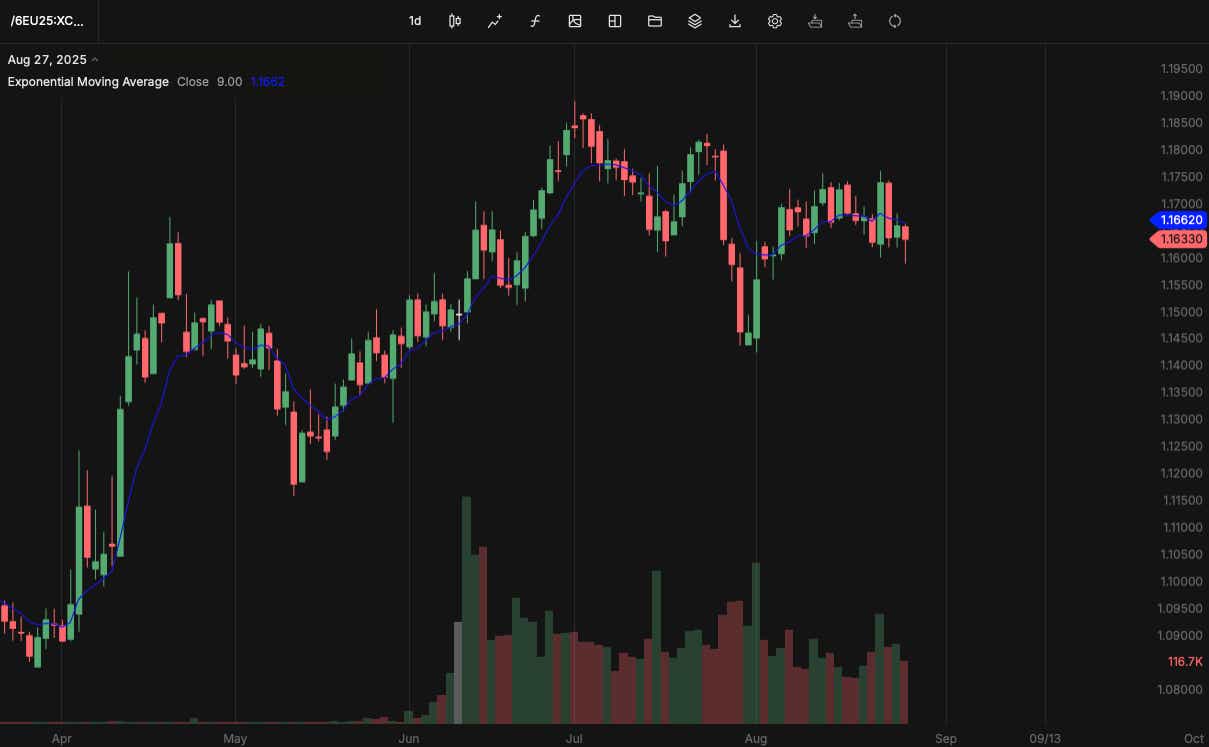

Euro futures fell 0.26% Wednesday, although the currency trimmed deeper overnight losses that saw prices extend to the lowest levels traded since early August. France will hold a confidence vote on September 8 as lawmakers attempt to pass a budget bill that would reduce spending. French lawmakers are warning that the budget deficit is unsustainable. Meanwhile, the dollar advanced against the Yen to help bolster the dollar index. For now, the Euro’s technical position displays more downside than upside risk and is trading below its 9-day EMA.

| Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 1.155 p Short 1.16 p Short 1.17 c Long 1.18 c | 27% | +450 | -175 |

| Short Strangle | Short 1.16 p Short 1.17 c | 54% | +1987.50 | x |

| Short Put Vertical | Long 1.155 p Short 1.16 p | 70% | +212.50 | -412.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices