U.S. CPI Preview: Markets May Hit a Sour Patch on Soft Data

U.S. CPI Preview: Markets May Hit a Sour Patch on Soft Data

By:Ilya Spivak

Pending U.S. CPI data may now spook the markets amid renewed recession worries

- Concerns about recession increase as central banks ratchet up the inflation fight.

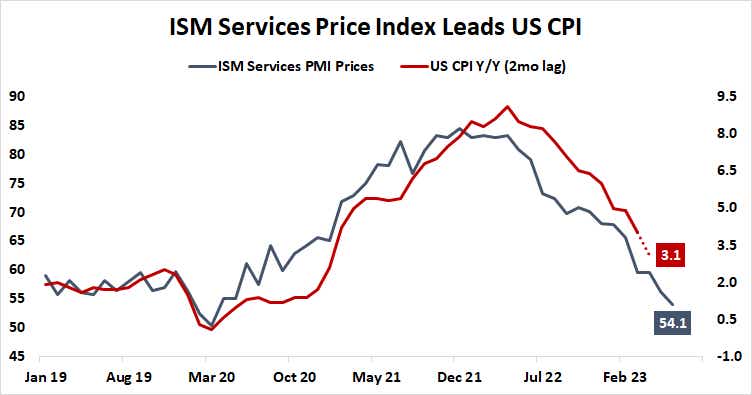

- With the U.S. CPI in focus, leading ISM data suggests disinflation is progressing.

- Soft inflation data may hurt stocks and risk appetite on growth fears.

Financial markets are seemingly undergoing thematic evolution from the first half of the year into the second.

The first six months of the year were punctuated by the banking crisis caused by the Silicon Valley Bank and the U.S. debt ceiling debacle. Each episode took its turn on the front burner for a relatively short while, then slowly retreated into the background as markets digested and moved on.

The second half of the year began with the curious combination of a rate hike pause at the June Federal Open Market Committee (FOMC) meeting and a sharpening of Fed officials’ hawkish rhetoric. Fed Chair Jerome Powell spent nearly a month brandishing the central bank’s appetite for renewed rate hikes at back-to-back speaking engagements.

Policymakers seem concerned that priced-in inflation expectations have stopped falling even after the disappearance of heady rate cut bets penciled in by panicked traders amid the first half’s two crises. They are now expected to deliver one more 25 basis point hike at this month’s FOMC conclave, followed by standstill until easing starts in March or May of next year.

Recession fears build as central banks ratchet up inflation fight

That marks a potent hawkish shift in market pricing. As recently as the start of June, the first interest rate cut was already priced in by January 2024. This readjustment seems to be feeding fears about a more severe slowdown in economic growth on the horizon.

As much seemed to emerge in the price action after June’s pivotal U.S. nonfarm payrolls (NFP) data crossed the wires last week. The spotlight now turns to the U.S. consumer price index (CPI) measure of inflation to see if the new regime survives.

Stocks may shudder if soft CPI data stokes growth concerns

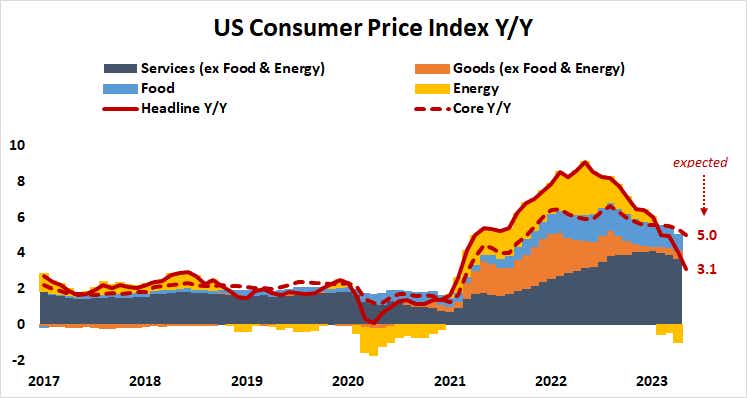

The headline number is expected to fall to 3.1% year-on-year in June. The core reading excluding food and energy—a focal point for the Fed considering policymakers’ acute focus on the service sector—is projected to be lowest since November 2021 at 5%.

While U.S. economic news-flow has generally improved relative to baseline forecasts recently, last week’s leading Institute of Supply Management (ISM) survey data suggested disinflation continues to progress. If this sets the stage for a soft set of numbers and post-NFP (nonfarm payroll) dynamics carry through, cycle-sensitive assets including equities may be hurt as economic downturn worries grow.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices