Uranium Prices Drop 30%, But Cameco & BWX Surge in 2025 Nuclear Rally

Uranium Prices Drop 30%, But Cameco & BWX Surge in 2025 Nuclear Rally

The market continues to favor uranium miners in 2025.

- Uranium prices have fallen nearly 30% from their 2024 peak, and now trade around $72 per pound.

- Despite the commodity’s pullback, Cameco (CCJ) and BWX Technologies (BWXT) have both surged more than 50% in 2025, supported by long-term demand drivers and pro-nuclear policy momentum.

- CCJ offers unmatched leverage to uranium prices through its tier-one mining assets and growing Westinghouse stake, while BWXT offers contract-backed stability through its naval reactor monopoly and record backlog.

After a record surge in 2023 and early 2024, uranium prices have retraced about 30%—falling from above $100/pound down to $72 today. But in the equity market, you’d hardly know it. Two of the nuclear sector’s biggest names—Cameco (CCJ) and BWX Technologies (BWXT)—have surged over 50% this year, defying the pullback in the uranium market.

That gap between falling prices and rising stocks appears to signal something bigger at work. What’s driving it is a convergence of forces: pro-nuclear policies ranging from clean energy mandates to defense modernization, a supply chain that remains tight and record backlogs that stretch years into the future. Together, they’ve convinced investors that nuclear demand isn’t just intact—it’s set to grow, regardless of short-term commodity moves.

Today, we dig into each company’s latest earnings, strategic positioning and valuation to assess whether these stocks have more room to run.

Cameco: A market favorite, but the rich valuation could limit near-term upside

Cameco Corporation has emerged as one of the biggest winners in the global push for nuclear energy. The Canadian uranium giant controls tier-one assets in stable jurisdictions, including its flagship Cigar Lake and McArthur River/Key Lake mines in Saskatchewan and holds a 49% stake in the Westinghouse Electric Company—giving it exposure across the entire nuclear fuel cycle. It’s a positioning that few peers can match, and one that has been amplified by shifting government policy.

In May, President Trump signed executive orders aimed at easing regulations and expanding nuclear power production in the U.S., while specifically excluding uranium from new tariffs. The result: CCJ shares have surged roughly 50% year-to-date and nearly 100% over the past 12 months, recently touching an all-time high above $80/share before settling closer to $75.

The bull case is clear. Global uranium demand is rising on two fronts—civilian nuclear power expansion and military applications. On the civilian side, decarbonization goals, surging electricity demand from AI-driven data centers and supportive policy in the U.S., Europe and Asia are driving long-term growth expectations. Against that macro tailwind, Cameco’s vertically integrated strategy—layering long-term contracts for uranium and conversion services, aligning production with market conditions and maintaining a pristine balance sheet—gives it both pricing leverage and operational flexibility.

Financially, 2025 has been a standout year. In the company’s most recent earnings report, consolidated revenue jumped 47% year-over-year to $633 million, beating estimates by over $50 million, while adjusted EPS surged more than 300% to $0.51. On top of that, the uranium segment saw a 47% revenue spike, with gross margins also improving. .

Fuel services revenue climbed 37% on higher volumes and lower costs, while the Westinghouse stake delivered the biggest surprise—adjusted EBITDA from the segment more than doubled to $352 million, driven by its role in constructing two nuclear reactors in the Czech Republic. Cash flow also impressed, with free cash flow up 79% to $465 million. Management nudged up its expected average realized uranium price for 2025 to $87 per pound, reflecting firmer market pricing and raised Westinghouse’s full-year EBITDA outlook by roughly 45%.

Yet the near-term picture isn’t without challenges. Full-year revenue guidance calls for only 9% growth in 2025—down sharply from 21% last year—and management expects H2 performance to be weaker than the first half. Westinghouse growth is also projected to slow from last year’s triple-digit surge—down to the mid-teens. Production challenges also persist at the McArthur River/Key Lake sites due to labor, equipment. and geological challenges.

Momentum in the shares has brought investors face-to-face with one of CCJ’s biggest challenges: its lofty valuation. The stock trades at roughly 85x trailing GAAP earnings and 59x forward earnings—more than triple the energy sector median. Its price-to-sales (12.7x) and price-to-book (6.7x) ratios are equally stretched compared to sector norms of 1.3x. These multiples leave little margin for error, especially in a commodity-linked business where sentiment can shift quickly.

Supporters argue the premium is warranted. Cameco is a low-cost producer operating in a supply-constrained market, fully integrated across the nuclear fuel cycle, and possesses assets with genuine scarcity value. That combination has kept analyst sentiment firmly bullish: 18 of 20 rate the stock a “buy” or “overweight.” But with an average price target of $77—right where the stock currently trades—Wall Street sees limited near-term upside unless uranium prices push higher or management raises its growth outlook.

Bottom line: Cameco offers unmatched exposure to a nuclear renaissance. The long-term growth story remains intact, and policy tailwinds continue to strengthen. But after a historic run and with H2 growth expected to slow, the shares may need a pause—or a fresh catalyst—to push materially higher from here.

BWX Technologies: A leader at the intersection of defense and nuclear power

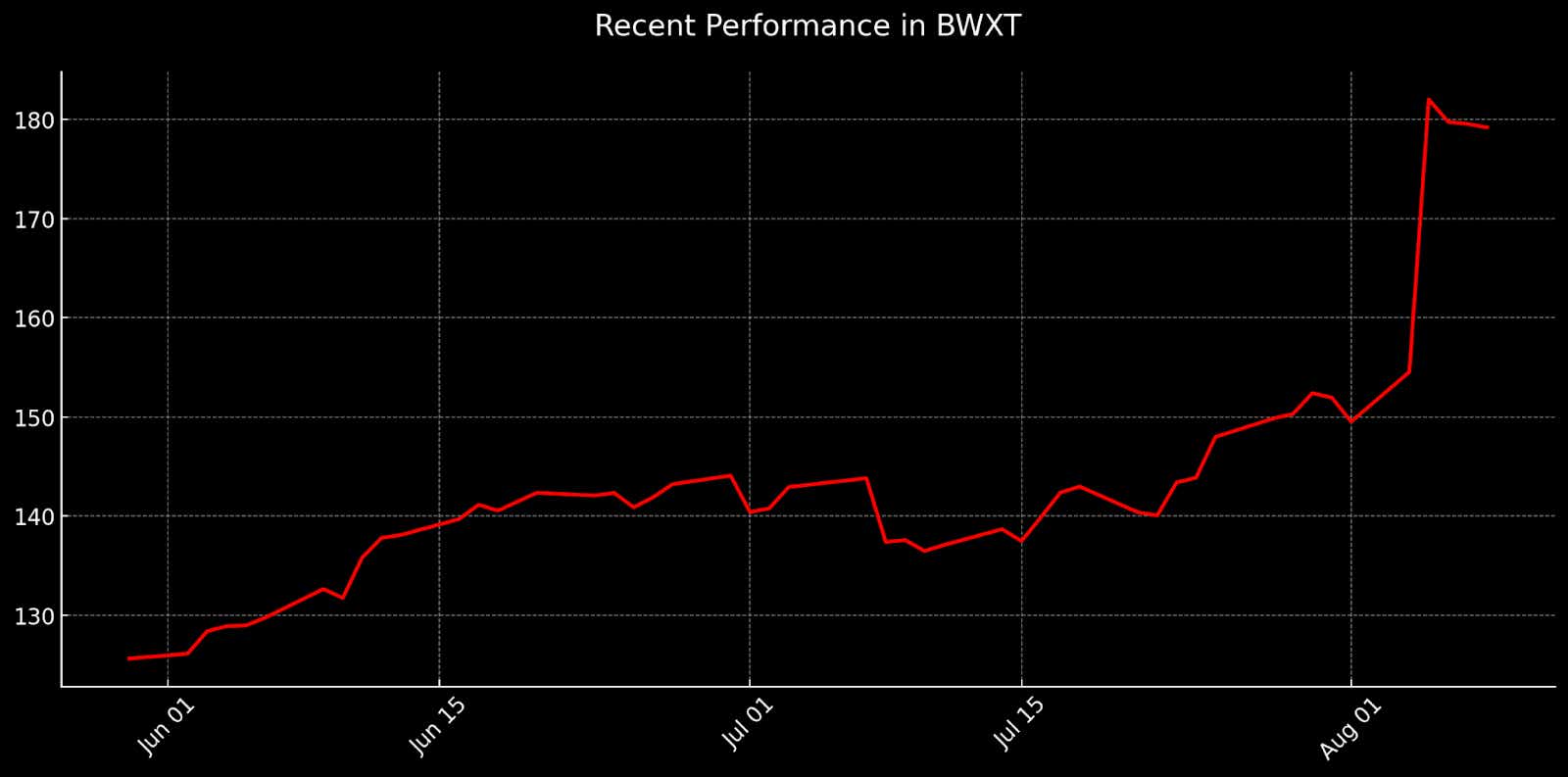

BWX Technologies occupies one of the most defensible positions in the nuclear industry. Best known as the sole supplier of naval nuclear reactors and fuel for the U.S. Navy’s submarine and aircraft carrier fleet, BWXT’s Government Operations segment generates roughly 80% of its revenue, with the remainder coming from commercial nuclear components, services and medical isotopes. This combination of long-cycle, government-backed contracts and exposure to the global nuclear renaissance has powered a breakout run—shares are up about 60% year-to-date and roughly 85% over the past 12 months, recently surpassing $180/share.

The company’s moat is reinforced by multi-year, often decade-long contracts with the Navy, Department of Energy and National Nuclear Security Administration. This includes the recently signed $2.1 billion agreement to supply naval reactors and nuclear fuel fabrication—part of a record $6 billion backlog. On the commercial side, BWXT is capturing growth from life extension projects at Canada’s CANDU reactors, demand for large nuclear components like steam generators and the early stages of the small modular reactor (SMR) buildout. Moreover, the recent acquisition of Kinectrics adds engineering and testing capabilities across the nuclear lifecycle, expanding BWXT’s reach into the broader energy infrastructure market.

The company’s latest earnings report reinforced the positive momentum in its underlying shares. Revenue rose 12% year-over-year to $764 million, driven by a 9% gain in Government Operations on higher naval reactor production and special materials processing, and a 24% surge in Commercial Operations on stronger nuclear component sales and medical isotopes. Adjusted EBITDA climbed 16% to $146 million, while non-GAAP EPS jumped 24% to $1.02—comfortably ahead of consensus estimates. Management also raised full-year guidance across the board—now calling for revenue of about $3.1 billion, adjusted EBITDA of $565–$575 million and non-GAAP EPS of $3.65–$3.75.

That performance has translated into a valuation that, while elevated, looks more defensible than some of the company’s peers. BWXT trades at 56x trailing GAAP earnings and 5.7x sales—well above the sector medians of 25x and 1.6x—and its 14x price-to-book ratio dwarfs the industry average of 3x. Premiums that steep can be a warning sign, but in BWXT’s case they’re underpinned by the rarity of its government franchise, a track record of consistent double-digit earnings growth and a strategic position at the crossroads of defense and clean energy policy. Analyst sentiment is solidly positive, with 10 of 14 rating the stock a “buy” or “overweight,” though the average price target of $175/share sits just below current levels—implying much of the near-term potential is already reflected in the share price.

Bottom line: BWXT combines the predictable cash flows of its naval reactor monopoly with meaningful upside from commercial nuclear growth. While its valuation leaves little margin for error, the company’s entrenched position in high-barrier markets and proven ability to execute on both defense and commercial contracts make it an appealing core holding for investors looking for long-term exposure to the nuclear sector’s expansion.

Investment takeaways

In 2025, the uranium trade is being powered by a striking paradox: spot prices have slumped nearly 30% from last year’s highs, yet uranium mining stocks are still surging. The rally isn’t about chasing short-term price spikes—it’s fueled by long-term forces like clean energy mandates, defense modernization and nuclear’s resurgence as a reliable baseload power source. Leading the pack are Cameco and BWX Technologies, both up more than 50% year-to-date.

Cameco is one of the purest uranium plays, anchored by tier-one mining assets and an expanding services footprint via Westinghouse. Q2 results beat expectations, though management cautioned about a softer second half and potential production headwinds. With the stock trading above 80x earnings and 12x sales, the valuation leaves little cushion—making CCJ a high-beta wager that hinges on uranium prices continuing to climb.

BWX Technologies, by contrast, is far less tethered to spot price volatility, with revenue anchored in long-cycle contracts. As the sole supplier of nuclear reactors and fuel for the U.S. Navy, it produces steady cash flows while pushing into commercial nuclear components, small modular reactors (SMRs) and medical isotopes. Supported by a record $6 billion backlog and entrenched government ties, its 56x earnings multiple is easier to justify.

For investors, the decision boils down to the type of exposure you want: CCJ appears to offer greater potential upside if uranium prices surge, while BWXT boasts steadier growth anchored by structural demand. Alternatively, those seeking broader exposure can look to the Global X Uranium ETF (URA), which holds a diversified mix of miners and nuclear-related companies and has climbed more than 40% year-to-date—matching the strong performance of CCJ and BWXT. Lastly, traders with a more tactical view might elect to express a bullish stance through a long position in the uranium futures market.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices