Vinfast is the Smoking Hot Vietnamese Auto Stock You Need to Know

Vinfast is the Smoking Hot Vietnamese Auto Stock You Need to Know

VFS shares are up 700% in less than two weeks.

- VinFast went public on Aug.15 after completing a SPAC merger with Black Spade Acquisition Co.

- Since its debut, VinFast shares have rallied over 700% which has seen it become the third-most valuable automaker.

- VinFast stock options began trading on Monday, Aug. 28.

If you sort the list 8,361 tradable stocks in order of performance, you will see that Carvana (CVNA) is number one with a year-to-date return of 857%. Immediately behind it with a return of 723% is a little-known Vietnamese electric vehicle company that is making waves after only two weeks of trading.

VinFast (VFS) was founded in 2017 by Vingroup and made its first efforts at becoming a public company in 2021. The automaker planned to merge with a special-purpose acquisition company (SPAC) in the U.S. but decided in May of to put things on hold due to the increased scrutiny surround SPACs at the time. On Aug. 15, the Vietnamese EV maker finally achieved its goal by successfully completing a SPAC merger with Black Spade Acquisition Co.

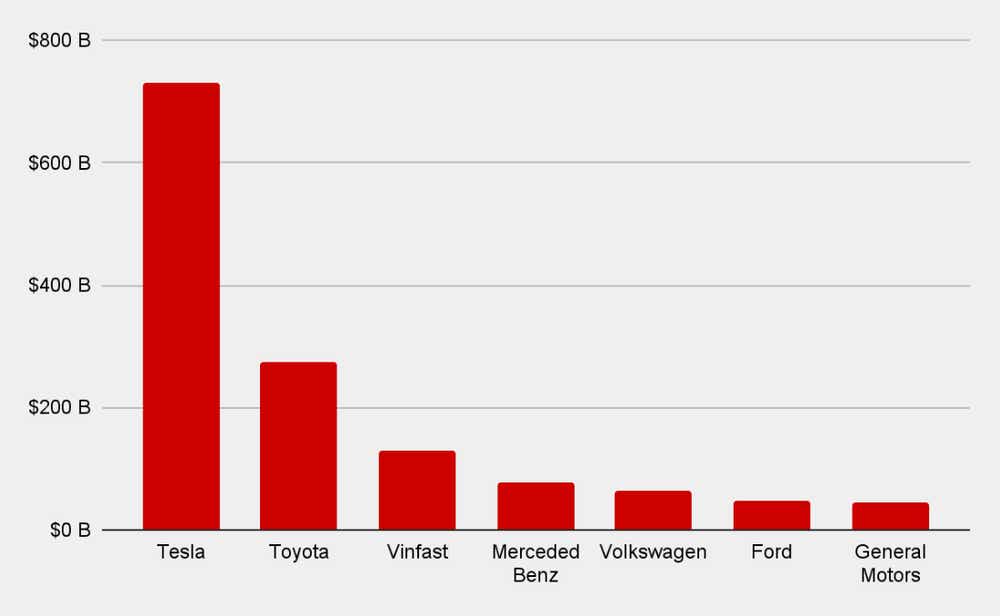

VinFast has made an explosive debut on Wall Street and, at $130 billion, has quickly risen in valuation to become the third-largest automaker behind Tesla (TSLA), at $730 billion in market cap and Toyota (TM), at $275 billion.

For those keeping score at home, VFS currently has a larger market capitalization than Ford (F), General Motors (GM) or Honda (HRC), which have been around for a combined 300+ years as public companies. How did this all happen so fast?

Well, for starters, the stock has rocketed up more than $50 from its debut through Monday's close of Monday. It's also worth noting that most of the company, 99% to be exact, remains under the ownership of its parent entity. This means only a limited number of shares available for trading. As a result, shares have been trading with a heightened sense of volatility since their debut on the Nasdaq. The stock has either jumped or tanked more than 10% in nine of the past 10 trading sessions.

On Monday, two weeks after its debut, VFS finally got tradeable options. However, saying these derivatives are "tradeable" is a stretch.

If you price out the at-the-money straddle one this becomes clear: VFS options are pricing a huge drop in the stock's future. Shares are hard to borrow, which means it is difficult to locate traders with long stock to initiate a short-sale trade. As a result, this creates a stock that is extremely skewed to the downside, thus making puts extraordinarily expensive. As more float becomes available, this will change.

In the meantime, with little-to-no information on long-term volatility available, VFS is a 'no trade' for me. For now.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday. @jermalchandler

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.