US PCE Preview: Can Stocks Justify More Gains as Inflation Rises?

US PCE Preview: Can Stocks Justify More Gains as Inflation Rises?

By:Ilya Spivak

Wall Street found a way higher despite Nvidia dropping after earnings. Can US inflation data dent risk appetite?

- Stocks found fresh vigor even as Nvidia shares fell after limp Q2 earnings

- Markets in “event risk survival mode” may speak to signs of exhaustion

- US PCE inflation data in focus, with seemingly little room for dovish cheer

Stock markets brushed aside an underwhelming earnings report from AI darling Nvidia (NVDA), with the bellwether S&P 500 sailing to a record high. The tech-tilted Nasdaq 100 remains pinned in a range below peaks set earlier this month, but it too posted a spirited advance.

Nvidia reported second quarter earnings per share (EPS) of $1.05 on revenue of $46.74 billion. These outcomes narrowly outperformed baseline expectations of $1.01 and $46.05 billion, but the upside surprise quotient turned out to be the narrowest in nearly three years on both counts (4.12% and 1.51%, respectively).

Moreover, the chipmaker set its projection for third-quarter revenue at $53.46 billion, which landed on the lower end of an unusually wide spectrum of estimates that ranged from less than $50 billion to over $60 billion. This dispersion reflected uncertainty about future sales in China, where the Trump administration has recently lifted a blanket ban.

Nvidia falls on unimpressive earnings, but broader markets celebrate

Nvidia shares plunged when the numbers came across the wires, echoing soggy price action following reports from the other six tech companies in the so-called “magnificent seven” that have dominated financial markets recently. The stock fell as much as 3.06% intraday but closed down by a more modest 0.79%.

The company accounts for an eye-watering 8% of the S&P 500, making it the single biggest individual contributor. Nevertheless, its troubles failed to bring the broader market to heel, despite seemingly weak-kneed sentiment. Earlier this week, traders struggled to extend gains after cheering on Fed Chair Powell at the Jackson Hole Symposium.

A pattern may be starting to emerge. Traders celebrated US consumer price index (CPI) data on August 12 when they reckoned it was good enough to keep Fed rate cuts on track, then stalled for seven days until Powell gave them another fillip at Jackson Hole. Then markets idled again until Nvidia’s report was deemed acceptable.

US inflation back in focus as PCE data looms ahead

With US equity indices at or near record highs, more of the same might begin to appear as though the markets are only just managing to survive event risk, as long as they can convince themselves the outcomes are digestible. Their inability to find lasting trend development independent of periodic jolts of relief from the calendar speaks to exhaustion.

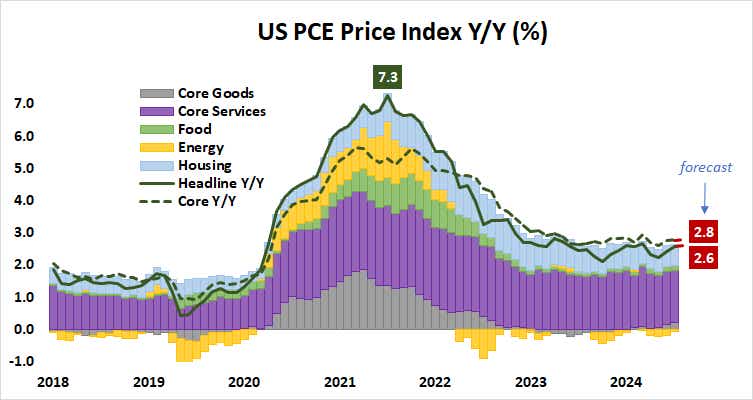

A test of this theory is ahead as the spotlight turns to July’s US personal consumption expenditure (PCE) inflation data, the Fed’s preferred price growth gauge. Headline and core price growth – the latter excluding volatile food and energy prices – are expected to hit five-month highs. That would broadly mirror the earlier CPI report.

A rate cut in September is now thoroughly priced in with a likelihood of 85%. The outlook for 2025 calls for 50 basis points (bps) in easing, matching the Fed’s forecasts dating back to December. The markets’ view for 2026 calls for at least three cuts, whereas the Fed has only owned up to one.

That sets a high bar on anything market-moving outside of a dramatic upside shock that scrambles policy bets. If a risk-on mood survives in the absence of any such surprise, the markets will have shown an ongoing ability to cheer the passing of event risk, whatever the substance. If progress stalls, an exhausted breaking point may seem closer at hand.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices