Will the Stock Market Melt Down if the US Economy Heats Up?

Will the Stock Market Melt Down if the US Economy Heats Up?

By:Ilya Spivak

Will the stock market melt down if the US economy heats up, banishing hopes for Fed rate cuts?

- Stock markets stall as crude oil surges on Iran risk

- January FOMC meeting minutes mark a hawkish tilt

- February PMI data may test aggressive rate-cut bets

Markets are drifting in an uneasy range on a holiday-shortened week for Wall Street. US equities drifted into the close with little conviction Thursday, putting the bellwether S&P 500 down 0.23% and the tech-tilted Nasdaq off nearly 0.4%. The US dollar, Treasury bond yields, and gold prices finished the day little-changed.

Crude oil was the outlier. Prices pushed to their highest levels since last June, extending a surge that began earlier in the week. That seems to reflect growing concerns about US military action against Iran. Talks meant to avert confrontation seemed to run aground in Geneva, Switzerland this week.

Meanwhile, the buildup of US forces around Iran suggests Washington is serious about using force against the regime in Tehran after its brutal suppression of popular protests erupting around the country since December. Reports suggest that close to 30,000 people may have been killed.

Crude oil prices surge as markets weigh US strike against Iran

Unlike last year’s flare-ups between Israel and Iran, this crude oil move appears to be rooted in something longer lasting. Regime instability in Iran, combined with tighter enforcement against Russian shadow fleet oil tankers, threatens China’s supply of cheap, sanctions-busting oil. That might amount to a durable supply shock.

If China – the world’s largest crude oil importer – has to make up the supply shortfall by buying more from the likes of Saudi Arabia, Iraq, and Brazil at market prices, the adjustment in the markets may be lasting. This backdrop would be strikingly different from the “crude oil glut” narrative that dominated expectations coming into the year.

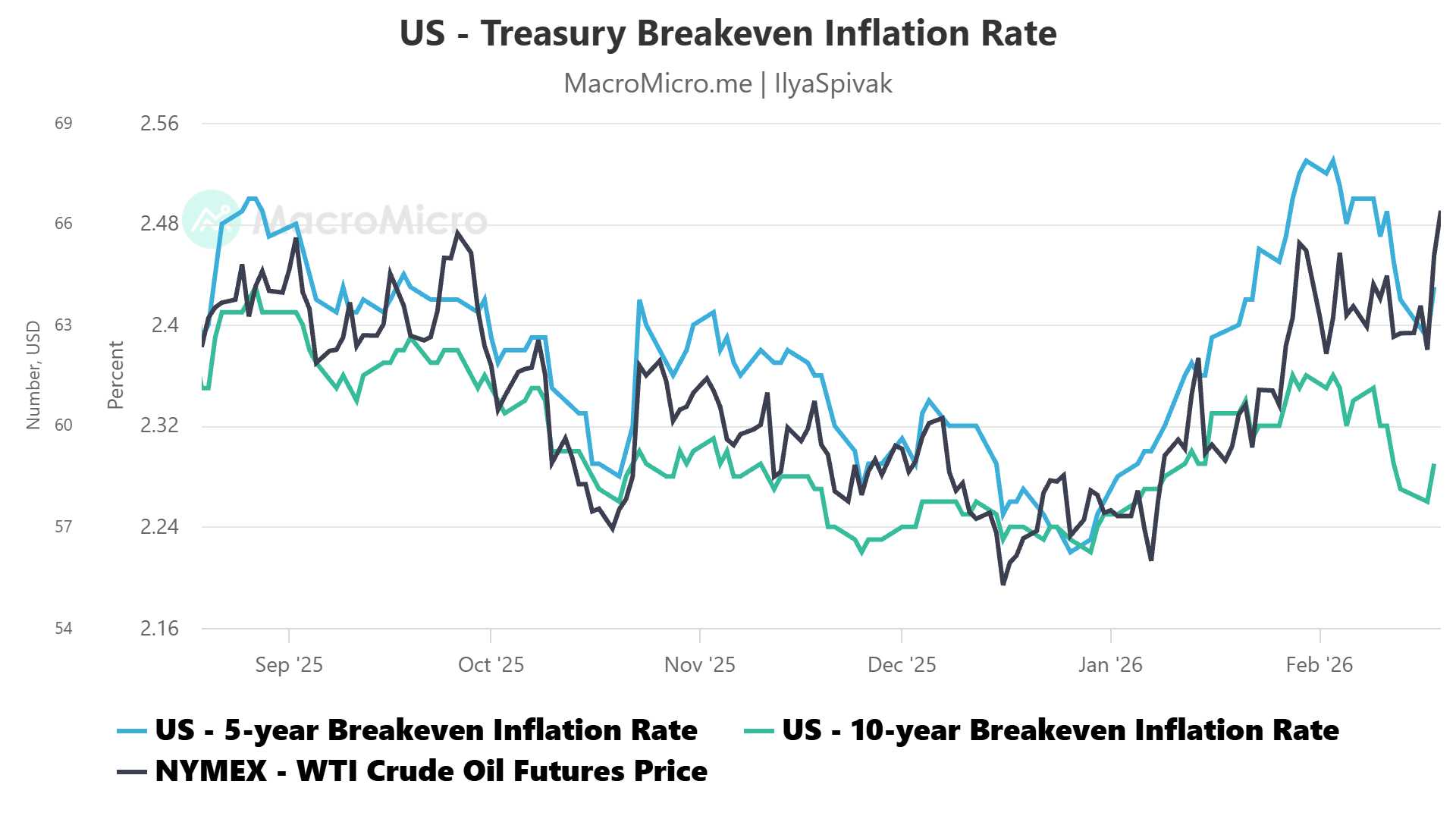

Bond markets have taken note. Inflation expectations baked into five- and ten-year Treasury prices have been marching higher alongside the benchmark WTI crude oil price since the start of 2026. That makes sense: it only takes about a month on average for a meaningful change in oil prices to be reflected in consumer price index (CPI) inflation data.

Fed officials waved off rate cut speculation in FOMC meeting minutes

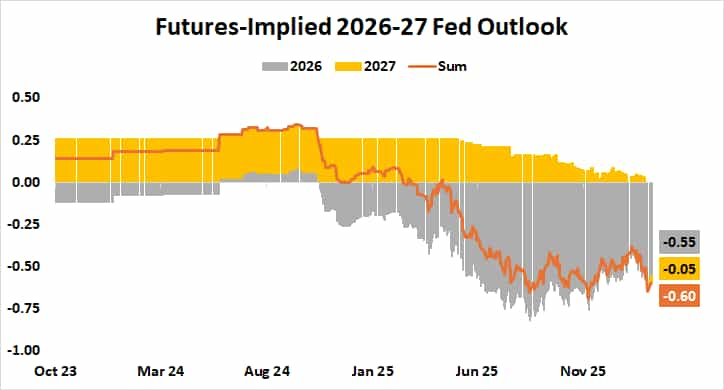

It is not difficult to see how this might derail traders’ hopes for imminent interest rate cuts from the Federal Reserve. In fact, minutes from January’s FOMC meeting stuck a distinctly hawkish tone. Most officials judged that downside risks to the labor market to have diminished, while inflation was seen stalling above the 2% target.

Fed staff projections were revised to reflect somewhat hotter price pressures and growth running above potential through 2028. Several FOMC members even discussed shifting guidance to a more explicitly two-sided stance, embracing the possibility of rate hikes on the horizon.

Notably, language committing to a return to 2% inflation by 2028 that appeared in December’s FOMC meeting minutes was conspicuously omitted this time around. That subtle shift matters. It suggests less confidence in a smooth glide path to cooler price growth and reinforces the sense that Fed Chair Powell and company are in no hurry to cut again.

Nevertheless, the markets continue to price in 55 basis points (bps) of easing this year. The first cut is seen as locked in by June, with the second one due in September. Fed officials penciled in one cut in December’s Summary of Economic Projections, and January’s FOMC meeting minutes hint that tally is – if anything – unlikely to get more dovish.

PMI data in focus: stocks may fall as the dollar gains if the US economy heats up

One explanation for this disparity is that the markets want insurance. Traders bombarded by geopolitical risk, US trade uncertainty and assorted political drama – including around Fed leadership – want the backstop of cheaper money in the event that something breaks. Solid corporate earnings and resilient economic data have not erased that caution.

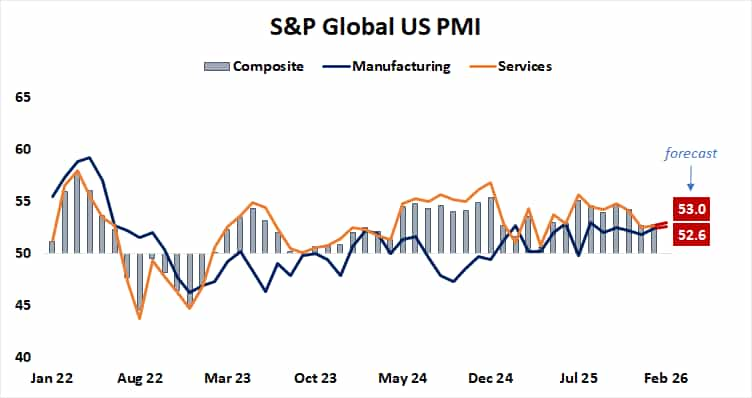

This puts February’s S&P Global purchasing managers index (PMI) data into focus. It is expected to show that US economic activity growth perked up a bit this month having stabilized in January after a slowdown in the fourth quarter. Analytics from Citigroup suggest that US data flow has tended to outperform relative to forecasts so far in 2026.

If that translates into PMI numbers that meaningfully beat analysts’ projections, the case for preemptive interest rate cuts will become harder to defend. The Fed’s dual mandate requires reasons rooted its employment or price stability objectives to justify action. Traders’ desire to cushion against hypothetical market shocks is not enough.

Stock markets appear vulnerable in this scenario as risk appetite deteriorates around the financial markets. The US dollar may rise, buoyed by a more supportive interest rate outlook as well as haven demand. Gold may also suffer a setback, although its uptrend since early 2025 has been remarkably resilient against rates- or dollar-related shocks.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices