Why Did the Markets Stall After Cheering Powell Rate Cut Signal?

Why Did the Markets Stall After Cheering Powell Rate Cut Signal?

By:Ilya Spivak

Stocks and the US dollar seesawed as markets cheered Fed Chair Powell at Jackson Hole, only to lose momentum.

- Stock and gold rose, yields and the US dollar fell as Powell spoke at Jackson Hole

- Markets hit a wall after loudly cheering rate cuts, cutting off dovish follow-through

- Sentiment seems fragile as US PCE inflation data, NVDA earnings loom ahead

Financial markets roared with approval as Federal Reserve Chair Jerome Powell delivered a much-anticipated speech at the US central bank’s annual Jackson Hole Symposium. Parsing through the carefully crafted wordsmithing, traders seemed to extract confirmation that an interest rate cut is indeed on the menu for next month.

Benchmark Fed Funds futures show that the probability of a 25-basis-point reduction when the policy-steering Federal Open Market Committee (FOMC) gathers on September 17 rose to 84.7% from 74.9% on the prior day. That marked a welcome respite after nearly two weeks on tenterhooks following inflation data released on August 12.

The markets cheered as Fed Chair Powell set the stage for a rate cut

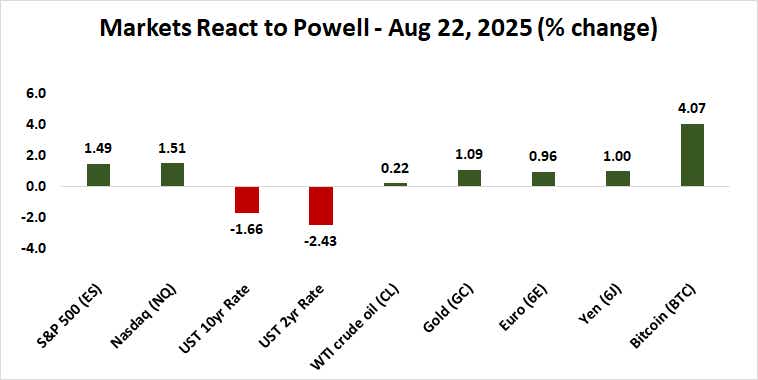

Stock markets surged, with the bellwether S&P 500 and the tech-tilted Nasdaq 100 adding 1.5% apiece. Treasury bonds rose as borrowing costs fell across the yield curve. The two-year rate fell 2.43% while the 10-year lost 1.66%, hinting a sense of immediacy around stimulus speculation. The US dollar broadly fell while gold prices rose.

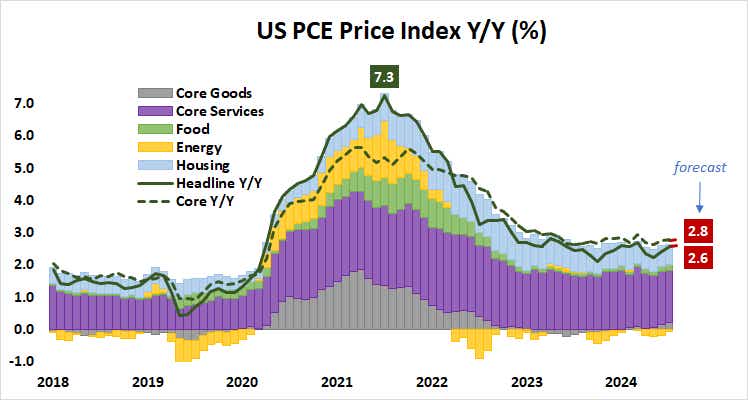

Powell said that risks to the labor market are rising while economic growth has slowed notably, reflecting a downturn in consumer spending. He then argued that, while the effects of tariffs on consumers are clearly visible and will accumulate in the coming months, it is a reasonable base case that the impact will be short-lived.

Nevertheless, the Fed Chair warned that policymakers cannot allow a one-time increase in the price level to become an ongoing inflation problem. He stressed that the central bank’s updated framework emphasizes a commitment to act forcefully to ensure longer-term inflation expectations remain well-anchored.

Stocks and the dollar seesaw as dovish speculation runs out of road

One day removed from the fireworks, a curious lack of follow-through seemed to be clearly on display. Wall Street limped lower Monday, with the S&P 500 down nearly 0.4%. Treasury bond yields inched higher, while the US dollar launched a spirited recovery, erasing more than half of its Powell-inspired drop against an average of major currencies.

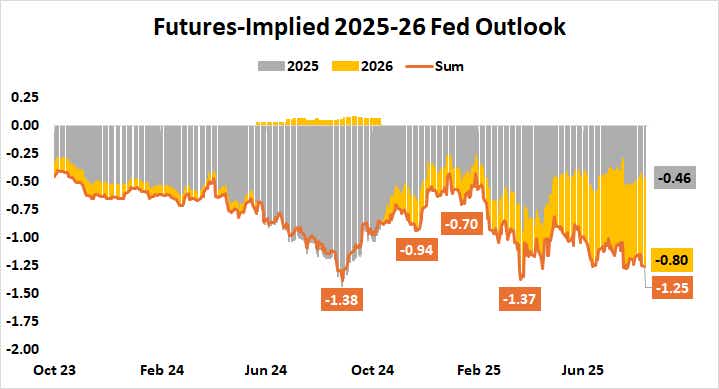

What happened to the markets’ forceful post-Powell vigor, and why did it struggle for follow-through? September’s rate cut has been priced in with strongly better-than-even odds for months. Indeed, the view for 2025 reflected in futures pricing has hewed close to the 50bps in cuts that the Fed has forecasted from December since at least mid-May.

Meanwhile, the disparity between the central bank’s position and that of the markets beyond this year has only diverged further. Traders now price in 80bps in cuts for 2026, whereas the Fed has owned up to just 25bps. That leaves officials with plenty of room for a dovish pivot before they’ve caught up with the markets’ baseline.

Risk appetite seems fragile as US PCE inflation data, NVDA earnings loom ahead

This may help explain why prices across asset classes found only limited scope for a dovish reaction. The markets’ initial exuberance marked relief at having avoided the risk of a hawkish surprise at Jackson Hole, but without much novelty for speculators, that move was quick to fizzle.

This leaves stocks in a vulnerable and the US dollar poised to recover further if incoming news-flow undermines sentiment, especially if that comes by way of highlighting the yawning gap between traders’ appetite for easing beyond 2025 and that of the Fed. US PCE inflation data and an earnings report from Nvidia Corp (NVDA) take top billing.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices