When Options Strategies Fail: Lessons from Major Market Events

When Options Strategies Fail: Lessons from Major Market Events

By:Kai Zeng

When Options Strategies Fail: Lessons from Major Market Events

- The magnitude of a market correction does not reliably predict options selling performance — the correlation between the size of the market’s decline and strangle results is weaker than expected

- Traders should be extra cautious when implied volatility is low because markets offer limited premium while creating exposure to volatility expansion events.

- Proper position sizing makes even challenging years manageable, as evidenced by 2025's high single loss ratio but low median loss ratio.

Options selling strategies are popular for their consistently high success rates, but when losses do occur, they can be substantial.

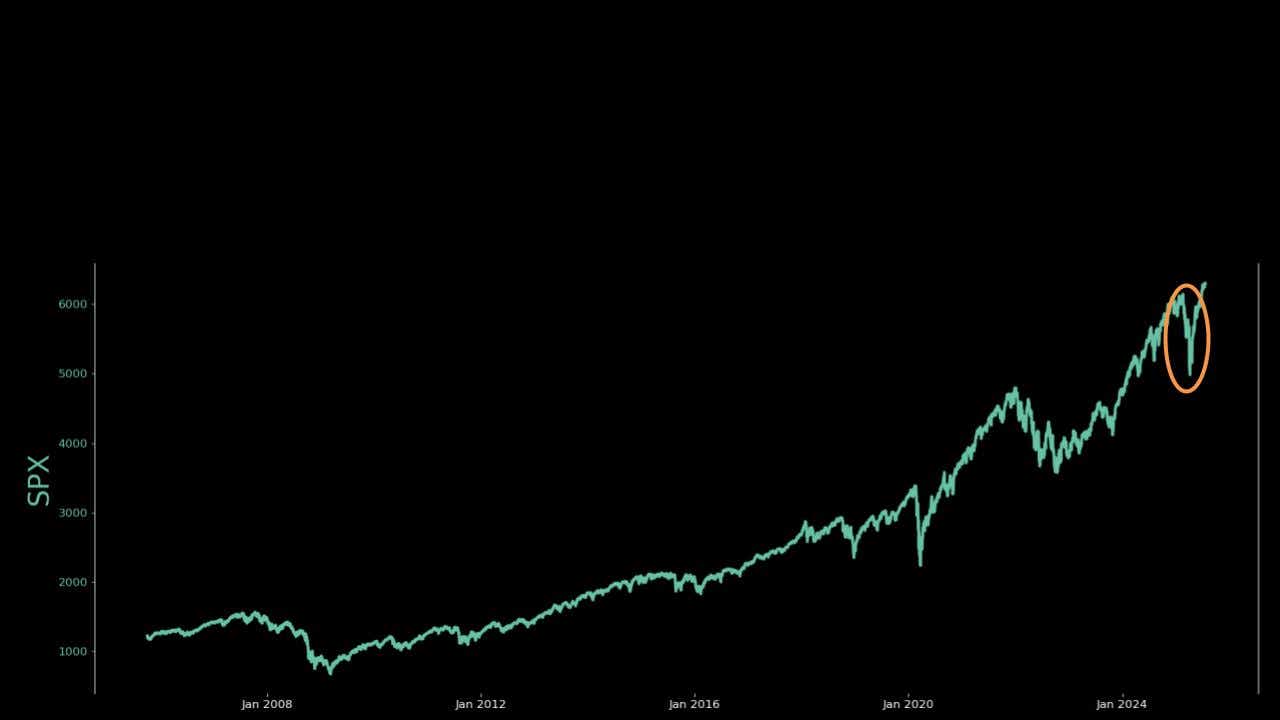

April's market pullback was one of the quickest movements in recent decades, providing an ideal case study for examining how volatility affects options positions over time. A comprehensive analysis of SPY 1SD strangles over two decades reveals surprising insights about how market corrections actually affect options positions.

_(1).jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

The loss-to-credit ratio

To measure potential losses during market turmoil, researchers use the loss-to-credit ratio — dividing the actual loss by the initial premium collected and multiplying by 100:

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

For example, a $1,000 loss on a position that collected $500 in premium would yield a loss-to-credit ratio of 2.0.

Findings from 20 years of data

The study examined 45-day SPY 1SD strangles held through expiration without management across two decades.

Surprisingly, the median loss-to-credit ratio is just 1.2, indicating nearly half of all losing trades experience losses smaller than the original premium collected. However, when extreme market conditions align, losses can reach significant multiples. The highest recorded loss-to-credit ratio hit 27 during the 2020 volatility spike.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

While this year's market movement produced notable strangle losses, both the frequency and magnitude remained below 2020 levels.

_(1).jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

To put current market conditions in perspective, the current SPY 45DTE 1SD Strangle collects $6.22 in premium with VIX at 17. Based on historical data, only 16% of 1SD Strangles lose money without management. That means only 8% (half of 16%) of all positions lose more than $622. Losses exceeding 3x the credit ($1,866) occur in under 4% of cases, making them extremely rare events.

Market correction comparison

Analysis of five major market correction years revealed counterintuitive patterns that challenge conventional wisdom about market declines and options performance.

Despite 2008 experiencing the largest market pullback (-48%), the largest strangle loss ratios were actually seen in 2020 (27x loss-to-credit ratio). Meanwhile, 2025 produced the second-highest single loss ratio (15x) but maintained a relatively low median ratio (1.5), demonstrating that even challenging years can be manageable with proper position sizing.

What drives large losses

Two factors consistently create the most challenging scenarios for premium sellers.

Speed proves more impactful than magnitude. Quick market movements are more damaging than large but gradual declines. Rapid price changes leave little time for position adjustments, explaining why 2020 and 2025 generated notable losses despite moderate market declines compared to 2008.

Low volatility creates the worst conditions for premium sellers. Positions established during calm markets followed by sudden VIX spikes consistently produce the largest losses. When volatility is compressed, traders collect limited premium while remaining exposed to volatility expansion events. Both 2020 and 2025 exemplify this pattern. They’re periods of low implied volatility followed by rapid volatility expansion.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices