US Dollar May Rise if Soft Jobs Data Adds to Gathering Recession Fears

US Dollar May Rise if Soft Jobs Data Adds to Gathering Recession Fears

By:Ilya Spivak

Financial markets anxiously await US labor market data, looking for signs of incoming recession after a string of worrying economic reports. Currency and gold markets are eyed to gauge investors’ sentiment.

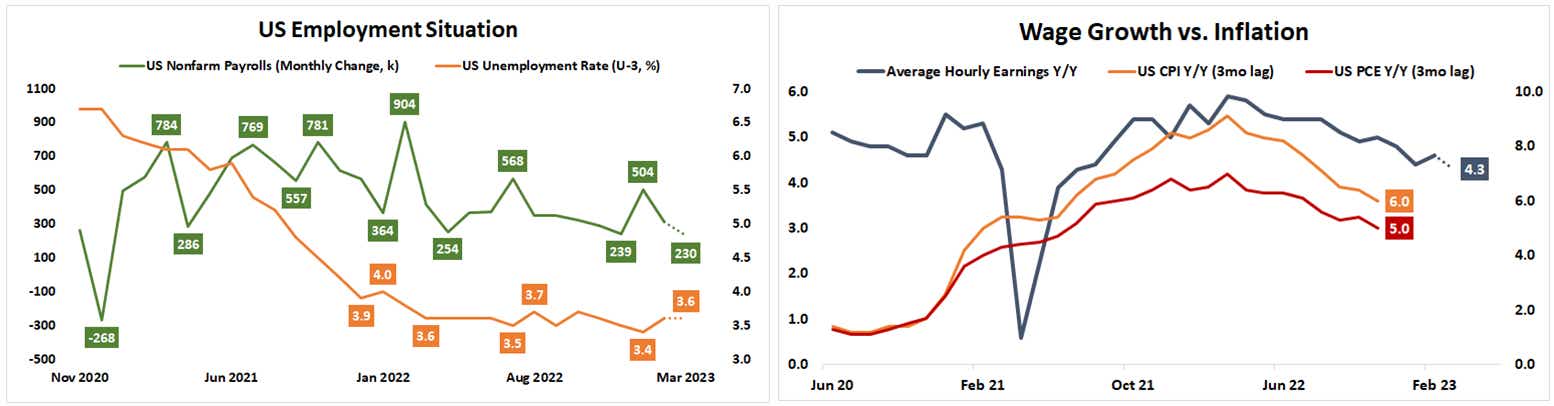

- US nonfarm payrolls seen rising 230k in March, jobless rate flat at 3.6%

- Recently disappointing US economic data has stoked recession worries

- Spot FX and gold markets are eyed amid Good Friday exchange closures

US job creation may drop to the slowest in over 3 years

A hefty dose of event risk hangs over financial markets. The Good Friday holiday will see most of the world’s major markets shuttered but the US Bureau of Labor Statistics will nevertheless press on with releasing the March edition of its closely watched employment statistics.

Economists expect to see that the economy added 230k jobs last month, a downshift from the 311k recorded in February. If that were realized, it would amount to the slowest pace of job creation since December 2020. The unemployment rate is seen holding steady at 3.6 percent while wage growth slows to 4.3 percent year-on-year.

Data source: Bloomberg

Soft US economic data has markets worried about incoming recession

The report follows a streak of disappointments on the US data front. Job openings unexpectedly slipped below the 10 million mark for the first time in nearly two years. Then, ISM surveys of purchasing managers revealed weaker activity than anticipated in both the manufacturing and services sectors.

The markets seem to suspect that all this amounts to broader recession risk. Fed rate hike odds have not recovered from the shock sustained amid the SVB-led banking crisis at the start of the month. The implied policy path priced into rate futures has lingered in dovish territory even as credit stress has eased.

Data source: Bloomberg

Data source: BloombergEyeing spot FX and gold markets’ reaction as exchanges close for Good Friday

Pushing out flagship figures to closed US markets seems unusual. The numbers are set to come out on the first Friday of each month. When this means that a data release falls on a holiday, the schedule is typically amended. Sometimes the report comes through sooner and other times it is delayed.

In this case, it will fall to off-exchange prices to signal how the outcomes are being received by investors. Spot currency and gold markets seem like a go-to place to get a sense of sentiment ahead of the next week’s Wall Street open. With many top markets closed for Easter Monday, that’ll be the first time the news is filtered through decent liquidity.

A soft result that stokes recession fears is likely to bode well for the anti-risk US Dollar and Japanese Yen. It may weigh heaviest on cycle-sensitive alternatives like the Australian Dollar. Bullion prices may struggle for lasting direction if bonds ascend alongside the Greenback, pressuring yields lower.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.