U.S. PCE and Eurozone CPI Inflation Data, China PMI: Macro Week Ahead

U.S. PCE and Eurozone CPI Inflation Data, China PMI: Macro Week Ahead

By:Ilya Spivak

Stock markets face a challenging mix of macro forces after failing to make good on another Nvidia earnings beat

The euro may lose ground if Eurozone CPI figures underperform.

Soft PMI data may punish China proxies like the Australian dollar.

U.S. PCE inflation data may be hard for stock markets to swallow.

The mood on Wall Street turned gloomy despite another upside earnings surprise from Nvidia (NVDA), the poster child for speculative fervor about the burgeoning artificial intelligence (AI) sector. The chipmaker posted earnings per share of $6.12 on $26.04 billion in revenue, beating expectations penciling in an EPS of $5.60 on income of $24.6 billion.

The stock shot higher, closing with a gain of 9.32% on the day. That cheer would not extend to the broader markets, however. Sellers came out in force at the opening bell, rapidly closing an upside gap reflecting Nvidia’s overnight reporting and pushing the major equity index benchmarks sharply lower for most of the day.

The bellwether S&P 500 slid 0.8%, posting its biggest one-day loss in three weeks. The tech-heavy Nasdaq shed 0.48% and the small-cap Russell 2000 lost 1.69%. The blue-chip Dow Jones Industrial Average lost 1.58%.

Meanwhile, white-hot U.S. purchasing managers index (PMI) data drove hawkish repricing of Federal Reserve policy bets. The data from S&P Global showed the pace of economic activity growth across the services and manufacturing sectors unexpectedly accelerated to the fastest in a year.

Treasury bonds fell across maturities as yields surged on the outcome, while the U.S. dollar shot higher against its major currency counterparts. Gold and silver prices swooned. Fed Funds futures moved to price in just 27 basis points (bps) in rate cuts for 2024, down from 41bps recorded a week ago after April’s closely watched U.S. inflation data.

Here are the macro waypoints likely to shape price action next week.

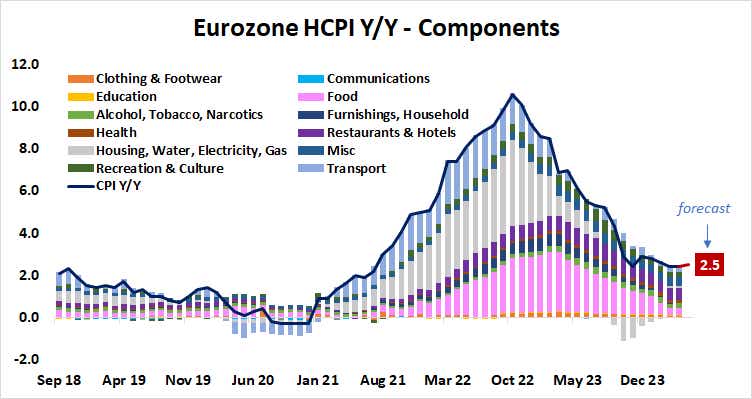

Eurozone consumer price index (CPI) data

Headline inflation in the Euro Area is expected to inch up to 2.5% year-on-year in May after hitting a four-month low of 2.4% in March and idling there in April.

Leading PMI data points to softening pricing power this month, even as the recovery in economic activity gains momentum. Meanwhile, analytics from Citigroup warn that data outcomes have weakened relative to forecasts since early March. That might set the stage for soft results, boosting European Central Bank (ECB) rate cut bets and punishing the euro.

China purchasing managers index (PMI) data

Official PMI data from China is expected to show a second consecutive month of slowing activity growth in the world’s second-largest economy. Here too, studies from Citigroup warn of deteriorating data outcomes relative to baseline forecasts.

If that produces disappointing PMI results, assets sensitive to China’s business cycle, like the Australian dollar, may come under pressure. Meanwhile, local shares have decoupled somewhat from macroeconomic trends since mid-April as the authorities in Beijing mandate the investment arm of the sovereign wealth fund to buy them.

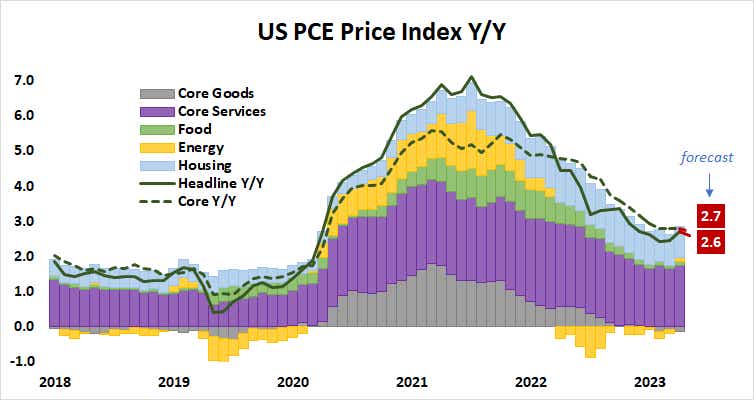

U.S. personal consumption expenditure (PCE) price index

The Fed’s favored inflation gauge is expected to show disinflation resumed in April. The core measure of price growth excluding food and energy—the gauge emphasized by Fed policymakers—is seen edging down to 2.7% year-on-year after stubbornly sticking at 2.8% for the preceding three months.

While that would echo the seemingly market-friendly outcome on analog CPI data, it is not clear that a result in line with forecasts would bring much cheer to investors. Despite the appearance of a three-year low on core CPI last month, near-term dynamics remain troubling for Fed officials.

April’s report showed the annualized three-month growth rate of headline and core CPI accelerated, suggesting that policymakers are probably no closer to confidently cutting rates. What’s more, a model of inflation trends from the Cleveland Federal Reserve that has been undershooting realized results all year now points to a pickup in headline and core PCE.

On balance, this warns that the report is unlikely to do much to rebuild the dovish case for monetary policy. That may be a hard pill to swallow for stock markets on the last day before a week-long commentary blackout for Fed officials leading up to the June 13 meeting of the Federal Open Markets Committee (FOMC).

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices