Why Sell Puts? Understanding the CBOE PutWrite Index (PUT) Strategy

Why Sell Puts? Understanding the CBOE PutWrite Index (PUT) Strategy

Why Sell Puts?

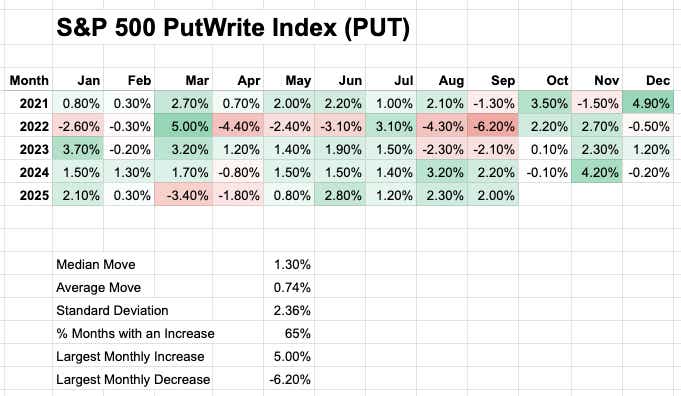

The CBOE maintains an index called the S&P 500 PutWrite Index (PUT Index), which tracks the performance of a portfolio that systematically sells S&P 500 put options against cash reserves held in Treasuries.

The PUT Index itself isn’t an ETF you can buy, but the strategy is straightforward to implement in your own account. Rather than buying stock directly, many investors sell puts as a way to express a bullish market view while aiming for smoother, more consistent month-to-month returns. This distinction shows up clearly in the historical results below.

