Stocks Threatened as U.S. News Flood Questions Fed Rate Cut Outlook

Stocks Threatened as U.S. News Flood Questions Fed Rate Cut Outlook

By:Ilya Spivak

The markets scored blistering gains as 2023 wound down, amped up by hopes for a meaty 2024 interest rate cut cycle from the Federal Reserve. Now, a flood of high-profile event risks threatens speculators.

- Dense U.S. economic calendar to test the markets’ ultra-dovish Fed policy outlook.

- ISM activity surveys, FOMC meeting minutes, and the jobs report take top billing.

- Middling outcomes may cool rate cut hopes, taking the steam out of Wall Street.

Wall Street is sailing on a wave of positive momentum as 2023 ends having erupted in loud cheer as the Federal Reserve endorsed dovish speculation with December’s monetary policy update. The moves seem to put something of an exclamation point on the rapid repricing of the expected Fed policy path in November.

As the calendar turns to 2024, an avalanche of economic news flow shaping U.S. monetary policy expectations lines up to appear in very first week of the new year. It will push sleepy and hungover markets to reckon with the fourth quarter’s ecstatic triumph and ponder its viability.

Here are the key macro waypoints ahead:

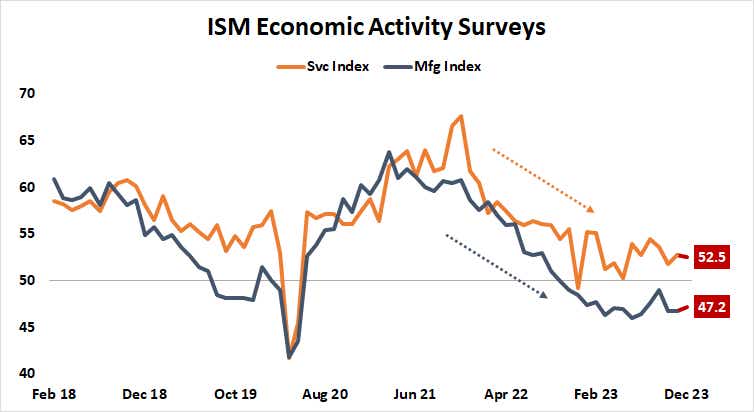

ISM economic activity surveys

December’s economic activity surveys from the Institute of Supply Management (ISM) will be a helpful barometer for where the U.S. business cycle is at the end of 2023. Expectations point to a familiar pattern, with the manufacturing sector shrinking for a 14th consecutive month while a tepid service sector keeps overall expansion modestly afloat.

Analytics from Citigroup suggest that U.S. economic data outcomes have increasingly converged on consensus forecasts since mid-August as market-watchers upgraded growth expectations for 2024. That seems to suggest a set of middling outcomes for the ISM roundup is likely.

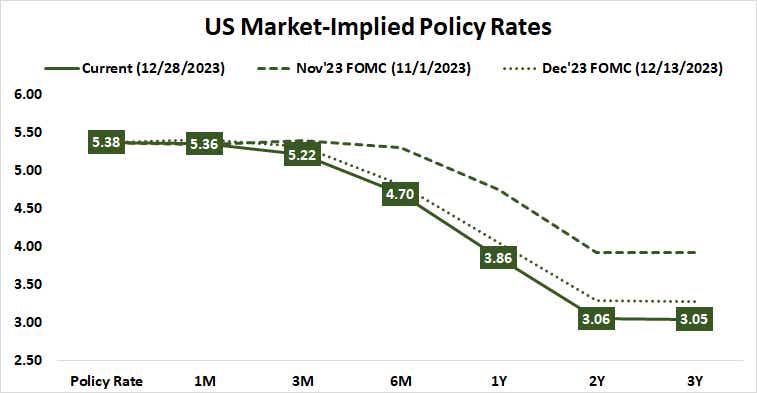

Market-moving potential remains despite an absence of controversy in the numbers themselves, however. The markets have already priced in a hefty six 25-basis-point (bps) rate cuts from the Federal Reserve in 2024. That seems to envision some truly acute economic hardship ahead. The central bank itself envisions just three cuts.

ISM data painting the now familiar “slow and steady” picture of the U.S. economy is likely to endorse the Fed’s more modest appetite for easing, as opposed the big-splash campaign dreamed up by investors. In that, it might help set the stage for cooling the blistering stock market rally from November and December, and a rebound of the U.S. dollar.

December FOMC meeting minutes

Minutes from December’s meeting of the Fed’s policy-steering Federal Open Market Committee (FOMC) will help us understand officials’ embrace of speculation that the rate hike cycle has ended, and that easing is on the way. As with the ISM reports, the risk here seems skewed toward a result that scales back investors’ dovish hopes.

Tracking the evolution of the priced-in Fed policy path in the last two months of the year reveals that most of the drama happened after November’s meeting, where the central bank’s guidance was more subtle but the contrast from September’s hawkish posture more overt. The minutes might echo as much.

In doing so, they might raise the obvious question yet again: is the economy truly on such a soft footing that six rate cuts are in order, or have the markets over-speculated? A measured tone from Fed officials that clashes with the dovish zeal now baked into rates pricing may help force a rethink, taking some steam out of the fourth quarter’s risk-on surge.

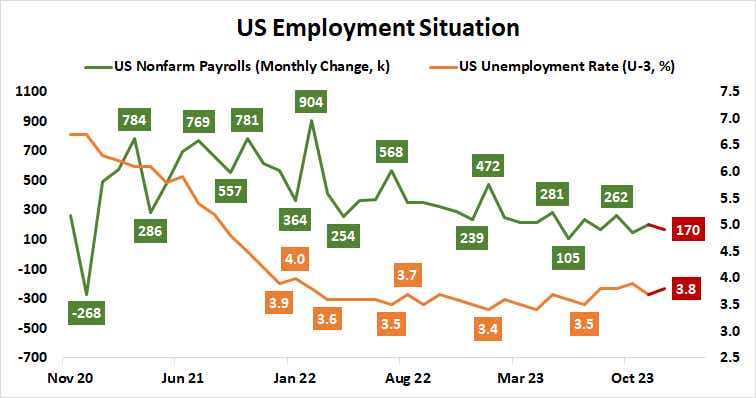

U.S. employment statistics

December’s official set of U.S. employment data headlines a flurry of releases offering various views of labor market conditions sprinkled throughout the week. Analysts expect it to show that 170,000 jobs were added to nonfarm payrolls while the unemployment rate ticked up modestly to 3.8%.

Experts project a similarly unremarkable lead-in from an estimate of private-sector payrolls growth published by HR services giant Automatic Data Processing (ADP). That is penciled in at 113,000 jobs for December, amounting to a hair-thin uptick from the prior month’s 103,000.

The latest Job Openings and Labor Turnover Survey (JOLTS) presents another variation on the theme. Vacancies are seen twitching higher to 8.9 million in November having clocked in a 32-month low of 8.7 million in October. Such minor changes are unlikely to alter the Fed’s calculus in a meaningful way.

Here too, signs of relative stability demand an explanation for why the central bank will plunge head-long into a stimulus program as soon as March. The first 25 bps rate cut is fully priced for that month’s FOMC conclave. If the data signals that a more measured path is likelier, stock and bond markets may retreat from December highs.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices