US Dollar Forecast: DXY Rebounds, but USD/JPY might be Carving Out a Top

US Dollar Forecast: DXY Rebounds, but USD/JPY might be Carving Out a Top

Fed Hikes Odds Peak, US Yields Steady

The US Dollar (via the DXY Index) is clawing back its losses from earlier in the week, thanks to a reach for safe haven currencies as US equity indices turn sharply lower. And while the US Dollar’s gains are coming mainly via movements in EUR/USD and GBP/USD rates, it’s noteworthy that USD/JPY rates are not following suit.

For much of the past few weeks, US Dollar gains and concurrent US equity indices losses were accompanied by a rally in USD/JPY rates, as Fed rate hike odds and US Treasury yields priced-in a more aggressive Fed rate hike cycle. But now that Fed rate hike odds have seemingly hit a ceiling, markets are behaving more… normal, so to speak. As has been the case historically, weakness in US equity indices are being met by lower US Treasury yields and a weaker USD/JPY – a classic ‘risk-off’ reach for safety.

It thus stands to reason that while the US Dollar may be finding its footing, gains may be further to come by if USD/JPY rates are back to acting in a typical safe haven manner. The DXY Index may no longer be a runaway freight train, whereby all USD-pairs move in the same direction all at the same time.

DXY Price Index Technical Analysis: Daily Timeframe (May 2021 to May 2022) (Chart 1)

The DXY Index has rebounded ahead of its daily 21-EMA (one-month moving average), but technical indicators suggest that the streak of overt bullish momentum has ended. Daily MACD has experienced a bearish crossover (albeit above its signal line) for the first time since April 4 and 5, while daily Slow Stochastics are likewise out of overbought territory for the first time since early-April. It may be the DXY Index retains a ‘buy the dip’ mindset until the DXY Index drops below its daily 21-EMA, which has proved itself as support since early-April, but gains are likely to be constrained if they do continue.

USD/JPY Rate Technical Analysis: Daily Timeframe (May 2021 to May 2022) (Chart 2)

USD/JPY rates appear to be carving out a near-term top as bullish momentum has eroded throughout May. After not testing their daily 21-EMA from March 8 until May 12, USD/JPY rates are working on their second close below their one-month moving average this month. Daily MACD continues to decline while above its signal line, and daily Slow Stochastics have moved below their median line. A drop below the monthly low at 127.52 would suggest that a head and shoulders pattern has formed, suggesting a move below 122.00 over the coming weeks.

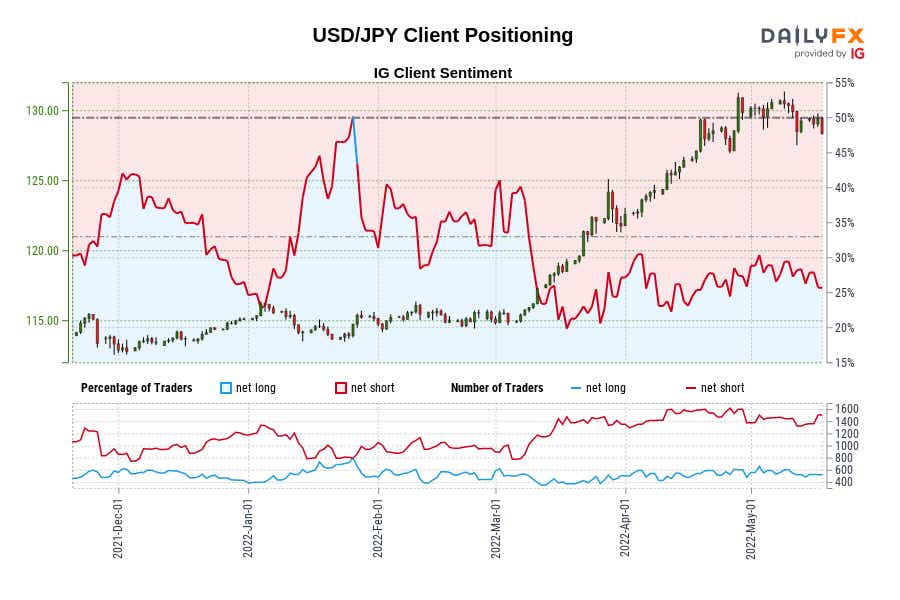

IG Client Sentiment Index: USD/JPY Rate Forecast (May 18, 2022) (Chart 3)

USD/JPY: Retail trader data shows 24.84% of traders are net-long with the ratio of traders short to long at 3.03 to 1. The number of traders net-long is 10.55% lower than yesterday and 2.08% lower from last week, while the number of traders net-short is 3.99% higher than yesterday and 5.75% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.