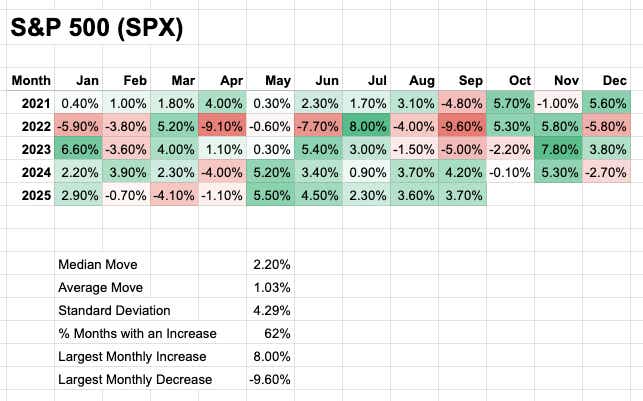

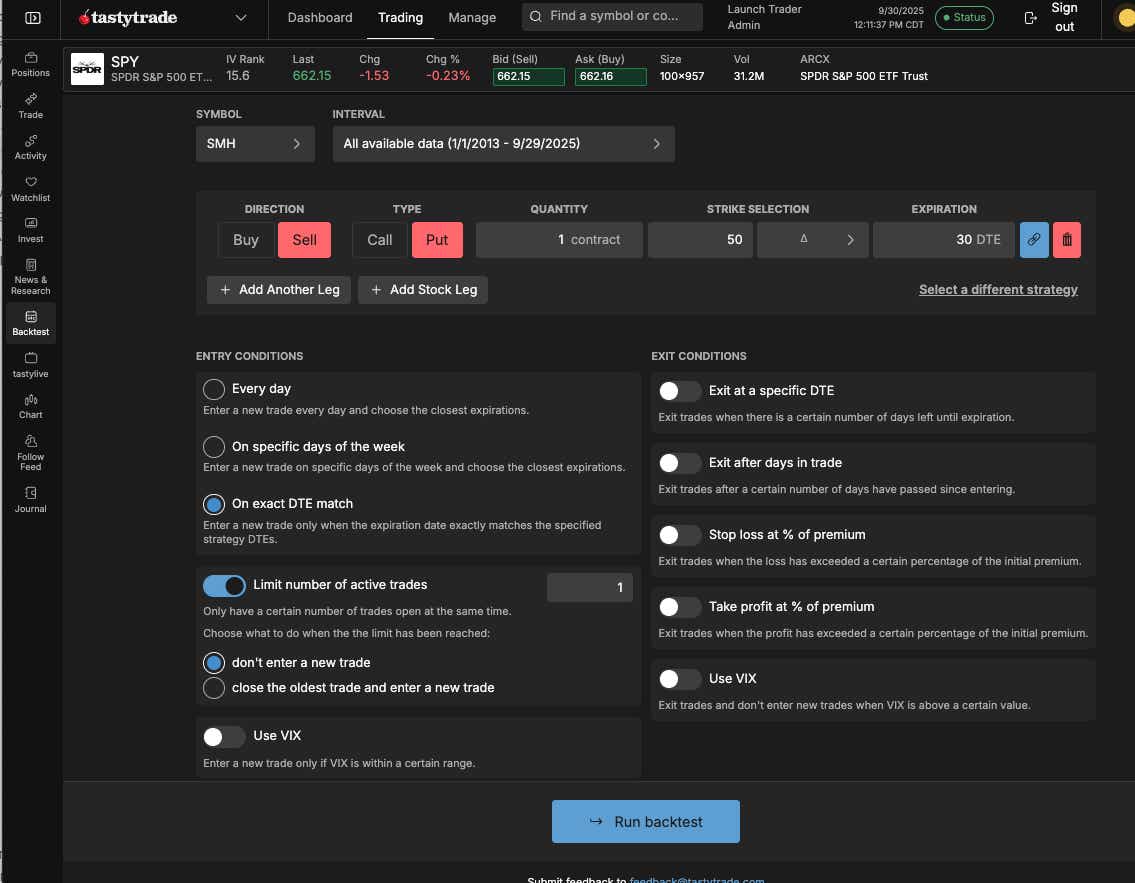

Notice that the moves in the PUT Index are generally smaller than in the S&P 500. Selling puts isn’t about consistently outperforming the market, it’s about reshaping the risk profile of equity exposure. Most investors use short puts as a way to stay bullish while reducing overall portfolio volatility. That trade-off is clear in the numbers: the standard deviation of monthly returns is almost cut in half (±2.4% for PUT vs. ±4.3% for SPX). In other words, selling puts smooths out the ride. You may give up part of the strongest upside rallies, but you also experience smaller drawdowns. The result is a more balanced, risk-efficient way to maintain stock market exposure. tastytrade also has a kick-butt options backtester built right within the platform. Check it out. Reach out if you have questions.

Gold and Silver

We discussed last week how the gold miners (GDXJ and GDX) have outperformed gold and silver by a wide margin - almost double.

Why does this occur? It has to do with "operational leverage" and margins. With gold prices around $3,800/oz and production costs averaging $1,080 to $1,220/oz, small gold price increases translate into large profit gains for miners because their costs are mostly fixed. This leads to larger percentage gains in miners' earnings and therefore in the ETFs representing those miners, explaining their outperformance relative to the metal prices themselves.

Here is the math:

At $3,800/oz gold with $1,200/oz costs → profit = $2,600/oz

If gold rises just

.png?format=pjpg&auto=webp&quality=50&width=1600&disable=upscale)

But this also goes in reverse. Small declines will have large impacts in the margins. If you think gold is a bit frothy - stay away from GDXJ/GDX or get short.

Two Trade Ideas

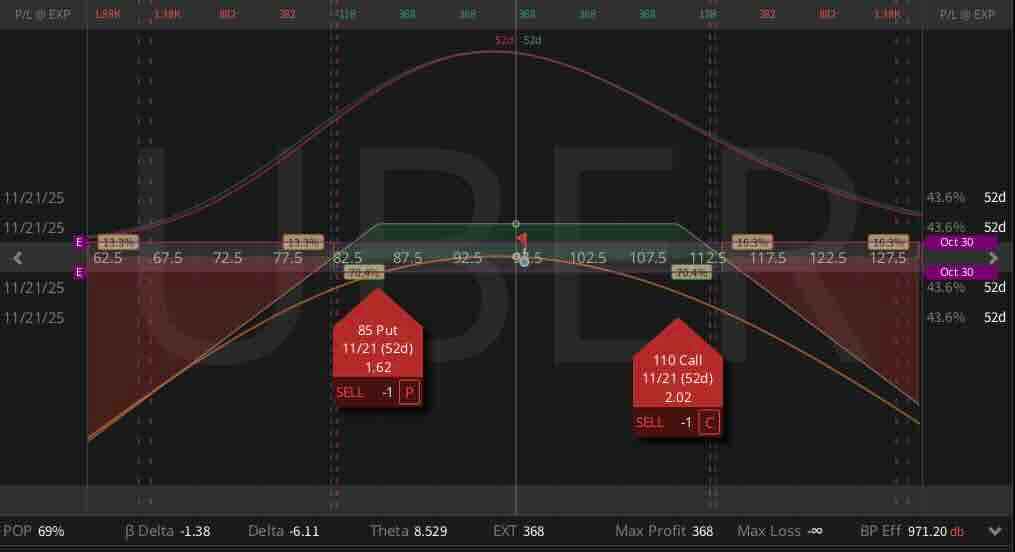

UBER ($97.14) Short Strangle (NOV) $3.67 Credit

Uber has been at the higher IVR on the board for a couple of weeks now at 32. They will report earnings at the end of October. If you think the stock might chop around in this 90-100 range prior to earnings, an 85/110 strangle plays into that short realized volatility for just under $1000 in buying power.

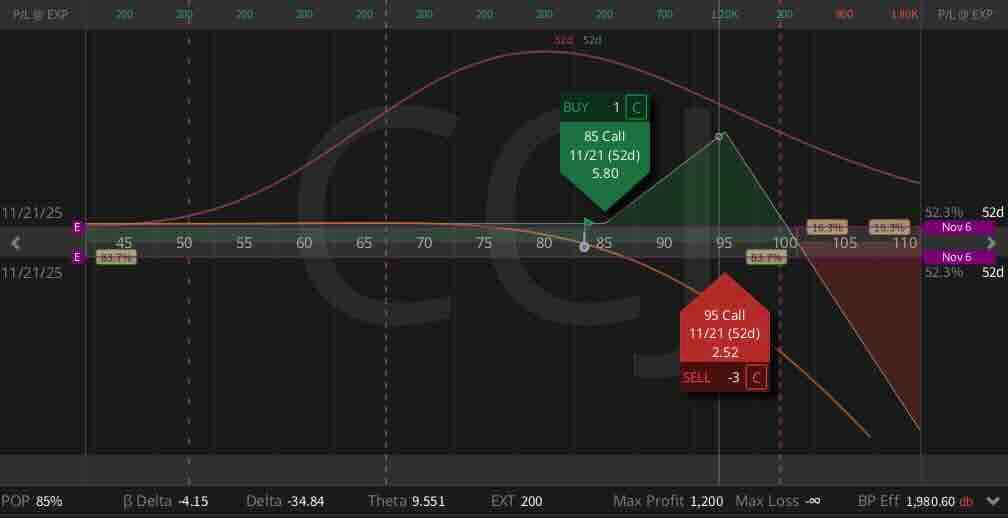

CCJ ($83.25) Call Ratio Spread 1x/3x (NOV) $2.40 Credit

Uranium stocks have been all the rage recently, with tons of upside volatility skew. Call ratio spreads play into this skew, adding an additional short call as a 1x/3x to add some additional short delta. The trade plays into an upside grind, but with no risk to the downside, and uses just under $2000 in buying power.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters too!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices