US Government Shutdown and Jobs Data: Why Are Stock Markets Happy?

US Government Shutdown and Jobs Data: Why Are Stock Markets Happy?

By:Ilya Spivak

Stock markets swallowed the US government shutdown amid hopes for more Fed rate cuts. Now what?

- Wall Street managed to close with gains despite a US government shutdown

- ADP private payrolls and ISM manufacturing data helped feed Fed rate cut bets

- Upbeat ISM services and (maybe) official US jobs data may cap stocks markets

Stock markets took in stride a much-talked-about US government shutdown, triggered amid a budget impasse between Democrats in Congress, their Republican rivals, and the Trump administration. Vital services will continue, but hundreds of thoughts of federal workers have been furloughed or are working without pay.

Russ Vought, the Trump team’s director of the Office of Management and Budget (OMB), said in a call with Republican lawmakers that a wave of layoffs would begin in the coming day or two. White House Press Secretary Karoline Leavitt confirmed the statement in a press briefing thereafter.

Stock markets found a way to rise amid the US government shutdown

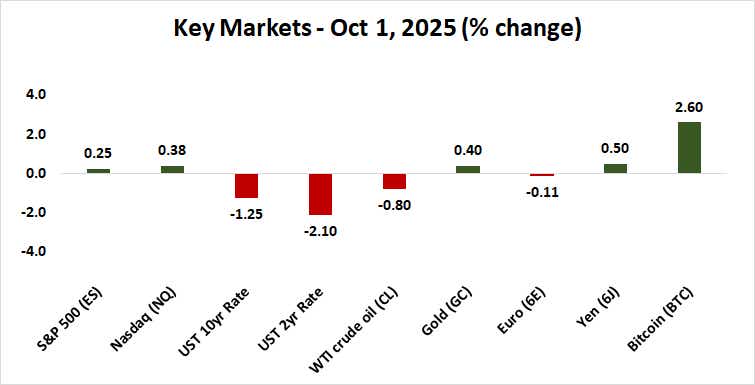

Nevertheless, the bellwether S&P 500 shrugged off intraday losses of as much as 0.87% to finish the day up 0.34%. The tech-tilted Nasdaq 100 offered a similar showing. It closed up 0.46%, having fallen as much as 1.08%. The shutdown, along with a dollop of complimentary economic data, seemed to encourage traders with Fed rate cut hopes.

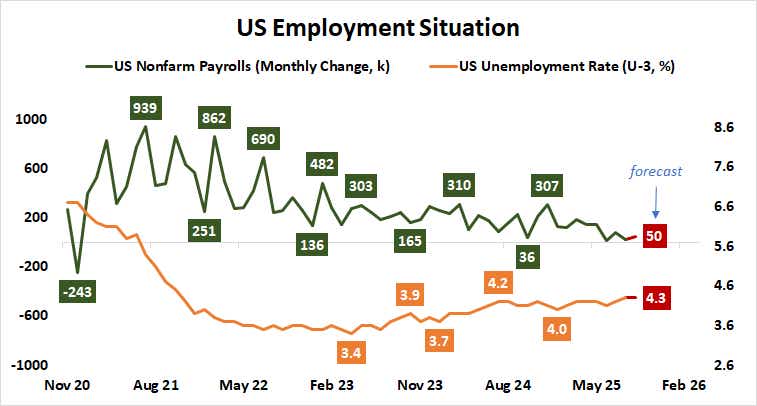

An estimate of private sector payrolls growth from Automatic Data Processing Inc (ADP) showed that the economy unexpectedly shed 32,000 jobs in September. Economists were penciling in a rise of 50,000 ahead of the release. August’s result was revised from a rise of 54,000 to a loss of 3,000.

Taken together, this amounted to the largest one-month payrolls drop since March 2023 and the first series of back to back monthly job losses since mid-2020, amid the Covid-19 pandemic. A separate report from the Institute for Supply Management (ISM) showed manufacturing employment fell for an eighth month straight.

Fiscal pressure, ADP and ISM data helped markets dream of rate cuts

The same ISM report also showed that inflation in the sector fell for a third consecutive month. While price growth remains dramatically elevated by historical standards, it has moderated to the slowest since January. Taken together, all this seemed to give cover to the Federal Reserve to continue cutting interest rates.

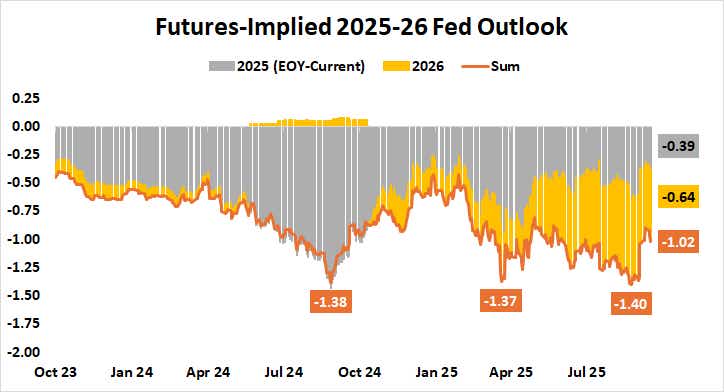

The markets have long since priced in another 25-basis-point (bps) rate cut in October. However, mounting fiscal headwinds and soggy jobs data helped buoy the probability of another move in December, pushing it to a commanding 89% from 77.3% just yesterday and only 40.1% a month ago.

Not surprisingly, Treasury bonds rose as yields fell against this backdrop. The US dollar narrowly weakened against an average of its major currency counterparts, with the rates-sensitive Japanese yen scoring the lion’s share of gains. Plainly, the markets seem to have decided to embrace labor market weakness if it brings more rate cuts.

Will upbeat US economic data put a lid on Wall Street and boost the dollar?

From here, this puts the spotlight on official US employment data from the Bureau of Labor Statistics. Its Friday release was due to show that the economy added 50,000 jobs while the unemployment rate held at 4.3% last month. The shutdown may now have delayed its publication.

Meanwhile, ISM will publish its survey on the service sector, which is expected to show that economic activity growth kept pace in September after growth there hit a six-month high in August. Close to 70% of nonfarm payrolls are on the services side, while only 8% fall to manufacturing. That makes this data a key input into the markets’ current calculus.

Analytics from Citigroup show that US economic data has tended to outperform relative to forecasts over recent months. Stock markets may wobble as the US dollar rises alongside yields if that translates into an upbeat ISM print that eats into Fed rate cut bets. A hot official jobs report – if it appears at all – might be doubly impactful.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices