USD/JPY: Yen at Risk on Bank of Japan Inaction

USD/JPY: Yen at Risk on Bank of Japan Inaction

By:Ilya Spivak

The yen may fall as the Bank of Japan resists speculation on a reversal of ultra-dovish policy

- Sticky above-target inflation and a bold new leadership stoke bets on a BOJ sea change.

- Governor Ueda and company are unlikely to feel urgency on rates, yield curve control.

- The Japanese yen may fall as stocks edge up after a status-quo BOJ policy decision.

The possibility of regime change in Bank of Japan (BOJ) monetary policy has captured the imagination of financial markets once again.

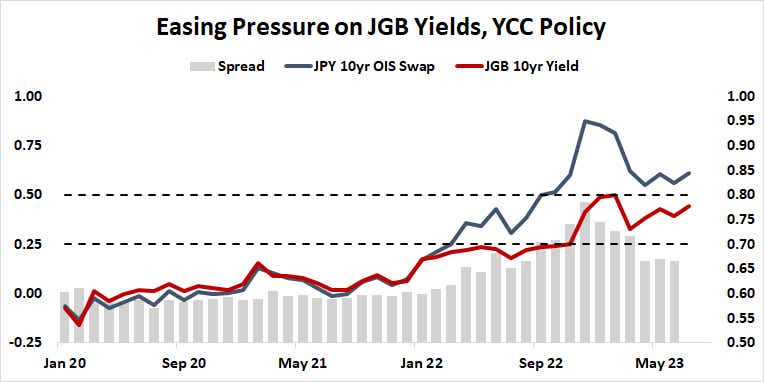

The central bank stood apart from its major peers as they rushed to fight inflation, keeping its target interest rate in negative territory and offering an expansive menu of other stimulus measures. These include purchases of a broad assortment of assets to inject liquidity into public markets as well as a cap on the 10-year Japanese government bond (JGB) yield at 0% (so-called “yield curve control," or YCC).

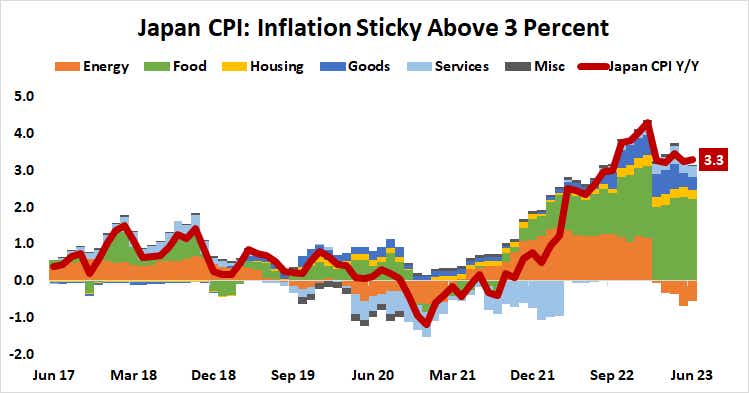

Japanese inflation has found a perch above the BOJ target

Japan was not spared the global inflationary upswell in the wake of the COVID-19 pandemic. The benchmark consumer price index (CPI) gauge has been pinned above 3% all year having peaked at 4.3% in January. It began 2022 below 1% and registered below zero as recently as August 2021. By then, the U.S. Federal Reserve had already acknowledged that inflation was stickier than expected, starting to set the stage for a blistering rate hike cycle.

The BOJ targets inflation at 2%, a level that CPI has now exceeded for 15 months in a row. That has understandably stoked speculation that price pressures would become entrenched as the central bank’s inaction drives consumers and businesses to act on the assumption the status quo will linger and lock in higher costs into stickier parts of the economy, like wages.

The sense that change is imminent has been reinforced by the arrival of a new kind of Bank of Japan governor.

The appointment of Kazuo Ueda, who took the helm at the BOJ in April, stands in contrast to the previously typical choice of leaders for the monetary authority. Ueda built his career in academia instead of the government. What’s more, he comes from the stable of transformative policymakers groomed by visionary economist Stanley Fischer. Other notable disciples include former Fed and European Central Bank (ECB) leaders Ben Bernanke and Mario Draghi, respectively.

Is the BOJ ready for a sea change?

Taken together, this has inspired markets to consider that Japan’s central bank may finally have the economic backing for reversing ultra-dovish policy as well as willing leadership to undertake bold change.

In the most widely told version of this narrative, the first act centers on ending YCC. That’s after Ueda’s predecessor Haruhiko Kuroda oversaw an adjustment to the regime earlier this year, widening the allowable band for oscillation around the 0% target from 25 to 50 basis points (bps). The Japanese yen duly surged in response.

The BOJ looks likely to pour cold water on such mythmaking when it delivers its policy announcement this week.

The spread between the 10-year JGB yield and the analogous rate in the swaps market—a measure of where the bond market ought to be absent central bank meddling—has dropped back from the policy-busting 50bps in January to just 14bps now. This means the pressure to do anything with YCC looks absent. Meanwhile, most Japanese inflation still seems to be imported, dimming the prospects of a local policy response.

The Japanese yen is likely to fall in this scenario, while local stocks edge up. That risk-on lead might have some capacity for positive uplift across global equities more broadly. A status-quo BOJ would amount to the continuing availability of cheap, abundant JPY-denominated funding. That might be seen as helping to digest ongoing tightening elsewhere.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices